Launched embedded lending product in 1 month without single line of code

96% of loans approved in-store via direct POS -to-LOS integration

Enabled 24/7 self served credit card applications with instant credit decisions

LendAPI lets you ship, test, and profit from new credit logic in hours—not sprints. Slash decision costs, raise approval rates, and keep every rule version in one audit-ready place.

Cut down manual reviews

Automate tiered risk trees and pricing in < 50 ms

85% faster product launches.

Teams ship new lending flows in weeks, not quarters—freeing engineers to innovate instead of stitching APIs.

45% less revenue spent on bureaus.

Credit-bureau and KYC rates drop operating costs nearly in half—money that goes straight to your bottom line.

~35% increase in approval rates

Higher approval rates, dynamic pricing, and multi-lender matchmaking turn declines into fresh funded deals.

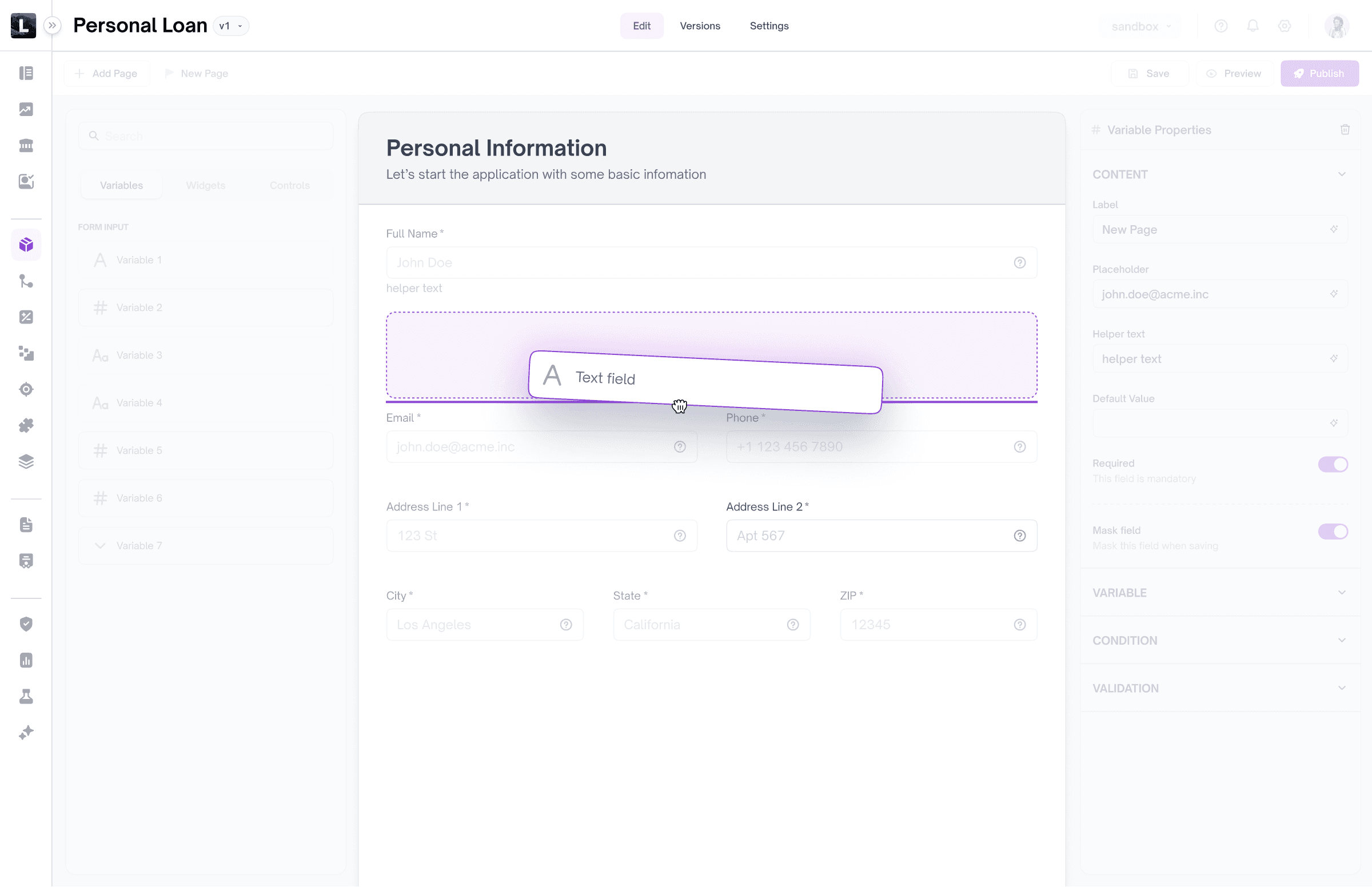

Build custom applications without a single line of code.

Design, iterate, and deploy new lending products in days, not quarters. Product Studio gives you a visual canvas, rule templates, and instant previews, so your team can test ideas, lower build costs, and expand into any market at warp speed.

New products, new revenue

Rapidly spin up applications and capture market gaps months before competitors.

Why LendAPI?

LendAPI was created to open new doors in financial services—making credit not only more accessible, but fully adaptable to every unique business. Traditional lending solutions might cover the basics, yet they’re rarely built to evolve with you. With LendAPI, you’re in charge of designing a solution that can grow, shift, and scale.

Think of our platform as your lending blueprint, giving you the tools and flexibility to craft an offering precisely suited to your brand and borrowers. Launch in record time, expand as your needs change, and never worry about jumping to another system. With LendAPI, you’re empowered to build a lending experience as singular as your business.

We're just getting started

Over 100 million applications processed, and our customers can’t stop raving about the flexibility and impact of our lending platform.

"LendAPI’s engineers and staff are truly the best in the industry when it comes to execution and build speed. Their ability to rapidly bring our vision to life has been nothing short of extraordinary, allowing us to bring much-needed legal fee financing solutions to market faster than we ever imagined."

Steven Highfill

CEO, LawFi

"LendAPI’s expertise in embedded financing and risk-based pricing has allowed us to provide our customers with a seamless and intelligent financing experience."

Matthias Kruwig

CEO, Enervee

"LendAPI and Lendiant share the same vision. We’re excited to build the future of Lending-as-a-Service together."

Vincent Zhang

SVP Strategy, Lendiant

"LendAPI is the industry’s only DIY and Launch-Yourself FinTech Product Deployment platform. We're here to make sure the next generation of fintech startups—including those solving real problems like RapidFi—can launch faster, pivot smarter, and scale securely."

Vivek Kumar

RapidFi

"Partnering with LendAPI allowed us to remove friction from our onboarding process, giving our investors and sponsors a seamless experience while ensuring full compliance. The integration was smooth, the cost structure fit our needs as a fintech startup, and the support from the LendAPI team was fantastic"

Mor Milo

CEO, Relli

"We went from concept to a live platform in a month—something that would have taken us a year and a full-stack team to build ourselves"

Mark Mughabghab

Co Founder, RNPL Credit