•

•

Buy Now Pay Later is taking over the planet and for reasons that may not make sense to a lot of people. It’s not a phenomenon amongst the GenZ or young people, but people across all demographic spectrums are leveraging BNPL or Point of Sale financing to increase their buying power. Today we will talk about all the ins and outs of BNPL.

What is BNPL?

BNPL stands for Buy Now Pay Later. It’s a friendly consumer facing nomenclature that makes it easy for average consumers to understand the nature of the service. You can buy now, whether it’s a product or services and pay later.

Sounds like a dream doesn’t it? We will talk about the reasons why consumers and merchants like BNPL as an alternative to some of the other methods of payment and why BNPL is superior to the traditional ways of buying.

BNPL is adopted online and also in physical stores where the shopping experience and this new financing experience is blended into one.

Why is BNPL so popular?

Point of sale financing has been around for a long time, traditional banks and financial services have been doing this for decades. Most of us probably have encountered a brand called CareCredit.

CareCredit is probably one of the most known and pioneers in the point of sales financing industry. This option is offered usually at the doctors office where the patient is getting examined for a potential procedure.

CareCredit’s offering is actually a credit card that can only be used for a specific purpose. For example, a lot of us were getting LASIK eye surgery to correct our near sighted or far sightedness. The credit card itself carries a 0% no interest feature where if you are able to pay off the entire balance within say, 12 or 24 months, no interest charge will be applied.

This sounds like a great option to pay for an expensive six or eight thousand dollar procedure.

Fast forward to today, there are still a ton of pure play points of sales financing companies offering BNPL services to the masses. Companies such as Klarna, Affirm and Sezzle are some of the popular US and European companies that offer BNPL services online and in-store.

There are millions of people using their services to avoid paying interests and stretch their spending power farther by not having to shell out the entire cost of the product and services all at once.

How does BNPL compare to Credit Cards?

Credit cards have been around for a long time. Historians will argue that the first American Express Diner Club Card has been around for over 60 to 70 years. Almost everyone today has a credit card.

One of the main reasons why credit cards have become so popular is because you can spend on the approved line of credit without having to pay from your hard earned money. Credit card statements are issued on a monthly basis and consumers has multiple ways to pay off the balance.

More than half of credit card holders pay off their balance as soon as the statement is generated and within the statement grace period. According to some studies, 50-60% of the credit card holders manage to pay off the balance and in theory the banks don't make any money off of the credit card holders that pays off of their credit card balance every month.

These savvy consumers are definitely taking advantage of the product feature to give them a breather and help to manage their personal cash flow.

The other half of the credit card carries are what is called “Revolvers”. That is to say that they can’t or don’t want to pay off their credit card balance and either pay a partial payment or paying a minimum payment to keep their account with the credit card issuers in good standing.

This is where the banks are raking it in with these resolver consumers. Banks and credit card companies can charge up to their state to maximize interest rate to anyone across the country. The supreme court ruling of 1978 which redefined the 1863 National Banking Act.

Since 1978, banks have been incorporating themselves in the most favorable state which they can then export the state interest rate to rest of the country or wherever their customers resides in the United States.

Simple Interest vs. Compounding Interest

One of the most lucrative (from a bank's perspective) features of a credit card balance is that the banks can apply an interest rate for carrying that balance on behalf of the customers. Today, the unsecured consumer debit between installment loans and credit cards have way exceeded one trillion dollars.

When you take out an installment loan such as a mortgage or an auto loan, the close-ended nature of these loans won’t allow the consumer to add more balance to the original principal balance.

Any interest applied to that balance is set at the very beginning of the loan based on the principal balance. The Interest applied to these close ended installment loans is also called a simple interest. Each payment into an installment loan with a simple interest feature is paid into pre-computed interest and some of the principal balance. So eventually after 12, 24, 36 months or some predetermined duration of the loan, the loan is fully paid off.

With credit cards, potentially the consumer will spend more each month and if the consumer are making partial or minimum payment, the interest is then applied to the new principal balance. However, at each statement cycle, the interest accrued from the previous month is added to the principal balance and future interest is applied not only to the new principal balance, but the previous statement cycle’s accrued interest. This interest-on-interest feature is called compounding interest.

If a consumer with a credit card balance that’s not paid off every month will have to pay interest over interest and some consumers are trapped into so-called “a cycle of debt”. Some consumers will take years or even decades to truly pay off their credit card debt and it’s become an epidemic.

In comes BNPL

Now that we understand some of the potential pitfalls of credit cards, we can see how BNPL or Buy Now Pay Later, often with 0% interest (not even simple interest) has become so popular as of late.

Consumers can still enjoy the fact that they can pay off their purchases or debt over time and without incurring interest, it’s a win-win situation for the consumers.

The most popular types of BNPL offerings are what’s called “Pay in Four”, meaning that the amount financing through a BNPL loan is paid back in four payments. Sometimes these four payments span four months, sometimes these four payments are synced with the consumer's payroll dates.

The reason behind the short term nature of these loans is that of credit risk. Lots of things can happen given enough time. Loss of a job or employment for example can put a lot of pressure on the consumer to repay their debt, so keep the term of BNPL shorter reduces the amount of risk the creditor might experience delinquencies and charge offs.

Even though these BNPL financing options have shorter terms, consumers are still more likely to take this option versus taking a chance to put their purchases on a credit card fearing that they won’t be able to pay off the balance and get into a cycle of debt with compounding interest in effect.

How do BNPL lenders make money?

Sometimes BNPL users can’t pay off their installment loan within the given period of time, BNPL lenders may extend their terms with a late fee or an extension fee.

Seldomly, BNPL lenders may assess a simple interest (most of the time, mid to high single digits) to make some additional revenue to cover their expenses and losses.

Pure play BNPL lenders make most of their money from what’s called “Merchant Discounts”. That is to say, their BNPL product will lend against MSRP or Manufacturer Suggested Retail Price.

So how does it work? The merchants will charge consumers a sales price of say, $100. But the merchants carry a 100% margin on their product and services. In other words, $50 is the amount of money covering all of the merchant’s costs. The cost to produce the product, the cost of shipping and handling as well as costs to run their online or instore business.

BNPL lenders will negotiate a merchant discount to help these merchants to move more services and merchandise by getting rewarded with some of that margin. Out of the $50 worth of margin, $5 to $15 might go to the BNPL lenders to cover their expenses and losses.

But why would merchants give up their margins to BNPL lenders? The biggest reason is that BNPL lenders help merchants to gain more customers.

Sometimes the customers may not be able to pay a $500 dollar product and services all at once but they can pay $100 per month for five months. Without the BNPL or point of sale financing offering the merchant might lose that business and giving up $25 (5%) or $50 (10%) of the potential revenue to save this client is a calculated move on the part of that merchant.

Even though the merchant makes less money or margin, at least they made a sale.

How do BNPL lenders calculate risk?

Just like banks and other financial services, BNPL lenders calculate their return on investment. Most of the pure play BNPL lenders have to pay the merchant overnight or in a few days just like the credit card companies.

Merchants then shift the risk back to the BNPL players. Other than some extreme circumstances, the BNPL lender will carry any risk or nonpayment or delinquency. In other words, if a consumer stops paying their BNPL installment payments, the BNPL lender will need to service the loan and/or potentially take a loss. The merchants are already made whole at that point (they got paid by the BNPL player already).

Because of this shifting of risk carried by the BNPL lenders, they need to carefully assess the credit worthiness of the borrower. Credit scores, income validations, identity verifications are some of the things that these BNPL lenders look at when they are assessing the creditworthiness of the borrower.

Perhaps one of the other reasons why merchants like to work with BNPL players is that they are willing to take on more risk and also willing to underwrite deeper into the credit spectrum. In other words, those consumers without a credit card because of their credit worthiness may be approved by the BNPL counterpart and therefore able to shop with the merchants.

This increases the merchant’s revenue or sales and everyone is happy. However there’s a good reason why some of the consumers are not creditworthy in the eyes of the credit card issuing banks. BNPL lenders are aware of this population of consumers, sometimes called subprime consumers.

To further protect themselves from higher losses and delinquencies, the BNPL lenders might ask for even a deeper merchant discount. Using the prior example where the merchants are giving up 5-10% of their margin, in order to make another sale to consumers with less than stellar credit they need to perhaps give up 15% to 25% of their margin.

Even with a steeper discount, the merchants are still able to make money by moving more inventory. For those merchants that are offering services, they rather have their service providers such as a dental hygienist or a merchant working than sitting idle.

New BNPL Trends in 2026 and Beyond

With hyper inflation and countries realigning themselves politically and economically, the cost of consumer goods are going up. Merchant’s margins are getting eroded like any other type of business.

With compressed margin and low consumer spending confidence, merchants are looking for ways to regain control of their entire supply chain including their working relationship with their financing partners.

Increasingly, their financing partners are also tightening their belts by asking for higher merchant discounts rates and lower approval rates to cover their losses and expenses. Naturally, elements in the merchant-BNPL relationship have come into a sharp focus and interests start to be misaligned.

Retailers are becoming BNPL

Today, we see retailers of all sizes becoming their own BNPL players. With the right infrastructure partners, retailers are launching their own BNPL options. We see that more and more retailers are choosing a variety of white labeled BNPL platforms to launch their own online and in-store financing options.

Why are retailers launching their own BNPL?

There are many reasons why retailers are choosing their own destiny when it comes to financing. From flexibility to control, having your own BNPL platform makes all the difference in today’s highly competitive and margin sensitive world.

Inherent conflict of interest between retailers and BNPL lenders

Pure play BNPL lenders have their brand displayed front and center in front of the consumers while they are shopping with the retailers. These BNPL players don't really care about the retailer's shopping experience.

BNPL players want these consumers to check out quickly and get them to sign up for other things that these BNPL players offer to extract maximum value from these consumers. The retailers want their customers to experience a more on-brand and intimate experience when it comes to shopping and their check out experience.

Even user experiences are conflicting and causing a lot of issues to the merchants. For instance, the financing arm of these BNPL lenders are Wall Street financing firms and their have a strict underwriting process which runs in conflict with the merchants that are partnered up with these lenders.

A low credit approval rate causes a lot of issues with the merchants. The consumers sometimes spend minutes to get approved or “declined” online and in store, it’s up to the merchants to explain why their clients are getting credit declined. This causes extra headache for merchants to lose potential customers and potential sales.

Cost savings for retailers to launch their own BNPL programs

Pure-play BNPL charges the merchants a heavy percentage of sales. Most of the time, it’s above 10% and on top of the merchant discount rate they’ve negotiated. It’s more expensive than the cost of running on Visa and Mastercard’s network combined.

If merchant decides to run their own BNPL program, they can either retain the cost of using pure-play BNPl players and add it back to the their bottom line or push some of the cost savings as an incentive program to their staff as a commission structure to encourage them to make more sales and use their own branded BNPL program.

These cost savings are substantial and even though some of those cost savings are going into running their own BNPL program, the savings is immense compared to giving your sales away to pure-play lenders.

User experience, approval rates and branding considerations

Merchants and retailers are finally able to brand their own financing arm with their own brand mark. Private label BNPL gives retailers, brands and merchants their own look and feel and their own shopping experience.

Not all merchants, brands and retailers are the same. Some of the consumer goods and services sold are not one and done or a quick checkout action then drives the consumers to the door. Many retailers want to create their own shopping experience, a store manager or an online shopping guide might want to help the consumer to explain the product and services they are purchasing.

Most of the pure-play BNPL lenders are championing a quick checkout, one button checkout experience which contradicts what the retail brands would like their customers to experience a different type of shopping experience.

Lastly, most of the pure-play BNPL lenders don’t care about approval rate of their financing product and disregard the impact and negative user experience a low approval rate may have on the consumers and in branch staff. Most of the pure-play BNPL players have less than 40% approval rate.

The reason for this low approval rate is that their objective is purely a financial objective. The pure-play BNPL lenders need to cater to their financing partners first and never consider what the retailer and brands have to deal with inside of the stores and branches.

Some lenders change their underwriting criteria willy-nilly without properly communicating or explaining these changes to their merchants, thus causing mass confusion and negative merchant and consumer experience.

New era of private labeled BNPL platforms

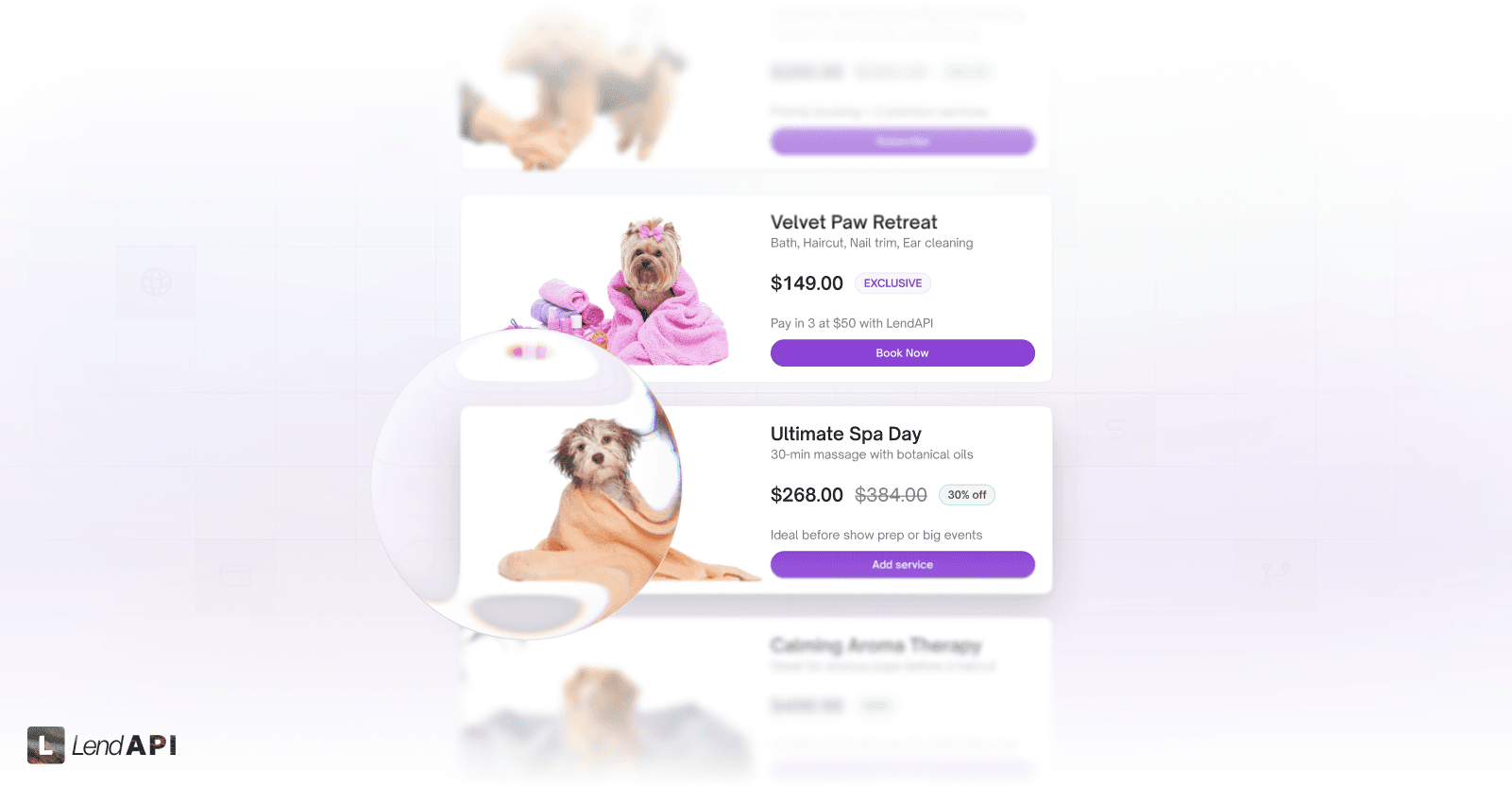

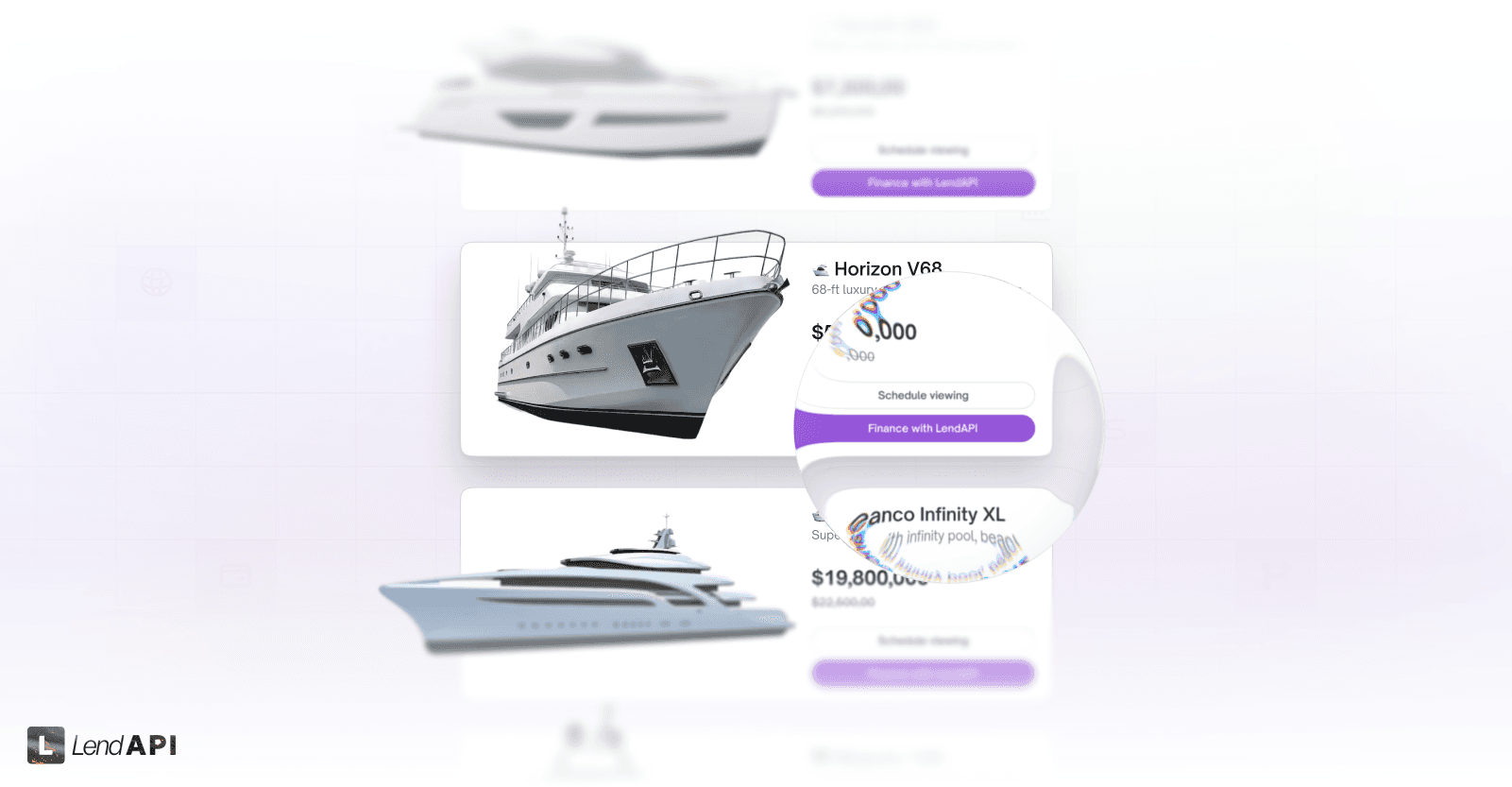

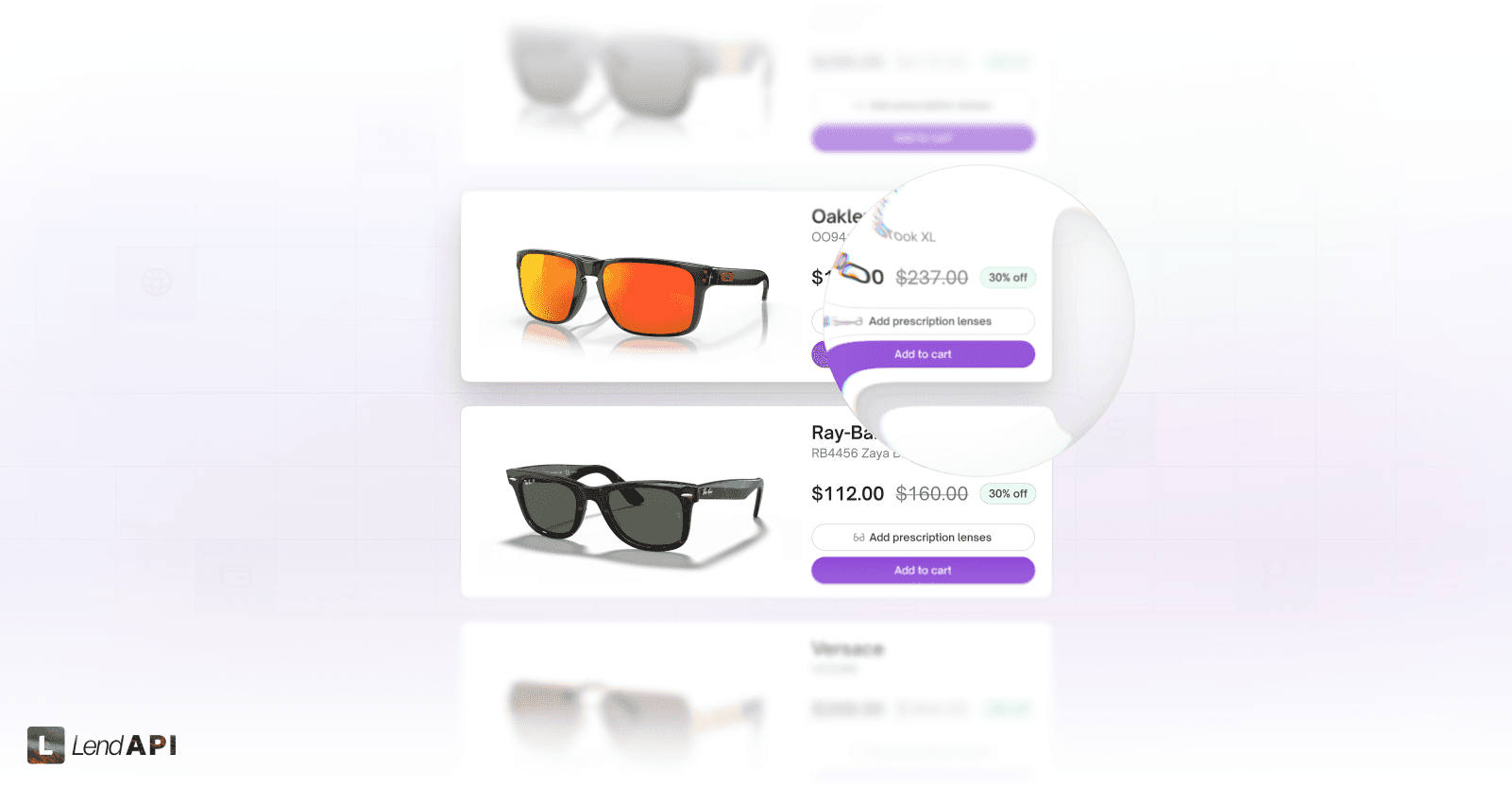

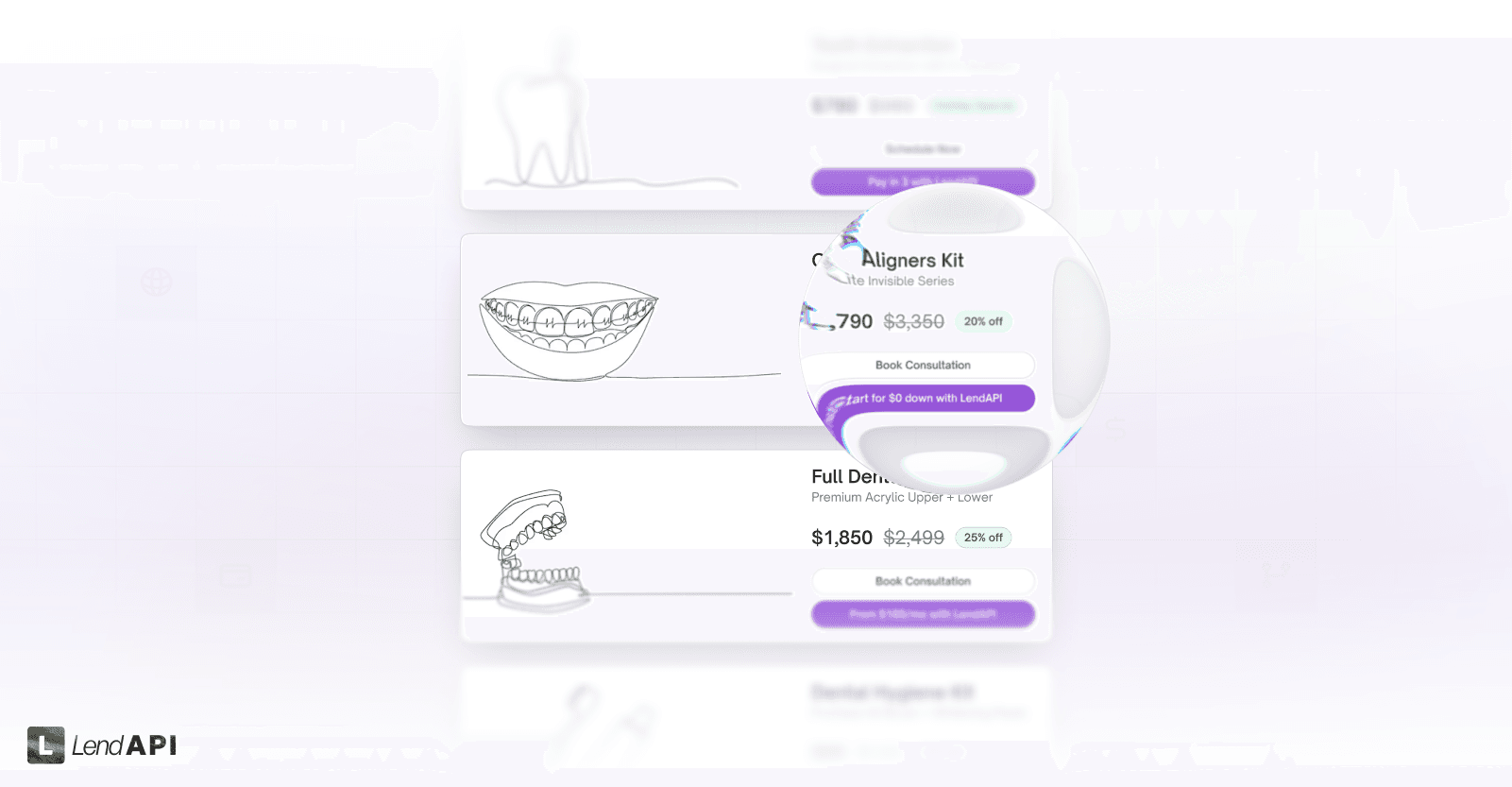

Consumer brands are now turning away from pure play BNPL lenders and working with partners like LendAPI to build their own BNPL.

They can now control 100% of their customer experience, approval rates, shopping experience with massive savings which they can add back to their bottom line. With private labeled experience, the consumers stay on brand with the merchant from product and services all the way to their financing options.

Merchants are also able to create different financing options for different products and services that they offer and are able to truly create curated financing options for different products and services. They no longer have to live with a one size fits all world with other more restrictive pure-play BNPL lenders.

LendAPI can customize your shopping experience and checkout experience to fit the merchant’s specific criteria. Brands can also dictate their underwriting criteria and set their approval rate to a level that achieves a balance between customer experience and risk. Most importantly, the look and feel of the point of sale experience is completely aligned with the retailer's brand guidelines.

LendAPI will provide lending licensing structure, payment services, technology and loan servicing which gives retailers maximize flexibility and specific experience they want their consumers to experience. It’s a true white labeled experience that merchants deserve to finally provide consumers a complete, on brand experience.