Key Features

Workflow Orchestration

What is LendAPI’s Workflow Orchestration?

Workflow Orchestration comes handy when an application is stuck because of a decision rule set that triggers a certain outcome that prevents the application from going to the next step. For example, if an application’s applicant identity verification score is less than stellar, meaning that third party data providers can’t positively verify the applicant’s identity, the application might be set to “needs review” or “additional document required” status. The applicant may submit certain documents for the company to review. This review process takes place in the LendAPI Workflow Orchestration platform.

LendAPI Workflow Orchestration Main Features

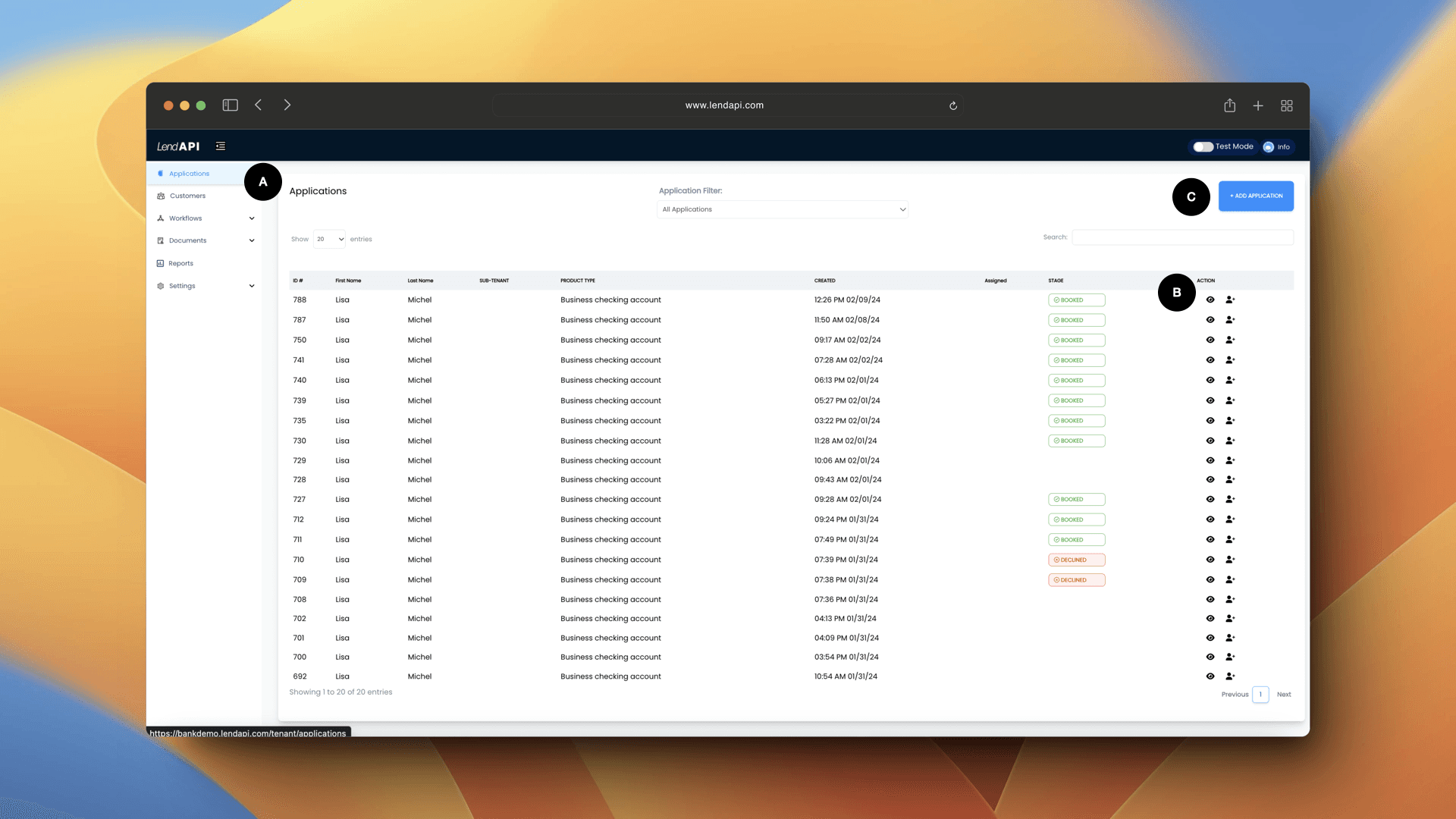

To get to the application workflow, head over to the “Applications” section on the left navigation bar. It is also the default view when you log into the administrative portal.

Application List: The application list where all of the applications in all of their status show up for the backend administrative staff to review. It is the default view when you log into the LendAPI administrative portal.

View Application: The view application icon or the eye icon will let you open up the application and look at all the detailed information within the application. This is where you will select your disposition of the application as well.

Add Application: Sometimes you may need to complete an application on behalf of the customer, and the Add Application button is where you can initiate an application from the administrative portal. You can step through the application just like a customer.

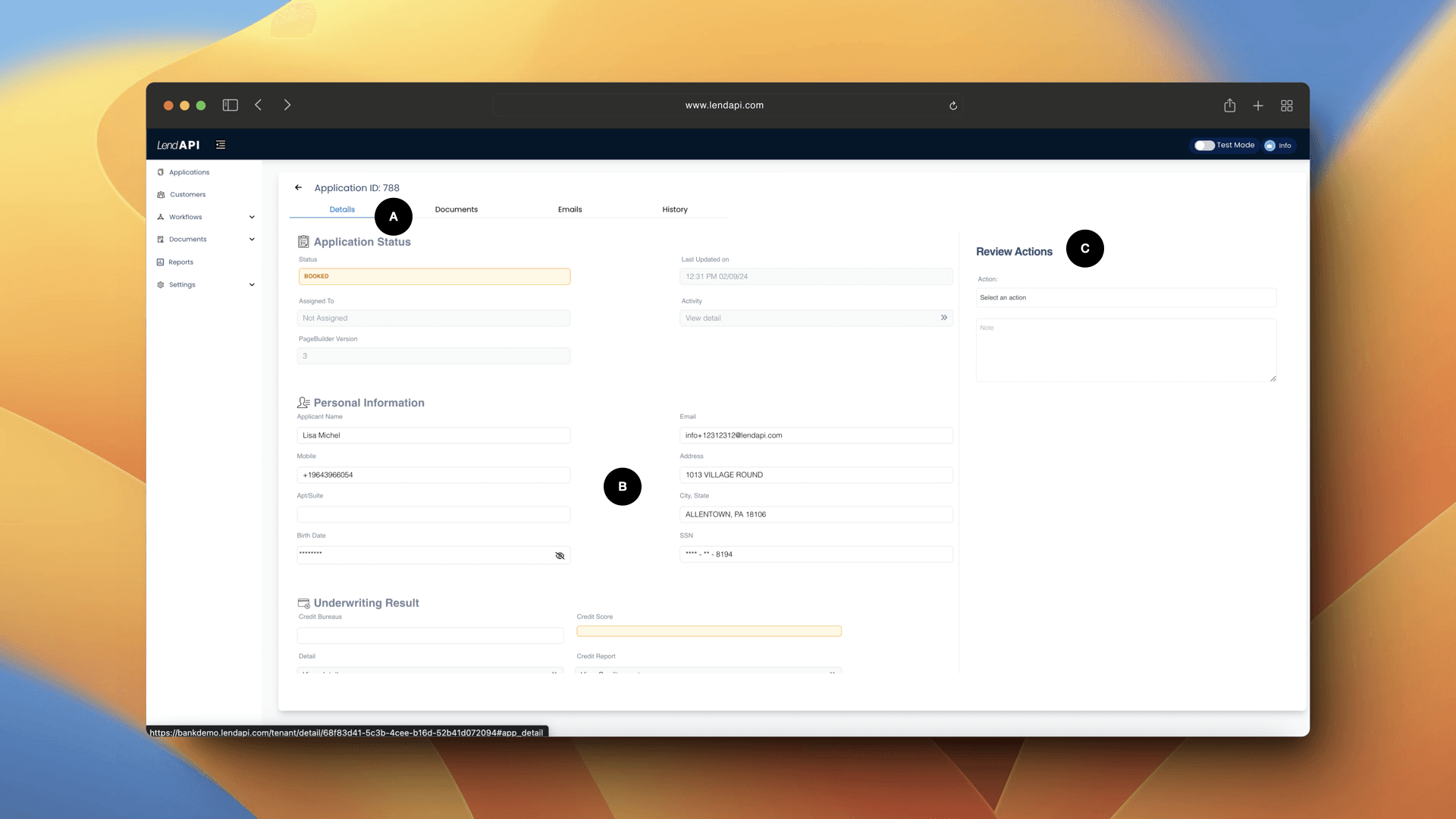

LendAPI Workflow Orchestration Detailed Application View

Detailed Application Application Information: Once you are in the application, you can see all of the data provided by the applicant. Every piece of information provided by the applicant themselves as well as all of the third party data provider’s data as well.

Additional Application Information: Third party data providers such as credit bureaus’s credit report. All of the decision trees this application ran through as well as integration data to the loan management systems, bank core software and other enterprise systems.

Application Review Actions: This is where the administrative staff can enter their disposition to approve or decline or request for additional documents to the application itself. For example, if the identity score is low and did not get an automatic approval but the score is also not low enough to get an automated decline, the application is parked in the application queue with a “Review” status. To clear this review status, the back office staff can manually approve this application and the applicant will get an email to let them know to continue with their application.

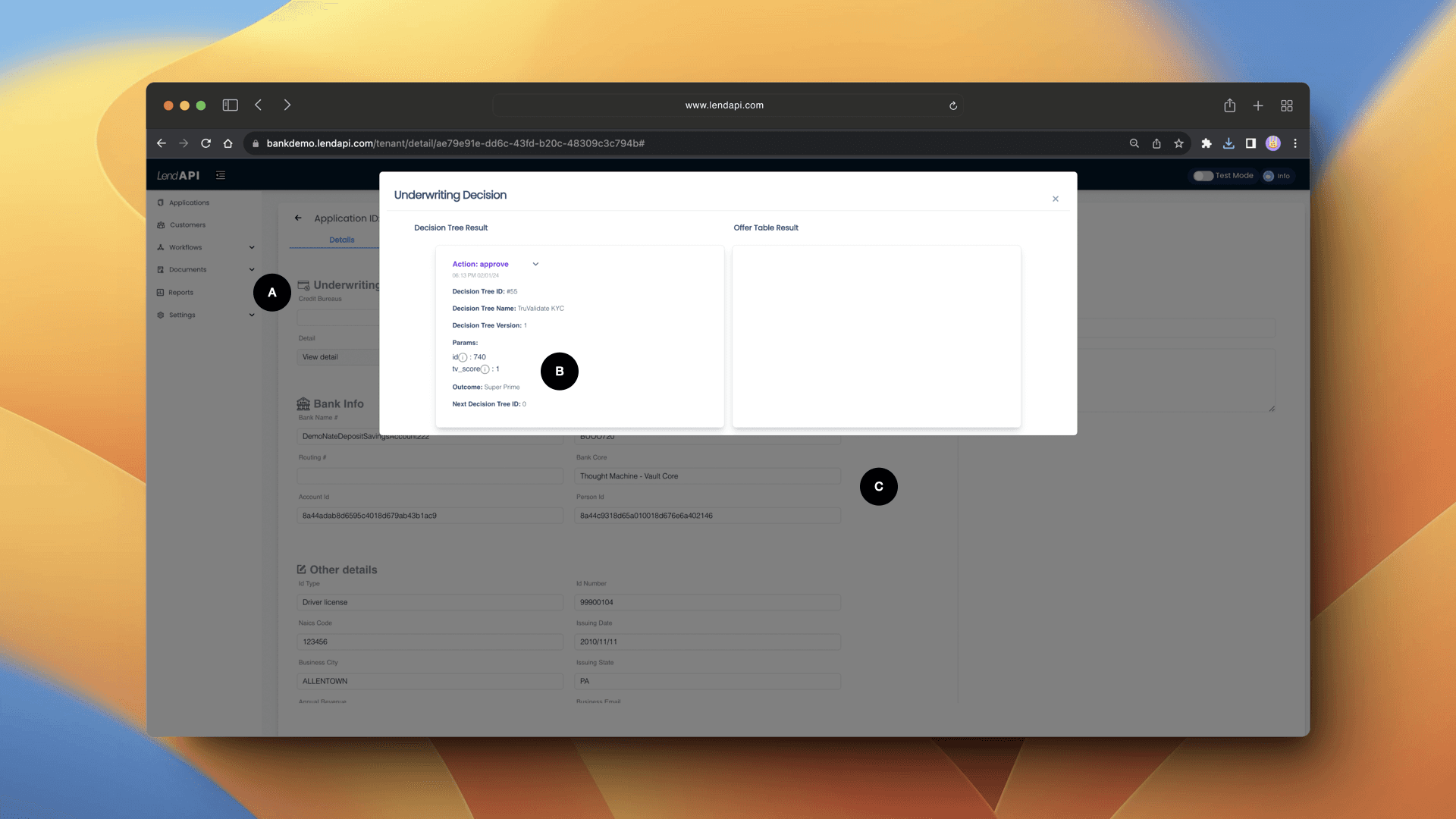

LendAPI Workflow Orchestration Underwriting Decisions

Underwriting Details: The underwriting details section contains all of the rules, variables that this application has gone through to reach the status it has reached.

Decision Details: If you click on Details, all of the parameters that this application experienced is visible, you can mouse over each variable and the system will tell you exactly how decisions were made with respect to this particular applicant.

LMS / Bank Core Details: If the product is a banking product, this section will display pertinent information on a bank core connectivity call. It might include routing and account numbers, ID numbers that the bank core echoes back to the LendAPI digital onboarding platform.

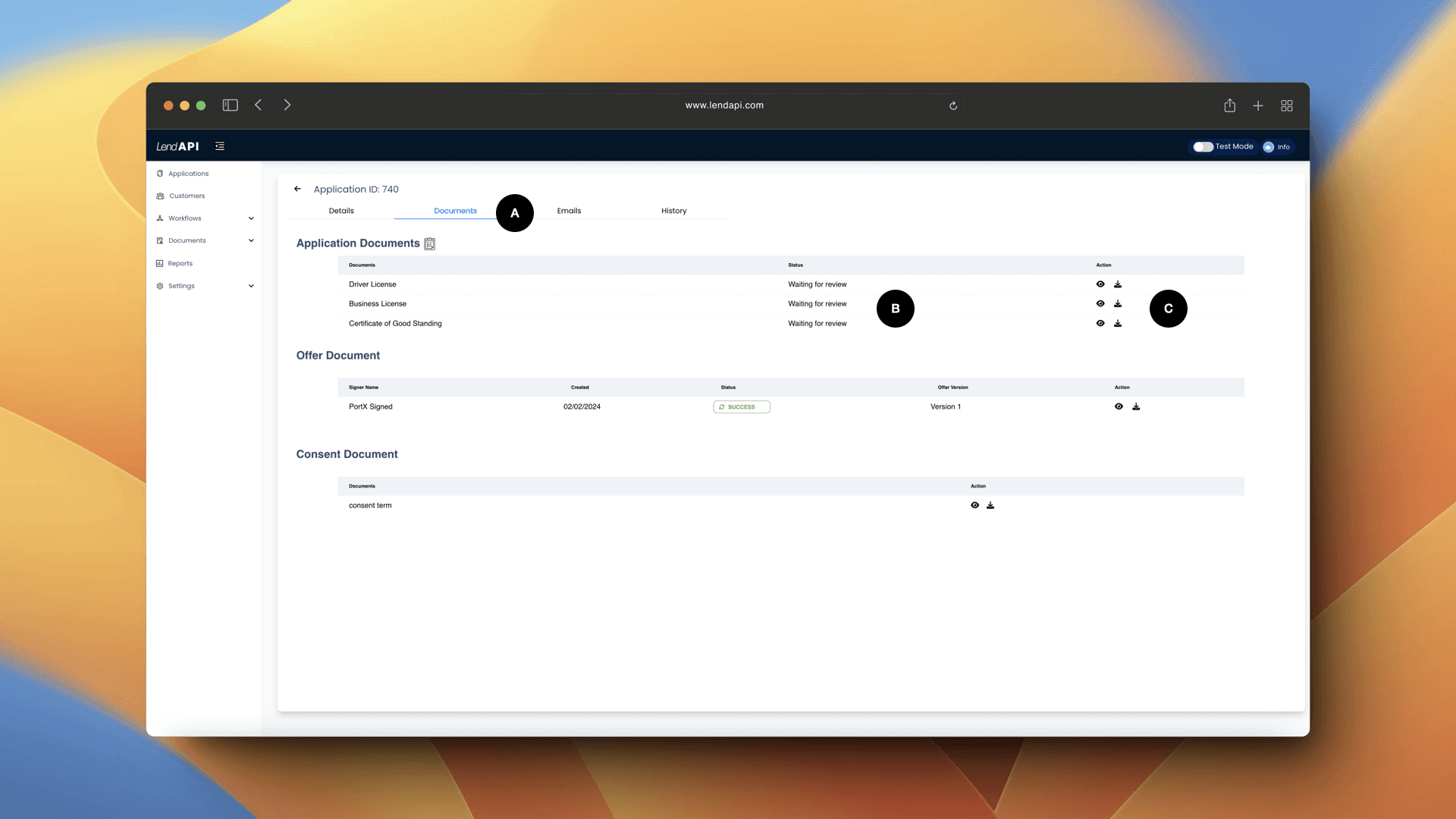

LendAPI Workflow Orchestration Document Center

Document Center: At the top of the application detail view, you can tab over to the Document tab, which contains all of the documents that the applicant either consented such as various consents or e-signed for such as the offer document. If part of the digital onboarding process requires the applicant to upload documents, then the uploaded documents are also located in the document center. Another way for documents to show up in the document center is when the back end staff requests additional documents. The applicant will get an email and log into their customer portal and upload additional requested documents. These documents will show up in the document center for additional adjudication.

Document Status: Document status shows the work that needs to be done for each of the documents uploaded through the application process or the request process. The document status will let the back office staff know whether or not the document needs to be reviewed and dispositioned.

Document Review and Download: The eye icon will let you view the document uploaded and the download icon will let you download the document into your local machine for further review

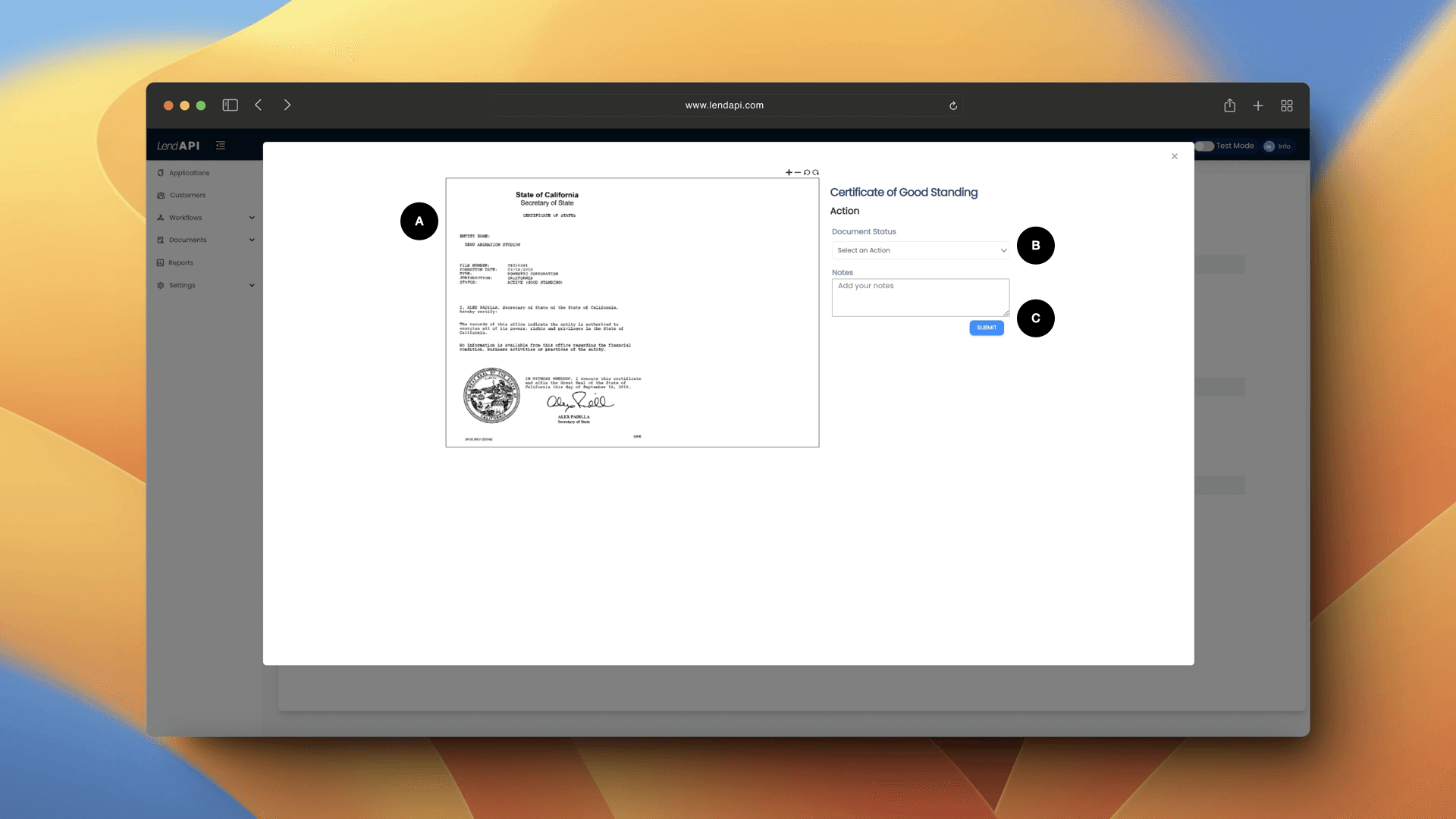

LendAPI Workflow Orchestration Document Verification

Document Preview: The document in question is previewed in this part of the screen. You can zoom and rotate the document and further examine the document.

Document Review Action: This drop down menu lets you select the disposition you’ve decided after reviewing the document. Until all the documents are reviewed, the application can’t be dispositioned as a whole. In order words, for the back office status to approve or the application, all documents uploaded must also be approved.

Document Review Notes: If the document review agent wishes to leave a note when they are reviewing the document, they can write them here and it will be saved.

LendAPI’s Workflow Orchestration Summary

LendAPI’s Workflow Orchestration layer combines the digital onboarding application which is end client facing as well as the decision trees programmed by rule engineers and the back office administrative staff’s actions all in one.

You can sign up at app.lendapi.com/signup and experience the entire digital onboarding process yourself, free for 30 days.