Launch Guide

Variable Library and Builder

What is LendAPI’s Variable Library and Variable Builder?

One of the biggest issues with other Loan Origination Systems is that clients have zero visibility into what’s all brought in from third party integration partners. There is no way to see if all the attributes, scores and strategy codes are brought in and ready to be used.

There’s always a guessing game between risk management professionals, their IT support staff and the loan originations software provider. We want to provide full transparency to our clients by showing every variable available from each integration partner and make them available to use in our decision engine, email template engine as well as other documentation templates.

Another massively underserved need is the ability to build custom variables. Product managers and risk managers have been asking for this feature for decades and we finally made this possible with LendAPI’s Variable Library.

You can create as many custom variables as you please. These variables could be created with other third party variables or variables collected from your application form. The possibilities are endless.

Once these custom variables are created and saved. You can use them in your decision engine and each application will enjoy new rules and decision paths going forward.

Where to find LendAPI’s Variable Library?

It’s easy to locate the LendAPI Variable Library. Please head to the left navigation bar and click on “Workflow” where all of your workflow, decision engine and template are located. Then head on over to the Variables section to open up the Variable Library.

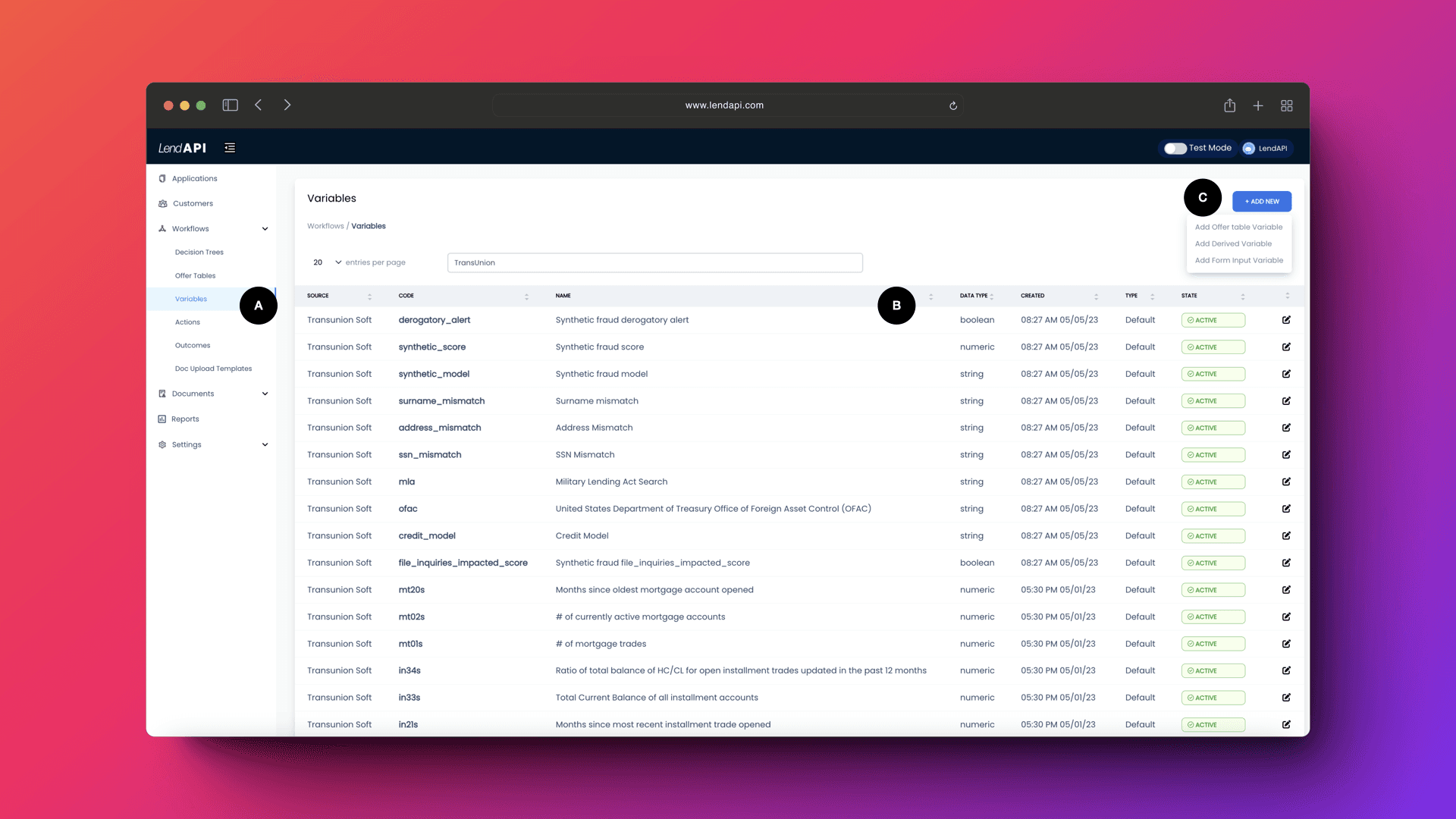

LendAPI Variable Library - Main Panel

The LendAPI Variable Library serves as the central command for all 1st and 3rd party data assets. Variables that are needed to support the Product Builder are located in the library. Third party integration partner’s data, attributes and scoring engine or decision engine is located here as well.

If you are creating your own custom variables or derived variables, these variables can be built here and immediately usable in your new application or decision engine rules.

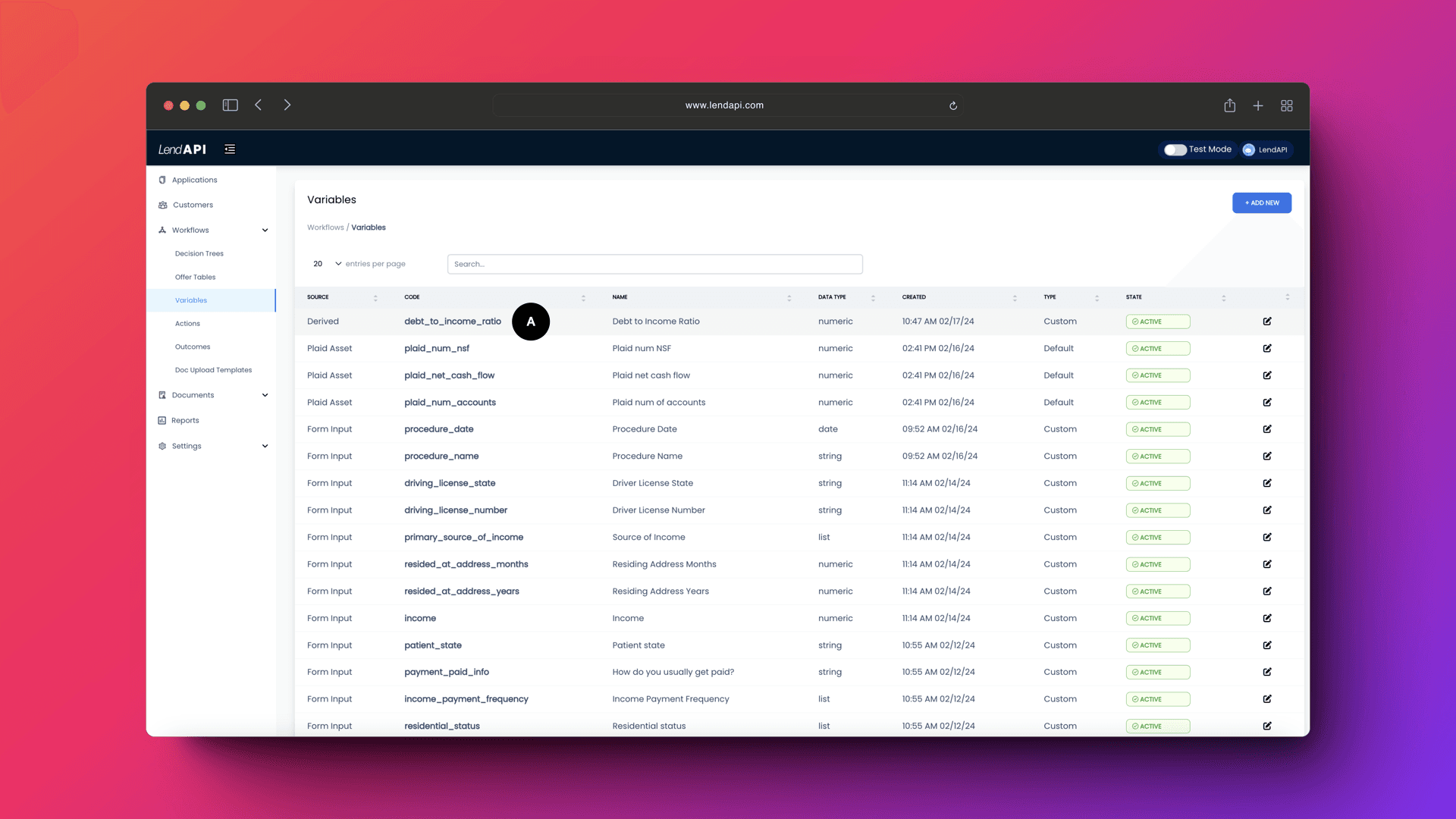

A. Variable Library Location: Head to the left navigation bar, goto Workflow then click on Variables

B. Variable Library Listing: All of the variables that drive your Product Builder, decision engine rules or product engine rules are all located here.

Source: This is where the variable comes from. If the variable comes from a third party data vendor such as TransUnion, the source of the vendor will be displayed here

Code: this variable code is the system name of these variables and it will come in handy when you construct derived variables. You have to refer to these variables by their system name

Name: This is a natural description of the variable.

Data Type: Variables comes in String, Numeric and Percentage

C. Variable Library - Add New: You can add any number of variables from scratch. You can use two existing variables and do a mathematical manipulation and save it as a new variable if you like. These new variables can be used immediately in your application if you wish to add this new variable to collect on your form. You can also use these variables in your decision engine rules.

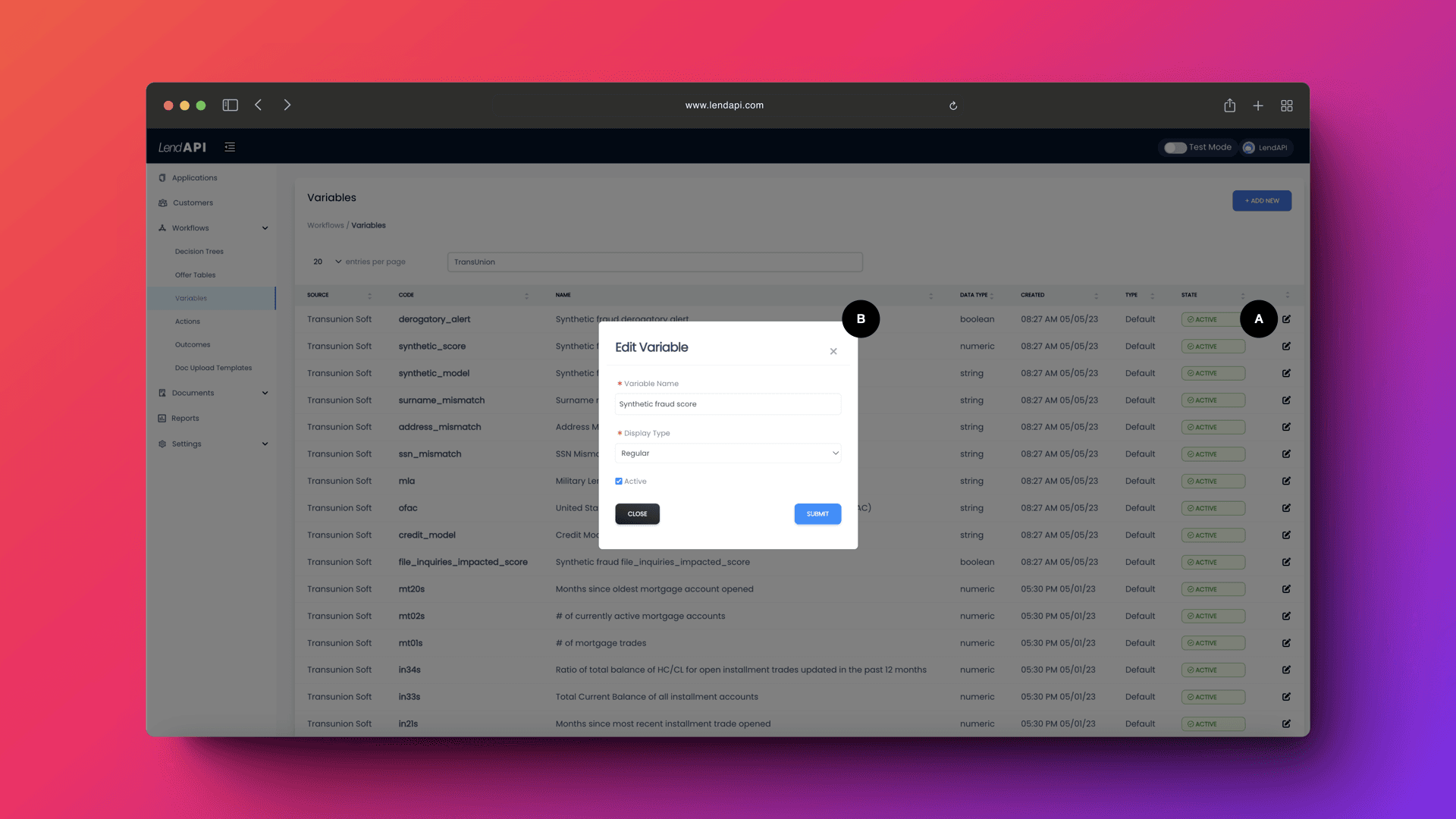

LendAPI Variable Library - Edit Default Variables

Most of the variables within LendAPI’s Variable Library are variables from third party sources such as credit bureau, identity verification bureaus or other third party data providers. These variables are not editable except for a few items such as the name of the variable.

A. Variable Editing: When you click on the edit icon. A module pops up and you can edit a few things about these third party variables.

B. Variable Editing Fields: You can edit a limited set of information on variables created by a third party.

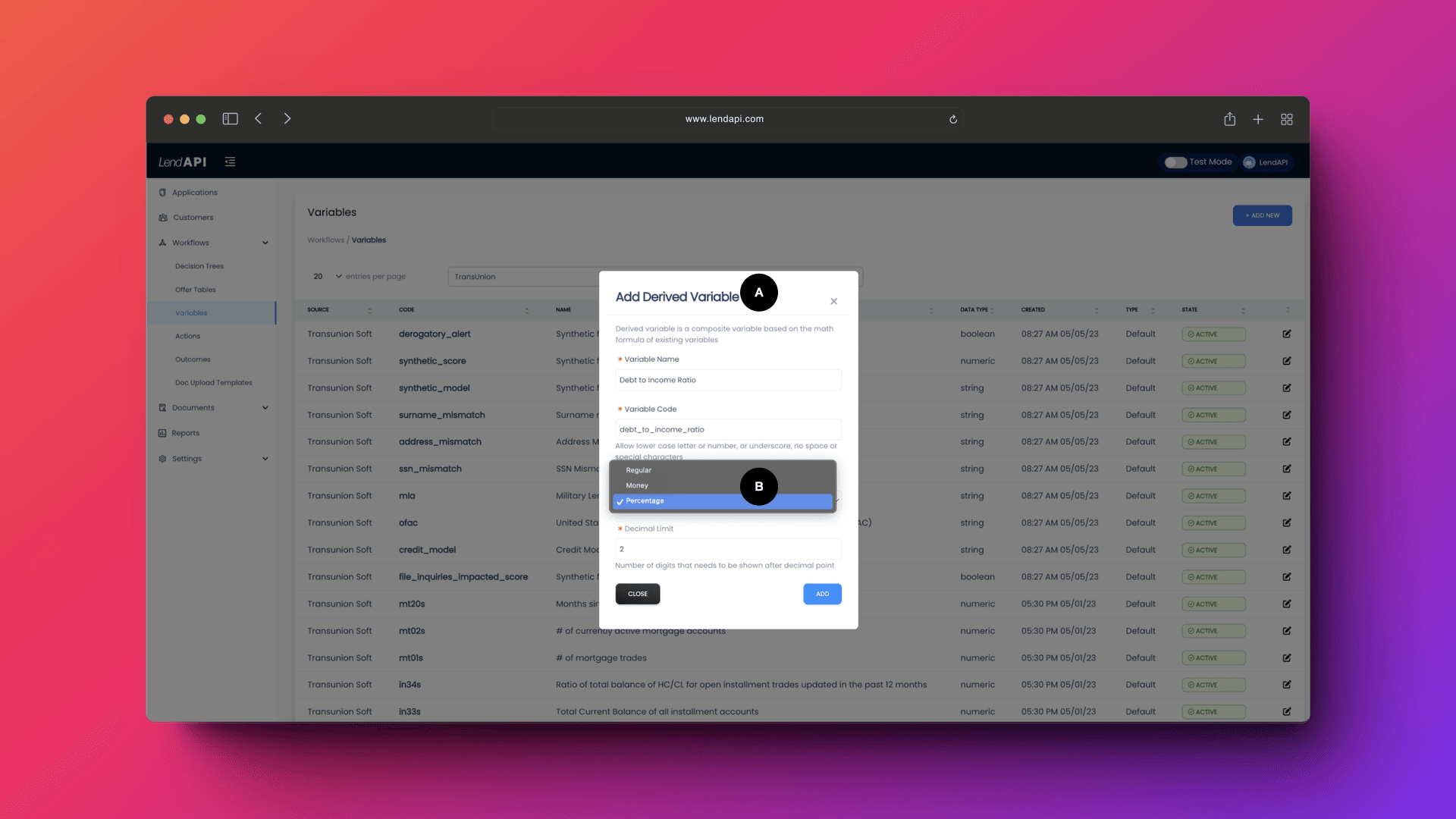

LendAPI Variable Library - Adding a New Variable

LendAPI is a fully customizable, no-code, DIY loan origination software and one of the major cornerstones of our product is the ability to create variables used in all aspects of LendAPI’s platform. Here, we will show you how easy it is to create a custom variable by combining multiple variables together from the variable already installed within the LendAPI Variable Library.

A. Adding New Variable: When you click on “Add New” from the LendAPI’s Variable Library main panel, a list of variables will pop up. Select “Add Derived Variable”. A window will pop up. You can enter the variable name, here we are adding a variable called “Debt to Income Ratio”. Then you must give it a system name, we simply made a lower cased name with “_” in between words.

B. Define New Variable Features: You will then define the variable type as Regular or string type, Money type of percentage type. You can also define the significant digits for this type of variable. Once you’ve completed this step, then click on “Add” button and you will be taken into the Variable Builder screen which we will go over next.

LendAPI Variable Library - Variable Builder

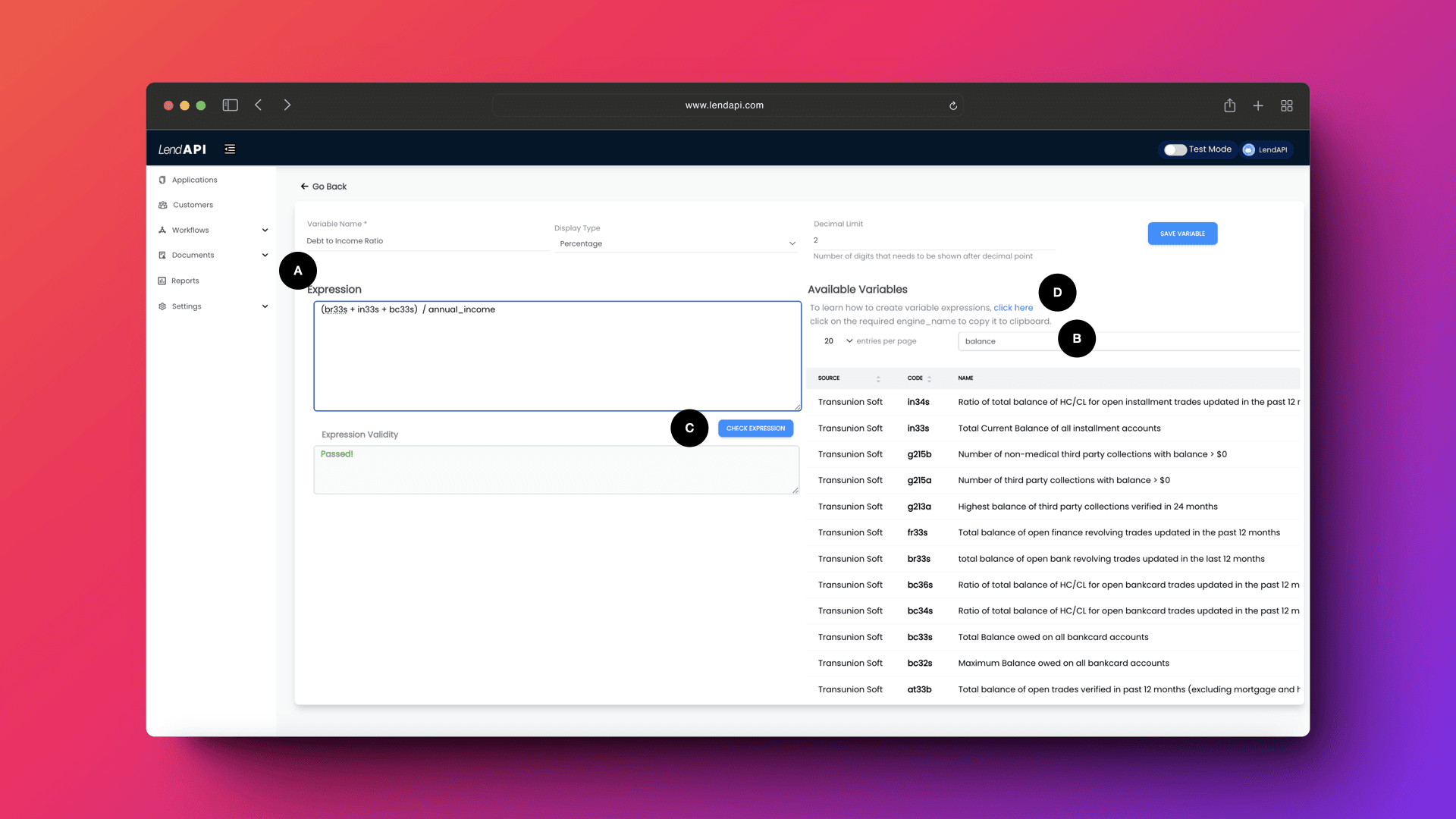

Variable Builder is one of the hallmark features of LendAPI. In this builder, you can create as many custom variables as you like. In this particular session, we will continue from the previous section where we start to define a new custom variable called “Debt to Income Ratio”.

Once some of the high level variable features are defined such as name and system name, we will take you into LendAPI’s Variable Builder and you may proceed to construct this variable. The LendAPI Loan Origination System is meant to be a no-code, do it yourself product. Anyone can operate this platform with zero coding experience needed.

A. LendAPI Variable Builder - Custom Variable Expression: We created a simple variable editor for anyone with some familiarity with standard spreadsheet tools to use. We have simple mathematical functions pre-programmed into the tool. Addition, subtraction, multiplication and division for example. And other algebraic expressions such as parentheses are also included in the editor. In the example above, we created a variable called Debt to Income Ratio. To calculate this variable. We are searching for a few variables that represent the balance of a particular person’s credit card, installment loans. Then we added these variables (br33s, in33s and bc33s) together and divided the sum of these variables into a variable collected from the application called “annual_income”.

B. LendAPI Variable Builder - Variable Search: To quickly find all of the variables that I am interested in to build my custom variable, we provided a quick look up search for you to browse through thousands of variables and find the few that make sense for you to use. In this example, we searched for the word “balance” and a few variables from TransUnion showed up that represented the balance of a particular outstanding debt and we took the variable name and plugged them into the Variable Builder Expression field.

C. LendAPI Variable Builder - Expression Checker: Unsure about what you just did? No problem, we have an expression compiler that checks all the mathematical expressions you’ve entered and gives you feedback where needed. In the example above, my simple mathematical expressions check out. This compiler gives you confidence in building variables on your own.

D. LendAPI Variable Builder - Mini Guide: We know that this part of the tool might feel a little daunting, fear not. We create a miniature user-guide right into the Variable Builder screen. There, you can take a look at all of the mathematical expressions available to you to use.

When you are finished with building this variable. You can click on “Save Variable” and the variable will be saved and the platform will bring you back to the variable list or the main panel. As you can see below, the brand new variable “Debt to Income Ratio” is now available in the variable library list. This variable is now ready to be used in the Decision Engine and you can start using it to write credit decision rules.

A. The newly created variable “Debt to Income Ratio” is now available to be used in the LendAPI Credit Decision Engine.

We encourage you to build your first variable and see how it works. If you have any questions please feel free to write to us. We are always available at info@lendapi.com