•

•

Credit cards have been around for over 70 years and there are about 18 billion cards world wide and just under a billion cards issued in the United States.

On average each adult in the US has four credit cards and over 80% of all adults in America have at least one credit card.

This payment method has been the most pervasive payment method around the world until it’s been challenged by other modern ways of payment especially with the advent of internet and mobile phones.

What is a credit card?

A credit card is a piece of plastic with a size of 3.370 inches by 2.125 inches. It has a 0.03 inch thickness. It can be easily fitted into a full-size wallet. It’s easy to carry around and hardly has any weight to it.

This piece of plastic is your representation of creditworthiness. It has your name, a credit card number. It has an expiration date, security code and sometimes it carries your signature on the back of the card.

Most recently, other technologies such as a security chip or Near Field Communication chipsets embedded into the credit card.

In some other implements, there’s even a screen built into a credit card where a random card number or a random scarcity code is built into the card. When you squeeze on parts of the credit card, a new number is then displayed as a measure of security.

How does a credit card work?

From a consumer’s perspective, a credit card is a form of payment. You carry it around in your wallet or your purse. It is a convenient way to pay for things.

Almost all of the merchants in the United States accept credit cards as a form of payment. There’s usually a terminal at the checkout area of a store that you can insert, tap or in the old days using a credit card imprinter to ink the credit card number onto a carbon copy. Someone will collectively process these carbon copies with the bank, say once a day.

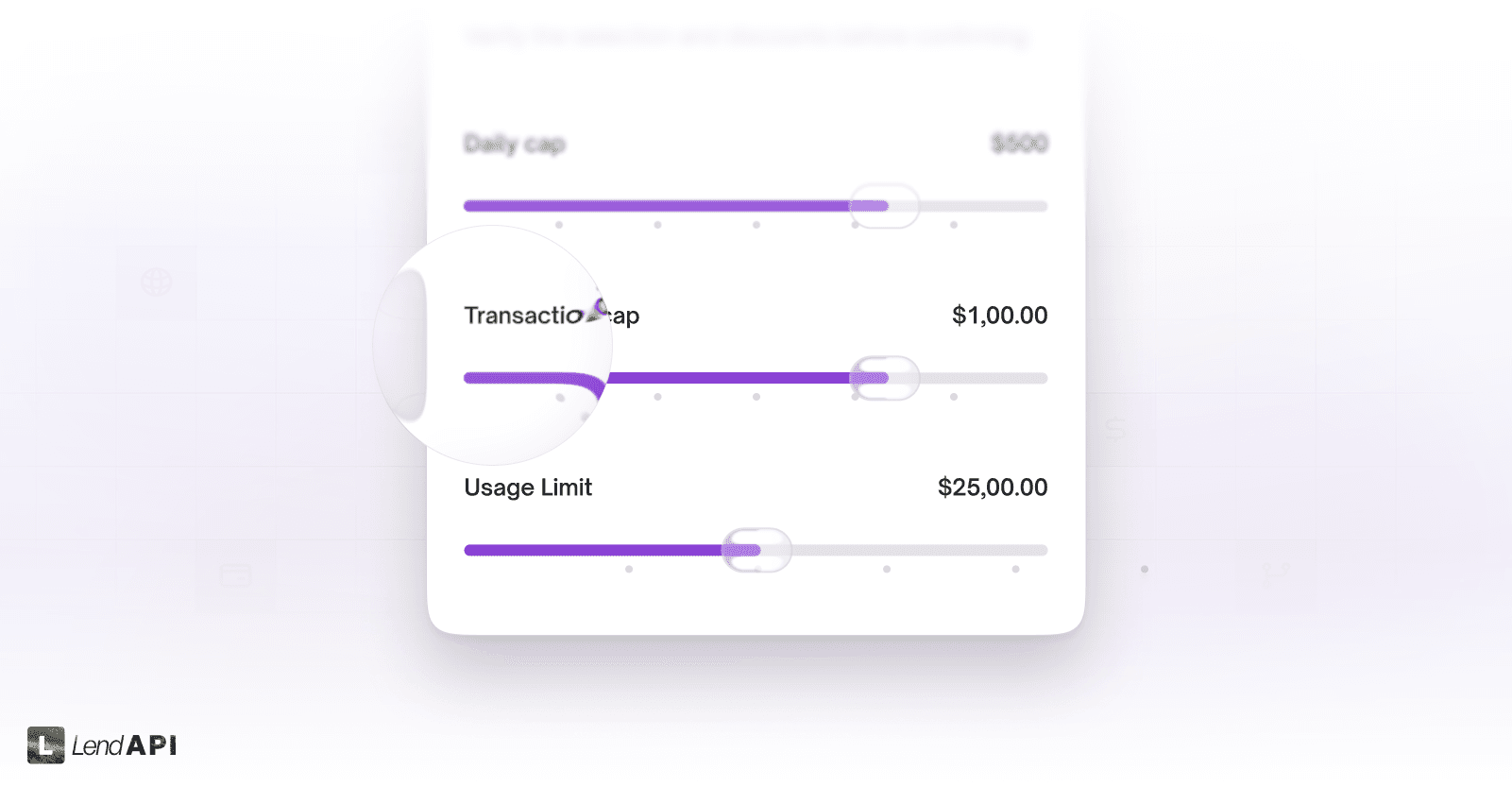

Every credit card has a credit limit issued by the issuer or the bank that granted this credit card to the end user. Sometimes these credit limits are low and sometimes and in very few instances, there are no limits as to how much you can spend on a credit card given a statement cycle. And these statement cycles are typically 30 days or a month.

We will talk more about how these credit limits are set in another section of this article.

Consumers can use their credit cards as much as they want within the credit card limits during a statement cycle until they clear or pay off the balance of the credit card to make more room to spend.

From a merchant’s perspective, a credit card is an easy way to accept payments from their customers. With a credit card transaction, the issuing bank of the credit card will work with the credit card processor to aggregate all of the monies paid to the merchant and settle with the merchant’s bank on a nightly basis.

This way, the merchant doesn’t have to deal with other more cumbersome ways of collecting payments such as cash and cheques. It alleviates some fraud such as fake money or cheques that could bounce when the merchants attempt to cash them at their bank.

There are also many back office tasks such as counting and delivering cash to their bank as well as collecting all of the checks and potentially going to various banks to cash them.

These are just some of the conveniences merchants will enjoy when they accept credit cards as a form of payment versus some of the other or older methods of payments.

From the issuing bank’s perspective, there are massive money making opportunities. These issuing banks are essentially banks that mints these credit cards for their customers. In the previous article titled Beyond the Button: Why Retailers are Reclaiming the BNPL Experience, we address the differences between compound interest and simple interest from a consumer’s perspective. But from the bank’s angle, it’s a massive profit center.

The banks will issue millions and millions of these credit cards to average consumers hoping that they will activate the card and start spending on their cards. Why? Because each time a consumer buys something from a merchant, the merchant pays the issuing bank a percentage of transaction fee for the conveniences that we talked about previously.

However, the biggest revenue generator is that the banks are hoping that consumers will not pay off their credit card balance from statement cycle to another and therefore have to pay interest over their balance. Billions of dollars of interest are collected annually from consumers that can’t afford or don’t want to pay off their credit card balances.

If an issuing bank is also an acquiring bank, they will take more fees from merchants for having their credit card terminal available at each retail branch around the country or the world.

Total interests paid by US consumers in 2024 is around $180 billion dollars on a $1.28 trillion dollar credit card debt.

The Network

Probably everyone in the world is familiar with VISA or Mastercard. VISA stands for Visa International Service Association. The word Visa comes from Dee Hock, and he renamed BankAmericard issued by Bank of America to Visa to make it shorter and universally adaptable.

Mastercard is a rival of the VISA network and now there are several major networks such as American Express, Discover. There are several smaller niche networks mostly operating in certain regions or focused on ATM networks.

What do these networks do?

These networks were created to process information from merchants or point of sale terminals and work as a money-internet communications network between the card issuing bank and acquiring bank. Essentially letting everyone involved in that transaction understand where the transaction took place, how much was the transaction, who spent the money and who accepted the money.

These networks also sometimes serve as a decision maker to prevent fraud. However most of these transaction authorizing which determines whether the credit card is accepted lies with the issuing bank since they are the ones taking the credit risk.

Why are these networks essential to the economy?

These independent money-internets wired our economy together before the advent of the internet. These companies invested billions of dollars into a network that processes billions of transactions a month with speed and accuracy that’s never been seen before.

These networks can process 2,000 to 5,000 messages per second. Each of these messages represents a single transaction. Some of the earlier blockchain networks can take 10-30 transactions per second.

However, in 2026, there are many networks that’ve been developed with VISA scaled transactions per second, but adoption of these networks is still elusive within the real work merchant community.

And just because a new network can theoretically achieve the transaction per second scale that can handle a Black Friday event, it doesn’t mean that the cost per transaction is low enough that will cause massive switching behavior of merchants, especially merchants with physical stores world wide.

However, some of the latest messaging networks developed on top of decentralized technologies have massive scale, in multiple of what VISA and Mastercard is capable of doing. We are excited to see how these networks will forever change the face of payment acceptance and bring the cost of transaction to zero.

Credit Card Approval Process

Earlier we said over 80% of American adults have at least one credit card and most of the card carrying community has on average 3 to 4 credit cards. So, how does someone get approved for a credit card and why doesn’t everyone have a credit card? We will discuss the credit card approval process and get to the bottom of these questions.

Who gets to have a credit card?

There are many regulations and laws governing credit cards and how they are given out to the public. Most recently, the Credit Card Responsibility Act attempted to prevent banks from overreaching their marketing boundaries and issuing credit cards to those potential card users that are young and haven’t had the practical life experience to use a credit card responsibly.

In essence, anyone over the age of 18 could obtain a credit card. These starter credit cards are often low in balance, say less than $500 dollars and have guardrails built into these cards such as overlimit preventions. In other words, they can’t overspend more than their limit. This also means that some credit card issuing banks allow credit card users to spend more than their limit but with a heavy over-limit fee.

These credit cards are intended to get folks to start using credit cards as a form of payment method and get them to use a credit card in lieu of cash. In some cases, these credit cards are also almost seen as a right of passage from your teenage years to adulthood.

This form of independence sometimes contributes to misuse, abuse or general misunderstanding of the responsibility that comes with credit. Some new users of these credit cards failed to make on time payments and get themselves into financial trouble that haunts them for the better part of young adulthood.

From the bank’s point of view, they are also taking a massive bet on new credit card holders. There are 20 million college students in the US at any given time. Even if half of these college students have a credit card and each credit card carries $500 worth of credit, that’s 10 million times $500, which is $5 billion dollars worth of credit and potential losses for the bank.

How does credit card underwriting work?

Banks have to be careful picking and choosing whom to issue credit cards to. If you are working adult with a predictable income, you are in luck. You are the primary target for credit card companies to give you a shiny new credit card to spend money on. They know that you can at least make their minimum payment and carry on with your lives.

For the younger generation of folks, they may be in school or just entering the workforce. There hasn’t been a lot of data collected on your employability or credibility. Sometimes the credit card issuing companies will still give you a low balance card.

Sometimes these low balance cards are backed by deposits that the bank holds as collateral. These cards are often called secured cards, secured by actual deposits as a backup in case you default on your card.

Sometimes these cards are co-signed by a more responsible person. Sometimes the card carrying person can ask the bank to give a companion card for the less creditworthy person to use. However these companion cards don't help in building someone’s credit because the true backer of these cards come from the original card holder.

Let’s say the credit card company decides to give you a credit card. What are some of the information they look at to determine the credit limit of the card?

Most of the time, they look at your income. Most of the time, the credit card companies will go off of your stated income. Meaning that on the credit card application, you can just tell the credit card company how much you make and depending on other factors, they may take that information at face value.

Most of the time, your bank, the bank that you have your salary deposited with, is the same bank that issues you a credit card. Therefore it is fairly easy for the bank or your bank to verify your income.

The bank will also look at your spending habits and other financial obligations. Let’s say that they know that each month you have to pay x amount of dollars for rent, car payment, student loans and other repeating obligations. Then they will take your income and calculate a debt to income ratio or free cashflow (how much do you have left at the end of the day) to determine how much more debt you can afford to carry.

These calculations give the bank an idea of how much credit they want to issue you. If you have a lot of free cash flow left at the end of the month, your credit limit might be bigger than those that are living from paycheck to paycheck.

Credit Limit Adjustments

Sometimes when your income has increased, you can request a credit limit increase. Some banks will automatically offer a credit limit increase.

On the flip side, if you are in a bind in terms of employment or income. Your bank can choose to decrease your limit or terminate the card to limit their exposure all together. During the 2008 economic downturn in the United States, many credit card companies cancelled their customers credit cards to eliminate credit loss. Some of them decreased the credit limit of their card holders to reduce the amount of credit risk the bank might carry during those difficult times.

Here comes the internet and mobile phones

For the past 30 years, internet technology has exploded. Mobile phones are the most pervasive technology known to man. Most people around the world have a mobile phone. This piece of technology is cutting across all demographics and social economic classes.

The Internet made deployment of credit card terminals easier to deploy. It gave these massive credit card networks such as VISA and Mastercard more bandwidth to deploy more sophisticated equipment. They can transmit more information with more security measures than ever before.

The internet technology is also global. These massive networks can now deploy their card acceptance network all over the world without spending massive amounts of money to lay the foundation for data transmission. The internet backbone such as mobile network and wireless network has helped the adoption of credit cards at a break neck speed.

Mobile phones changed everything

There are two fundamental ways that mobile phones have changed the way we use credit cards. First, mobile phones have more security built into them than anything we’ve seen so far. From security codes to biometrics, our phones have so much security technology built into them that is far superior to some of the technology native to a plastic credit card.

The expiration date, security code and your signature can easily be stolen and copied. However, multifaceted security authentication processes on a mobile device are almost impossible to hack.

So, it’s natural that digital wallets have been developed to store credit card information on your phone as a much safer alternative to your physical wallet. A natural and immediate extension of your mobile wallet is the ability to use that information at a credit card terminal at the same places you shop anyway.

Most of the newer credit card terminals can now accept tap-to-pay technology where you can hover your mobile device on and around a crest card terminal to process your payment versus taking the credit card out of your wallet to do the same. This is a much more secure way of payment than potentially exposing your credit card number or risking having your wallet stolen.

The last mile issue is how credit card companies are issuing credit cards in the new internet and mobile device world we live in.

Many credit card companies can now issue credit cards through the same credit underwriting process and push the newly minted credit card immediately into your mobile phone wallet. Most of the credit card issuing technology platforms have built extensions to let fintechs issue credit cards for a variety of niche markets.

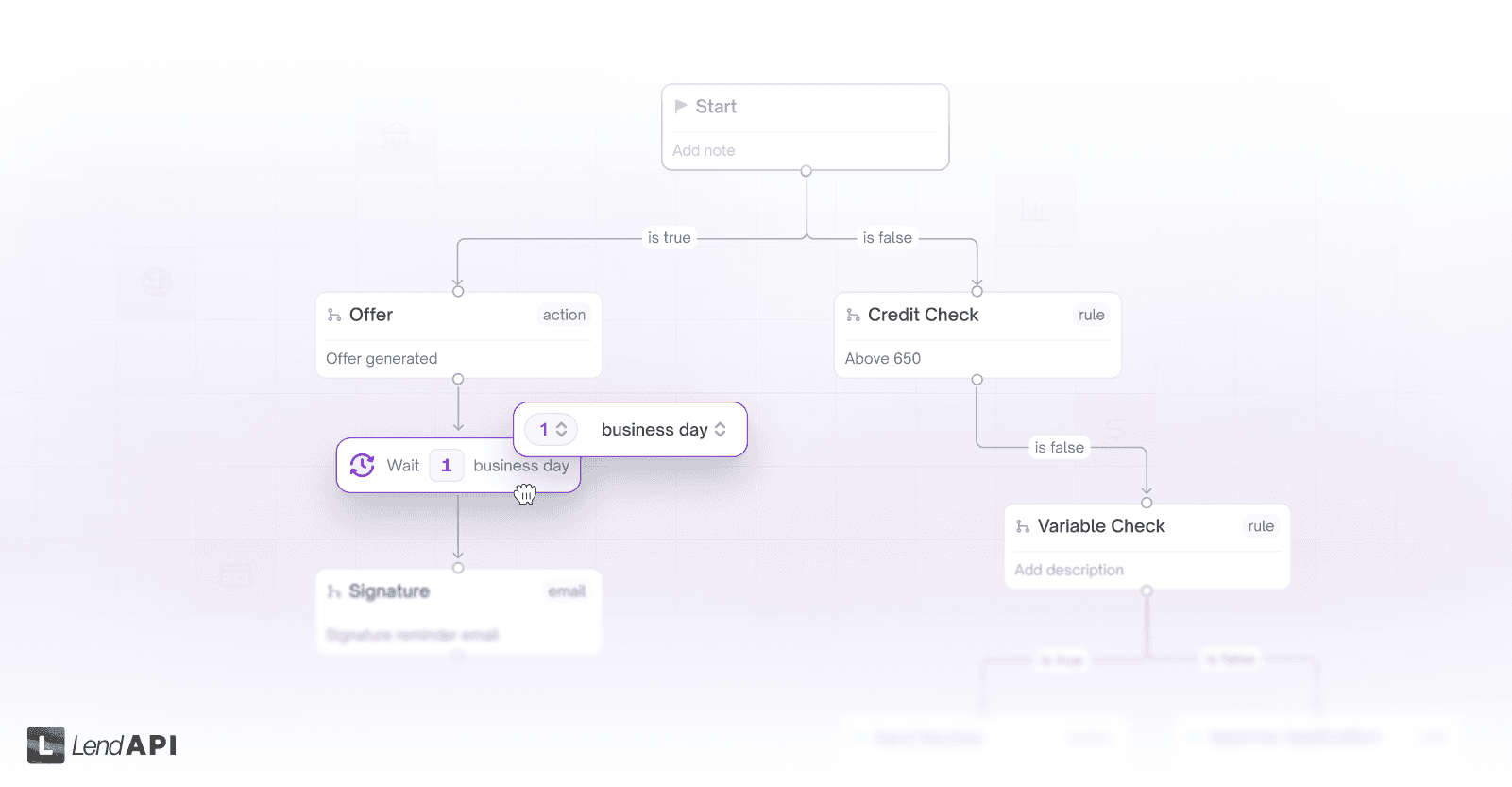

Virtual Cards

Today, we can help you to build the entire card issuing infrastructure from application to decision to linking to credit card core processors to deliver virtual cards straight into people’s mobile wallets. In some places, we can work directly with the VISA and Mastercard network without an issuing bank to issue credit cards. The credit risk lies within the fintechs rather than banks in places outside of the United States to increase the speed of adoption.

The differences between Credit (Financing) and Payment (Blockchain)

Many people compare the power of blockchain technology and how a decentralized network can process transactions faster or at least on par with VISA and Mastercard, however they fail to realize that transactions per seconds is only half of the issue.

The ability to understand credit worthiness and issue credit has not been replaced by any blockchain technology or multiple layers of authentication processes to increase the speed of raw processing power on top of the original blockchain technology.

In other words, the snow cap on top of the Himalayas is still feeding many natural or artificial tributaries at the foot of the mountain. The entire ecosystem from credit risk to transactional processing all need to work together.