•

Welcome to 2026! Our platform keeps on improving with the first release of the year. LendAPI v3.0.9 was released on January 8th, 2026, packed with some major features we can't wait to show you. We released a new way for lenders with complex negotiations to generate new contracts at will. We also added new features in our Rules Studio and Product Studio to give even more control on rules and collecting information on the application process.

Platform News:

We start the year by making some new hire announcements. We are welcoming AJ and Alen to our team. We are super excited to have AJ upgrading from being our Engineering Intern to our full time engineer working from our Irvine office. Alen joined our team a few months ago and he’s helping out with our embARC Loan Management System. We welcome them both.

We’ve onboarded five new clients last December and we are making plans to get them all onboarded. We can’t wait to grow with our clients well into 2026 in some of the critical areas such as the auto financing sector. With our RouteOne and DealerTrack integration, we are ready to take on the incumbent players and give credit unions even more flexibility when it comes to automation and full integration into dealerships. For more information, please visit LendAPI Auto Finance page.

If you are interested in seeing a demo from us, please connect us through our contact us page.

LOS Platform Update: Changelog v3.0.9

We’ve been adding big features consistently in every one of our releases and this one is no different. We finally got one of the major features into the workflow and that will satisfy a lot of our clients with a complex closing process that’s not a fully automated, one and done type of product.

We added a few other features into our Product and Rules Builder that will automate even more of our clients processes from more complex form takers to automatically update certain datasets upon competing rule sets. These features will make our platform even more flexible to give our clients the ultimate control from application to underwriting.

We also have a refactored Settings Page where you have new ways to upload your companies logos and brand marks. You can also upload your profile pictures and manage user permissions in this new settings section. That said, we moved a lot of the left navigation menu to the profile section to clean things up a little. We continuously make our platform cleaner and easier to use and we love to hear from you. Please write to us at info@lendapi.com.

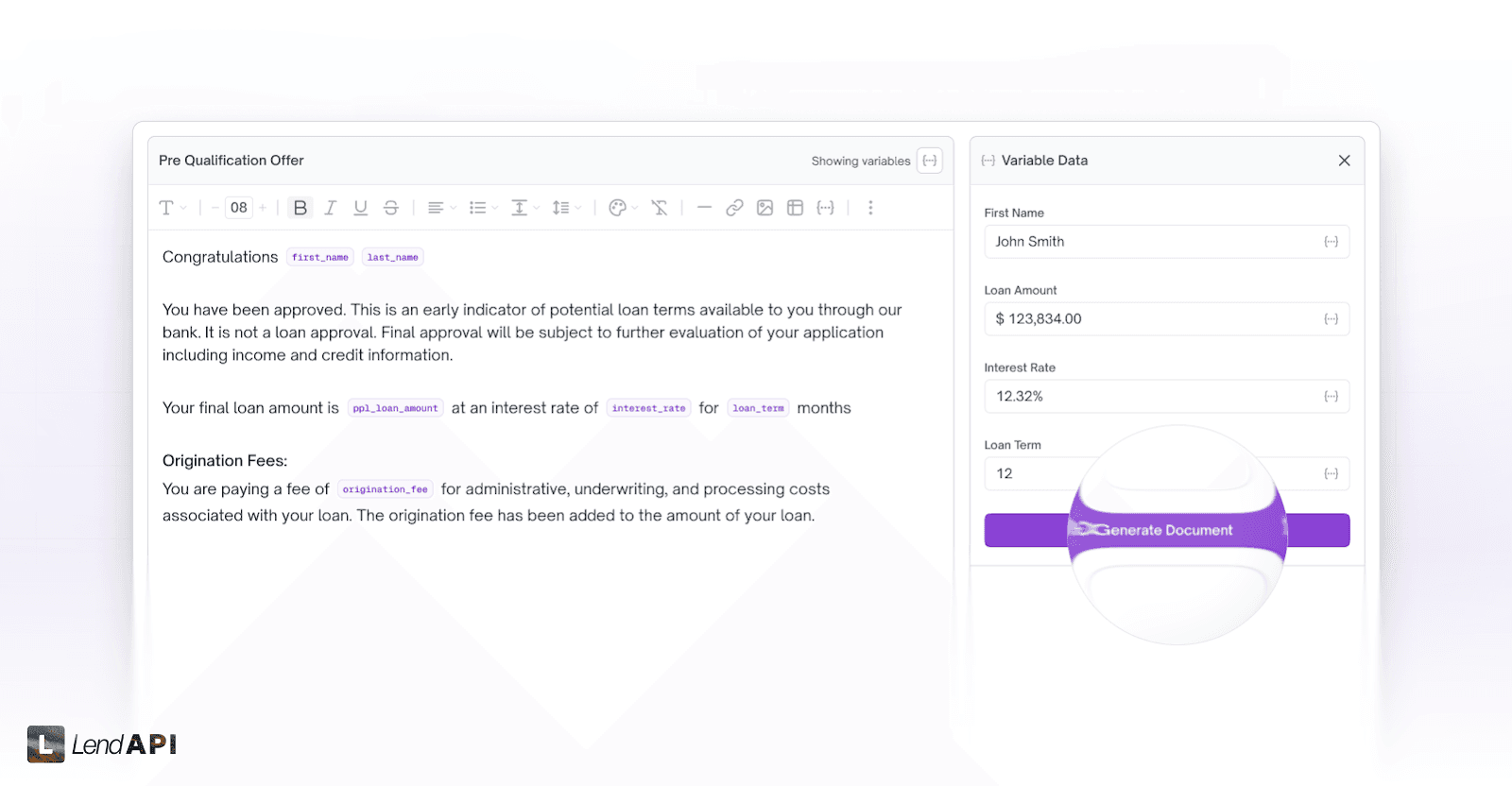

Contract Regeneration

One of the most requested items on our roadmap is the ability to regenerate a promissory note or a contract with the latest negotiated terms for the client to sign or resign a new contract.

Lenders in complex and large deals such as real estate, mortgages or even home improvement projects may need to negotiate some finer points before the deal is finalized. Often, discounts, terms of the loans are changed slightly from the original contract and applicants need to sign a brand new contract to finalize the loan.

This is a complex process and involves not just a brand new contract to be generated but the mechanics of re-running the loan parameters to re-amortized the loan is also involved to say the least.

In this build, we are only concerned with the ability to re-sign a newly generated contract. We will let the lender have full control on editing all of the dynamic fields of a contract such as the loan amount, interest rate and duration of the loan.

In subsequent releases, we will pass these parameters into the lender’s Loan Management System or our own embARC LMS to generate a new loan to fully amortize the payment schedule automatically.

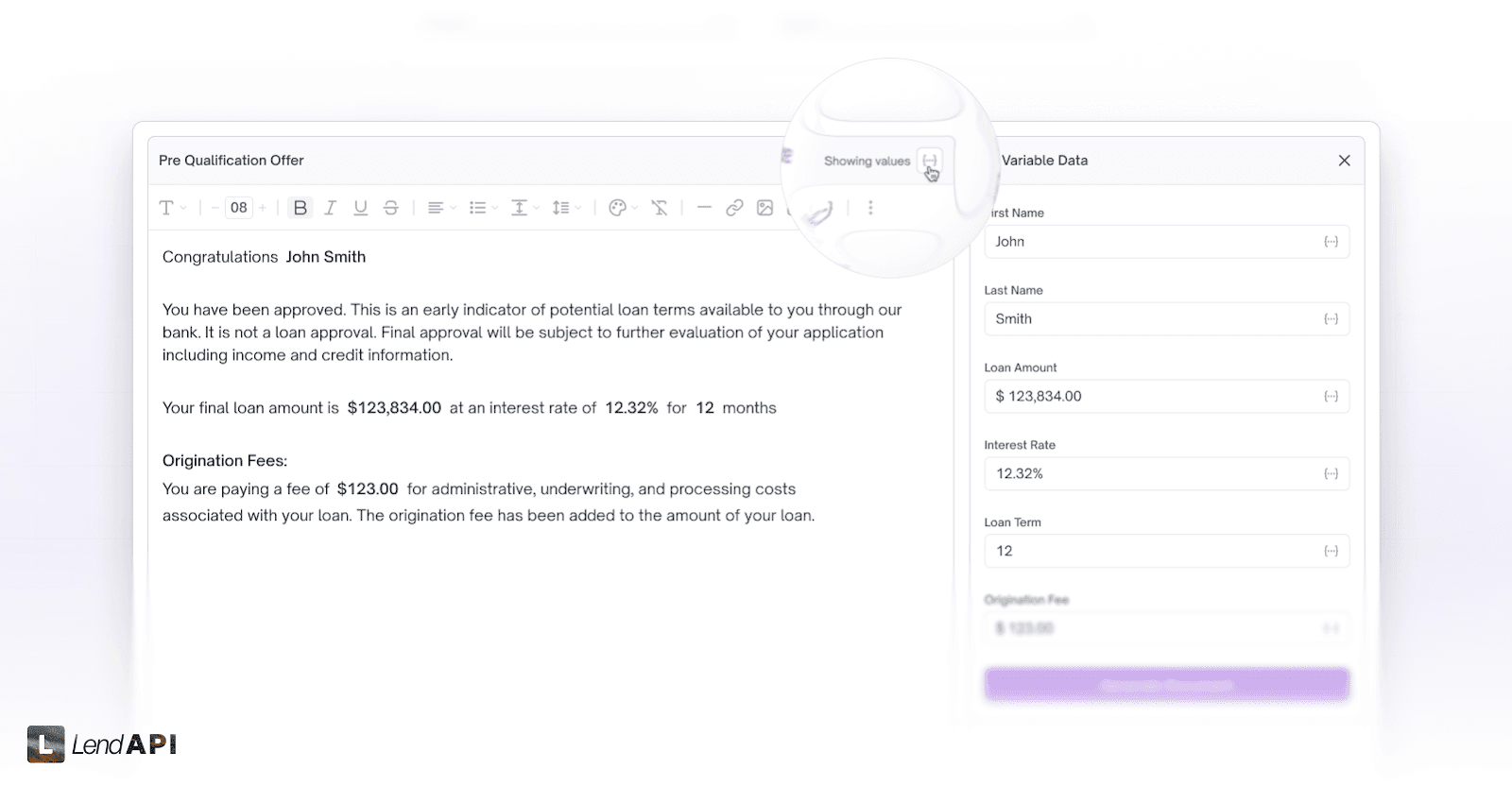

We have also implemented a new functionality for the user to toggle between the dynamic variables name to the actual value for this particular loan so the author of the new document can visually verify the dynamic field that’s about to go into a newly generated promissory note.

We think this new contract regeneration tool and process will be a crowd favorite and we finally give the ability for an underwriting to intervene into this process. The wait is finally over. This feature is now available in our latest build v3.0.9.

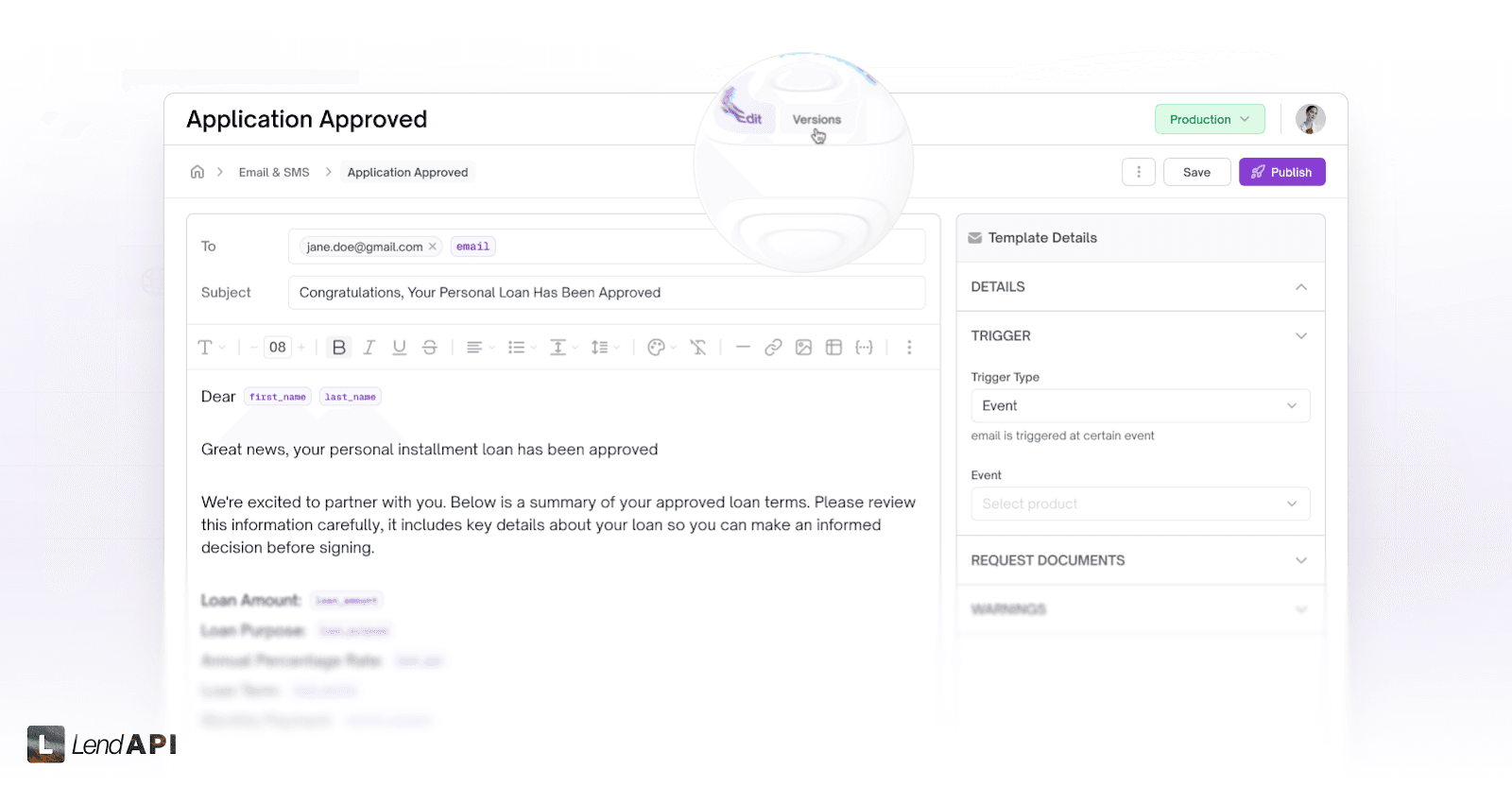

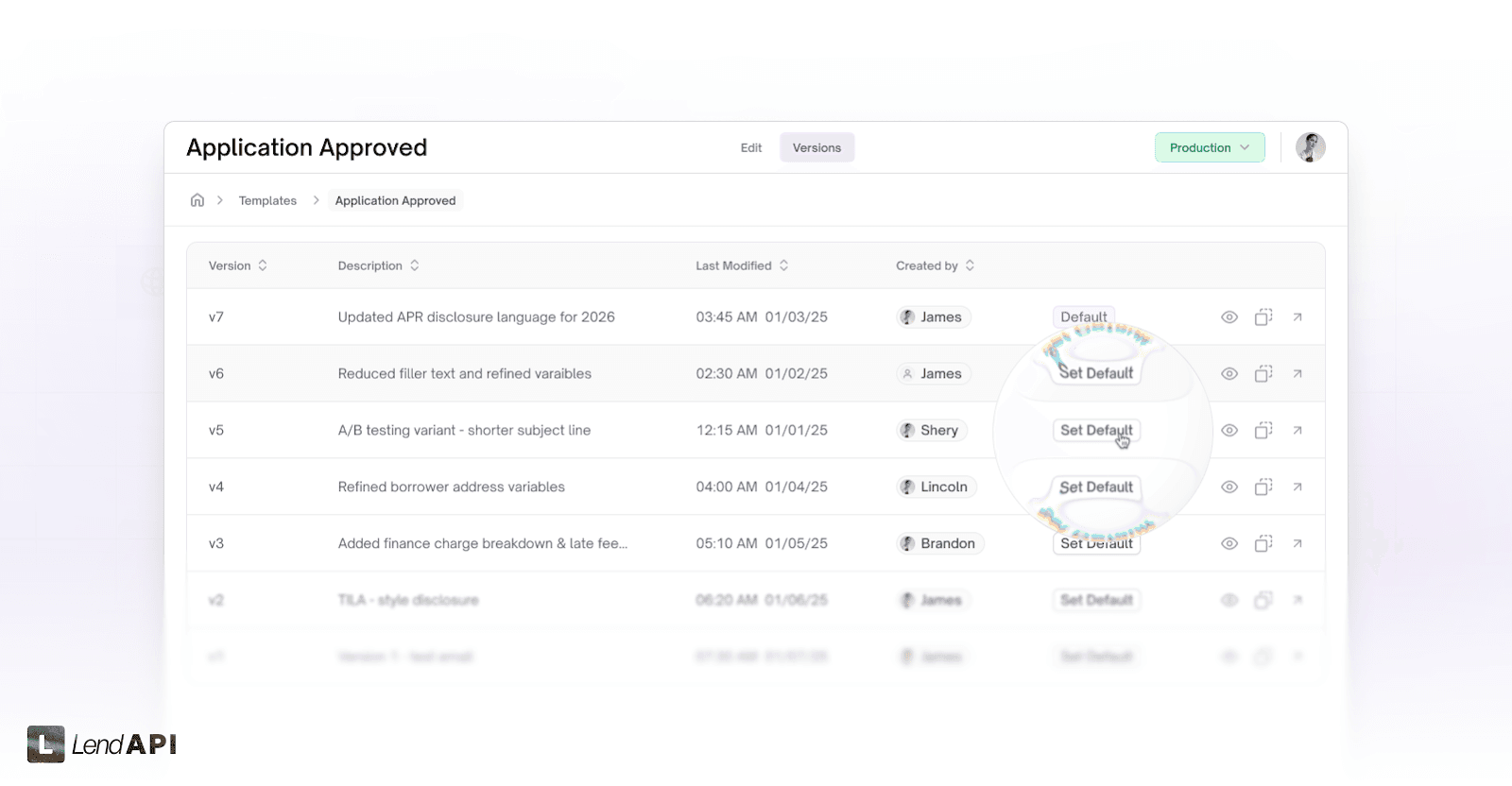

Email Template - Versioning

Our email services are being used constantly with lenders that are sending important emails such as adverse action notifications. We added something else to the email template engine in this release and we think you will use it even more.

We finally added “Versioning’ to our email templating tool. Just like our product, rules, pricing etc, everything we have in our platform is versioned for many good reasons and we finally brought the versioning to our email templates.

And not just email templates enjoying this new versioning process, our SMS templates can also be versioned. And with versioning, we can show you all of the previous versions of the email and sms templates in a list view.

With the Email and SMS template list view, you can revert back to the previous version of the template and set any other version of the email and sms templates as the default template to use going forward.

We think this brings about another level of automation and flexibility as well as compliance driven needs for our banks and leaders to keep track of every aspect of what their applicant sees.

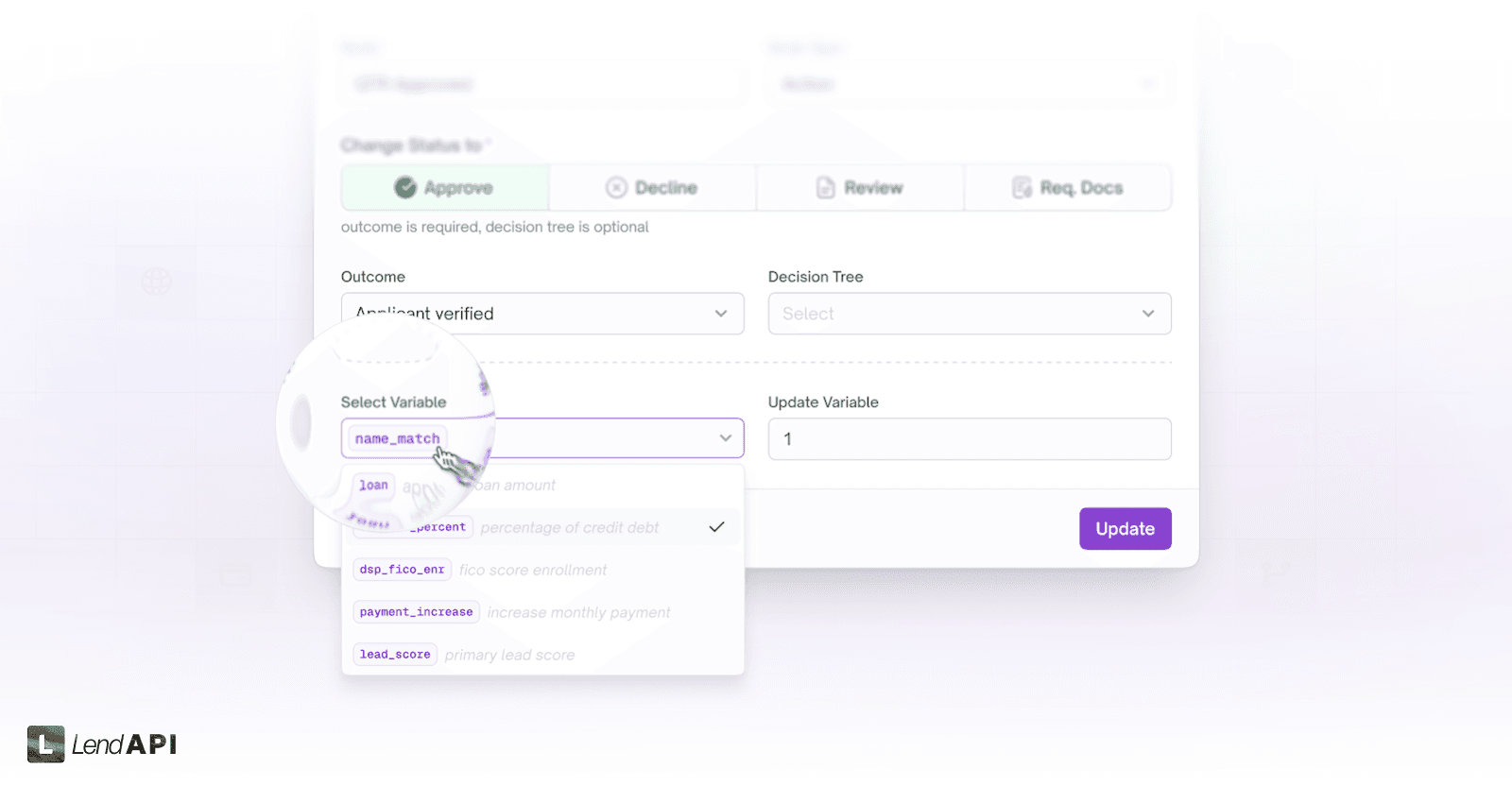

Rules Studio - Automated Data Update

Our Rules Studio is one of the most powerful rule engines in the market. You can build just about everything you can desire. Rules run smoothly and trigger all sorts of outcomes and activities.

What if you want the rules engine to write data? For example, when a rule is completed. If you want to increment a counter, or flip a switch (update a binary variable)? Well now you can.

We added a simple and convenient way for you to update any data upon triggering rules.

This way, our rule engine can also act as a data writer for you to use to augment a variable. We’ve said this before, these features will make your lives even easier and make this a powerful rule engine to direct traffic, send email as now, write data directly into your database to keep track of ledger or trigger another event based on variable values. This Data Updater feature within our Rules Studio is now available in v3.0.9.

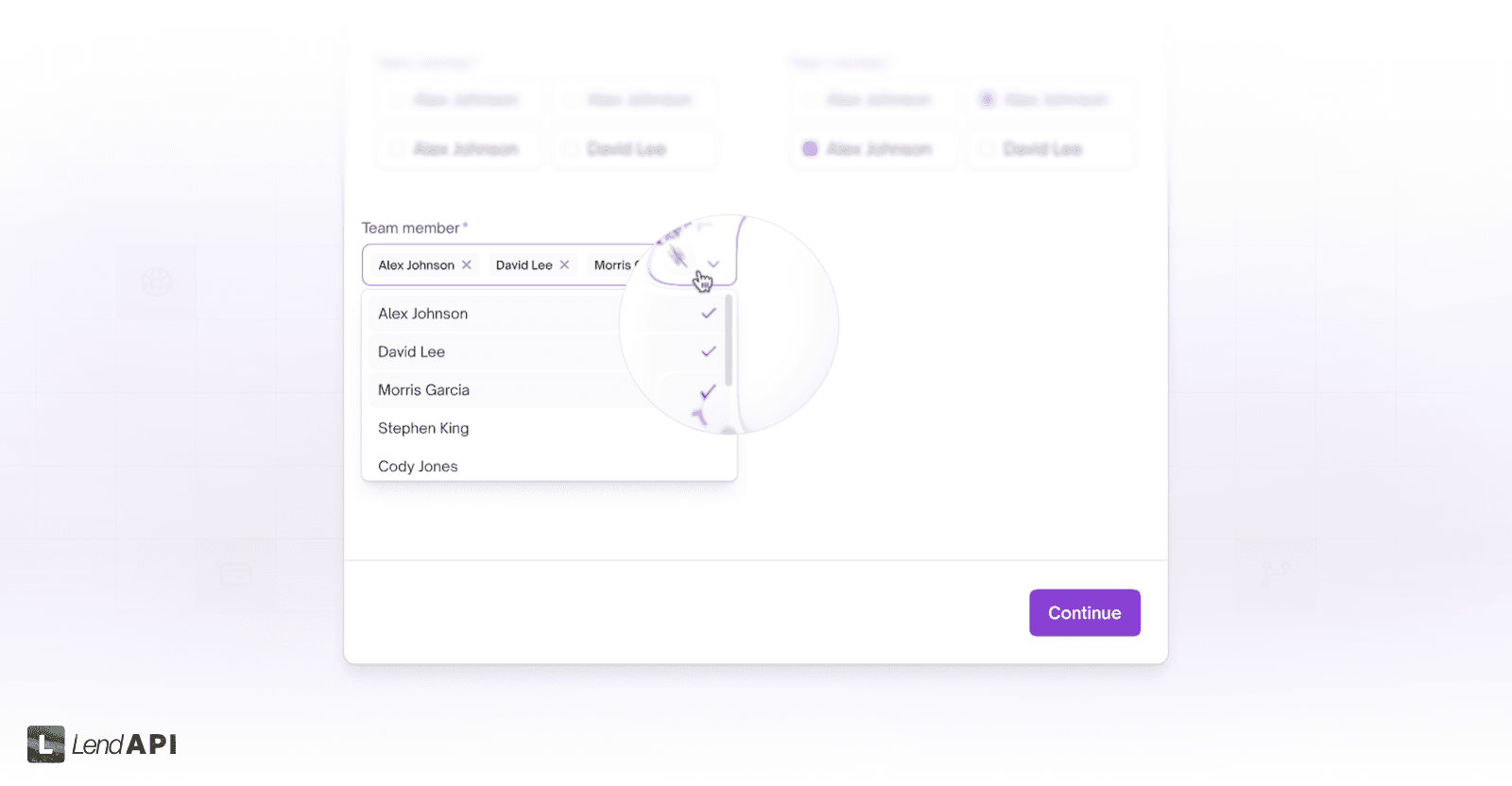

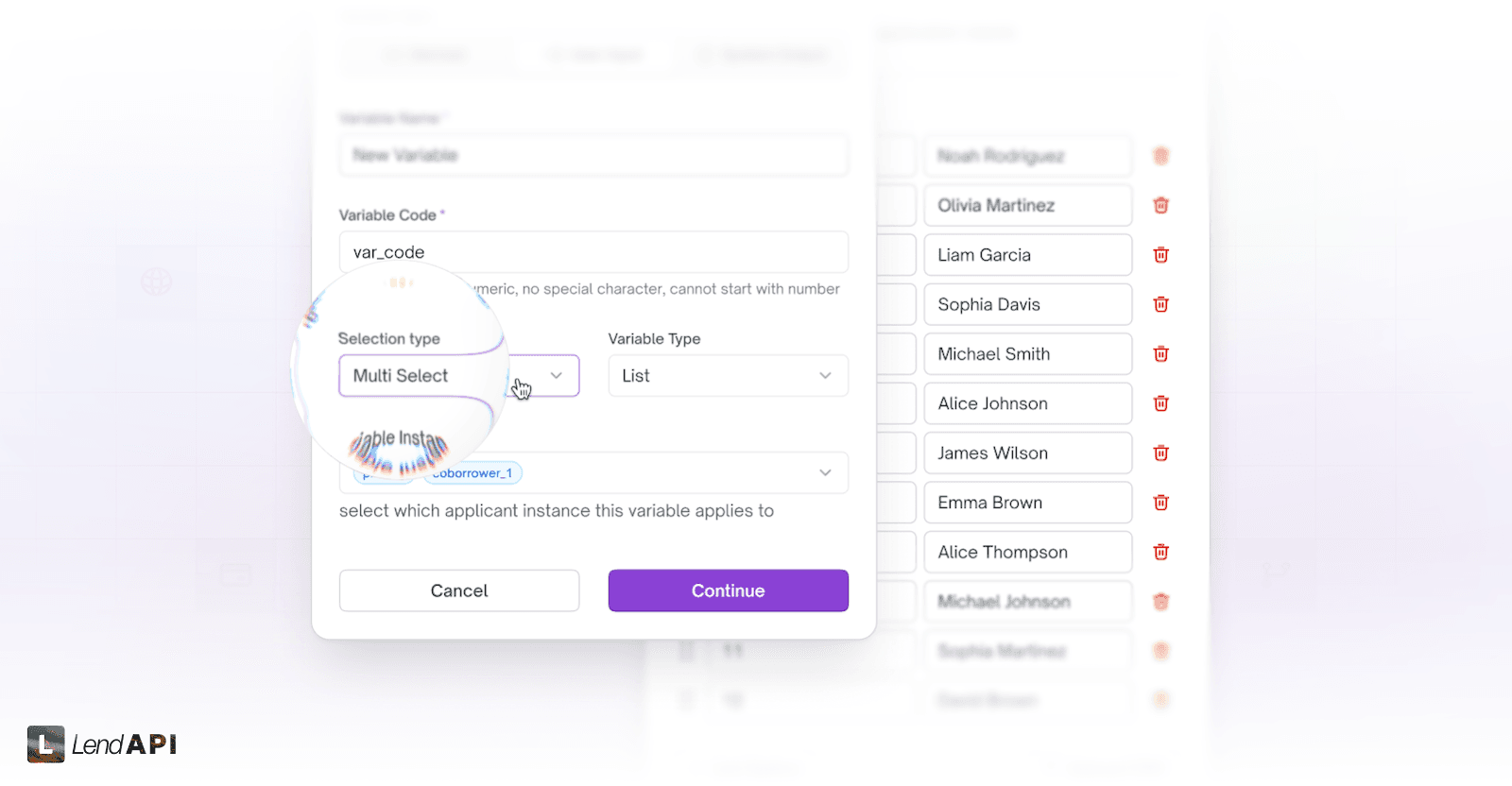

Product Studio - Multi-Select Field

We have so many features in our Product Studio now that just about everything is possible to be built within this studio. From radio buttons, drop downs, dates and data pickers, you can do it all within the Product Studio.

We also have this Widget concept where you can easily drag and drop Plaid-like functionality right onto the page without writing a line of code.

One of the more complicated fields is a multi-select field where the applicant can select multiple items within the field and select all that applies. Take a look at this screenshot below.

We implemented this multi-select functionality and made it available for you to use within our Product Studio. This new field widget will allow your users to multi-select and then you can write or run rules against the final selection.

Of course, we also provide a way for you to edit all the possible selections behind the mult-select feature. This is now available to use in v3.0.9.

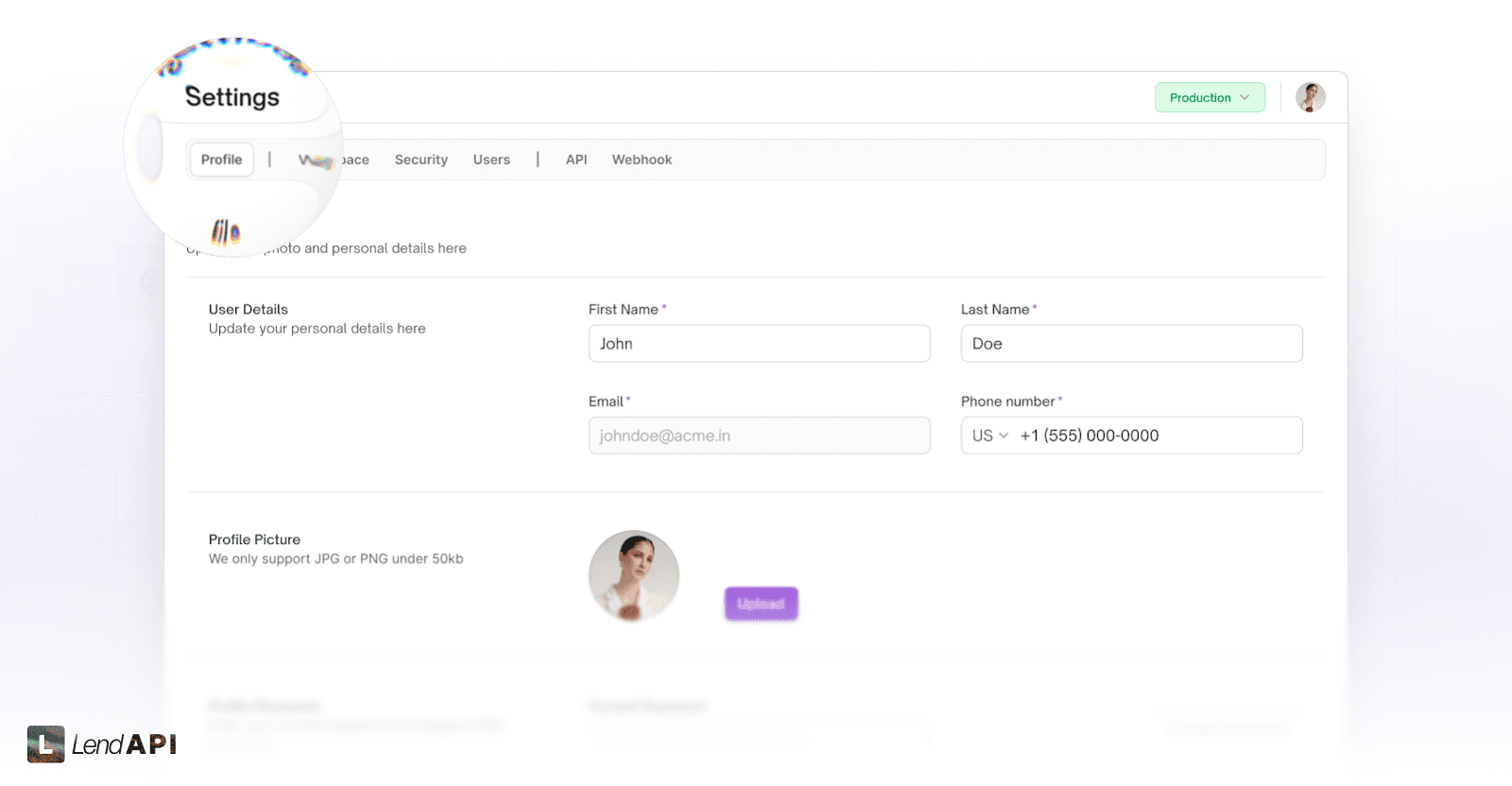

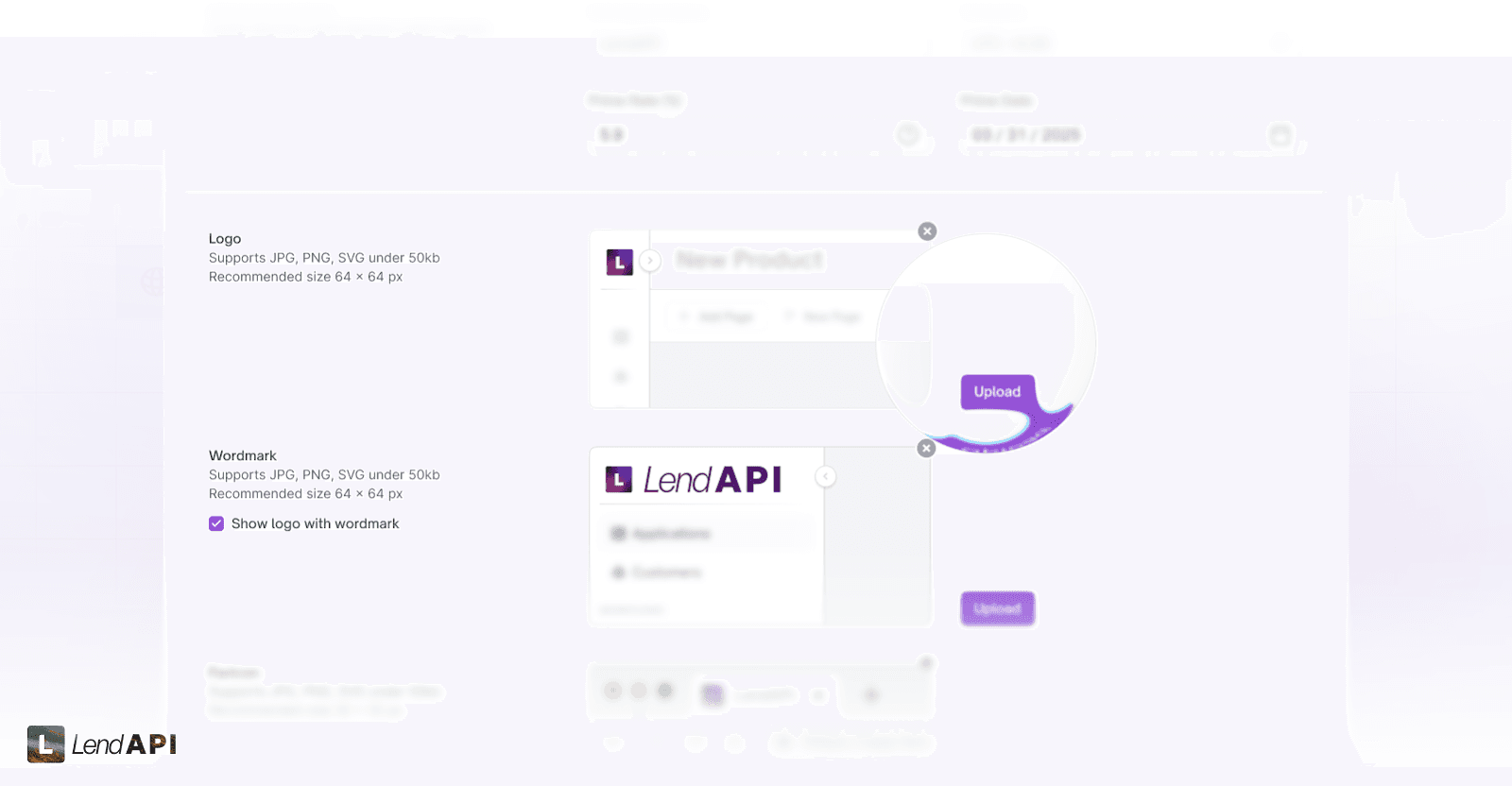

New Settings UI

One of the often overlooked corners of any platform is perhaps the Settings section. We finally gave it the attention that it deserves. Here are some of the new features that go into the feature: Profile Pictures, Adding Users, Uploading Logos are just some of the things you can do to get your platform look as pleasing as it can be.

After two plus years of this platform being available, you can finally change your profile avatar to make it as personal as you like.

Platform administrators can upload company logos and brand marks as well and it will get reflected on the left navigational bar to make this platform truly yours.

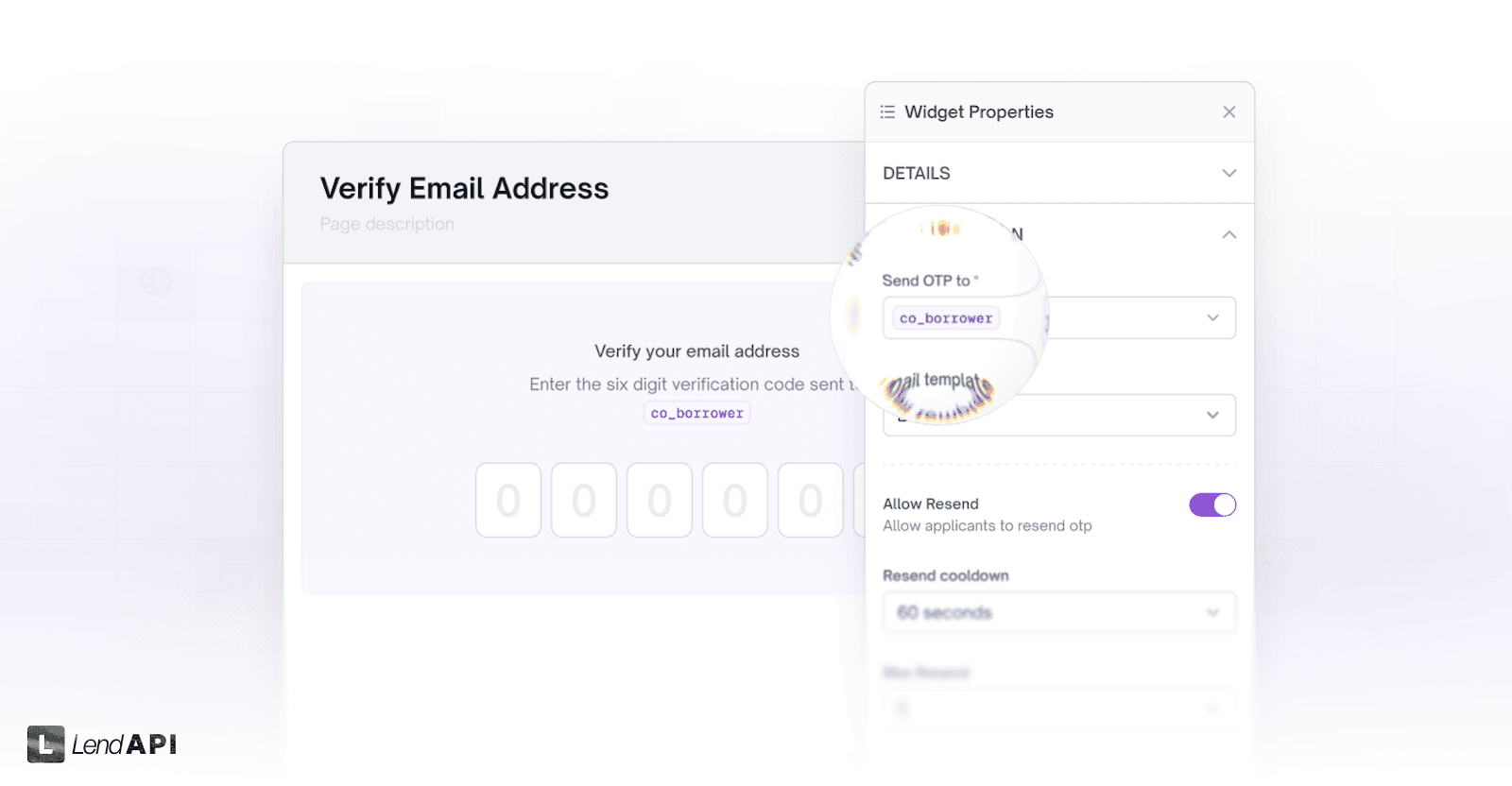

New: Email Verification Widget

We are introducing a brand new widget to the Product Studio: Email Verification Widget.

We already have the SMS Verification Widget which the system can send a text message for the applicant to verify their phone number. Now, our clients are requesting to use email as an alternative to the SMS Verification Widget.

Similar to the SMS verification process, this widget will send a code to the applicant's email address and the widget will compare the verification code to verify the applicant’s email address. This is a long overdue widget and we finally got it done for you.

As a reminder, everything that we do here at LendAPI becomes a feature, widget, and studio which allows you to configure the way you want your application to behave. So, instantly, these features become an application of its own and therefore complicated to implement.

We take the time to get them done once so you can use it over and again everywhere, which is why LendAPI is such a powerful platform to let our client control every aspect of their client onboarding process. We will have more features coming to you soon.

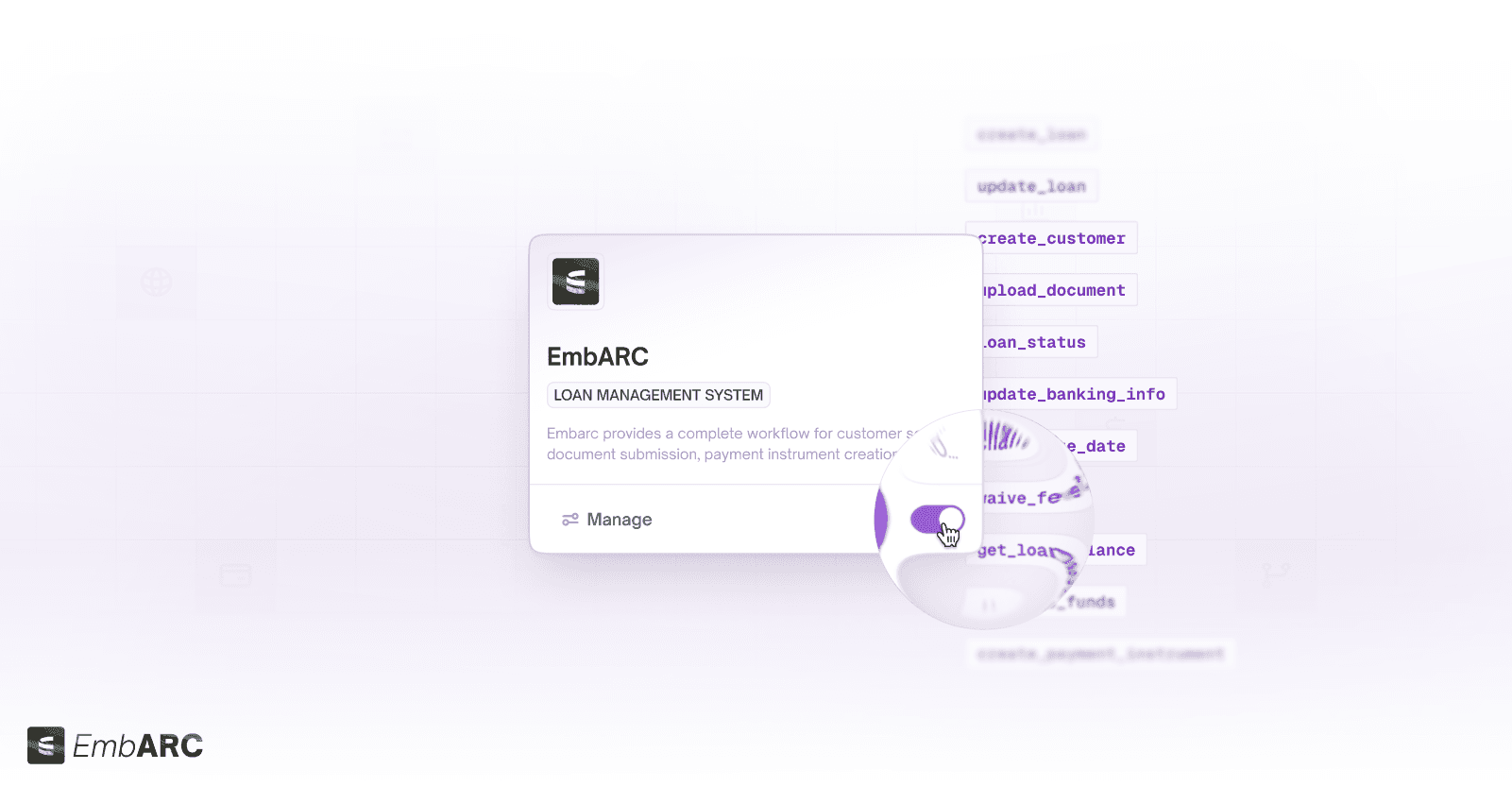

LMS embARC Platform Update

We’ve been working diligently on getting our LMS plugged into our LOS platforms and we’ve done just that.

LOS and LMS Integration

embARC is finally available as an LMS option within the LOS Platform. You can turn it on with the credentials we are issuing on the LMS side and enable embARC right away.

Please reach out to the team if you want to experience a brand new Loan Management System, embARC.

Budgeting Tool

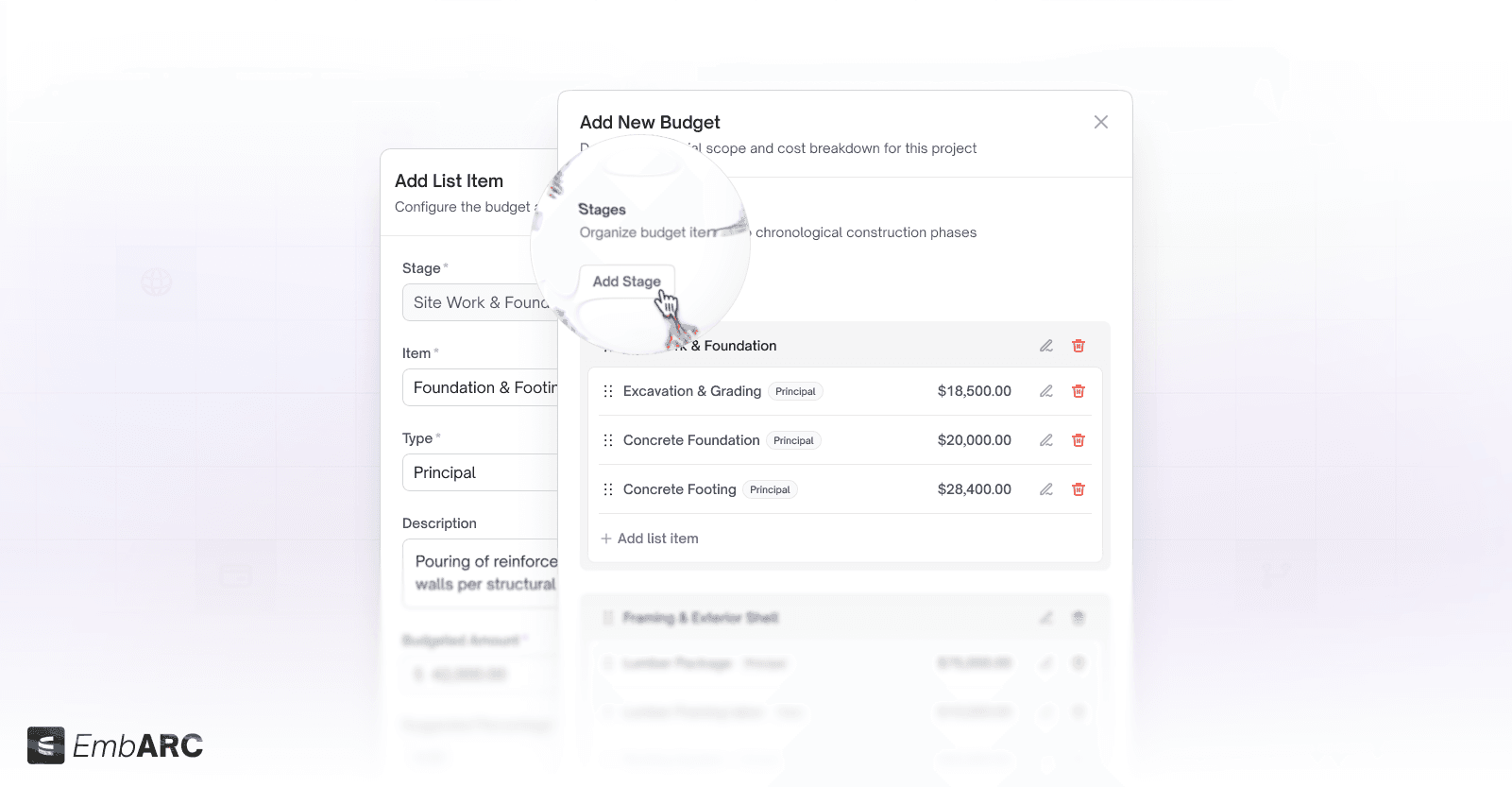

In more complex systems such as home improvement lending. Each stage of the home improvement process needs to be sized or budgeted so there is a composite cost of the total work that needs to be done.

When you are building a new home, each stage of the home building process also need to be budgeted and financed. So we created a budgeting tool for lenders to keep track of and understand the cost of each stage of the construction cost.

This budgeting tool is now available in v3.0.9. Email us at info@lendapi.com if you want to get a demo call with us to show you what embARC is all about.

What’s Next?

We are working on improving the Product Studio templates to make it more updated and flexible and modern with all the controls you need to customize the look and feel of the application itself. Look out for this in our Feb 2026 release.

We are also working on LendAPI Labs. We are coagulating all of the A/B Testing, Shadow Testing, Back Testing functionalities under one LendAPI Labs with an updated UI/UX flow for you to conduct experiments with better control.

We are also working on an unified Workflow Studio where all of our studios can be tied together and have you manage all of your workflow from application to decisioning to customer interactions all in one visualized workflow designer. You will love it.

About LendAPI

LendAPI is a complete Loan Core platform that helps banks, credit unions, fintechs and retailers to launch any finance products instantly. Request a demo at www.lendapi.com. Follow us on Linkedin.