•

•

Customer communication is key to reduce fraud, stay compliant and maximize conversion rate. Banks, credit unions and lenders spend the majority of their budget on marketing and it’s time to focus on maximizing your marketing dollars with up to the minute communication with the applicants to keep them engaged. Having a customer portal which you can easily communicate and work with the clients is the key for banks and lenders alike

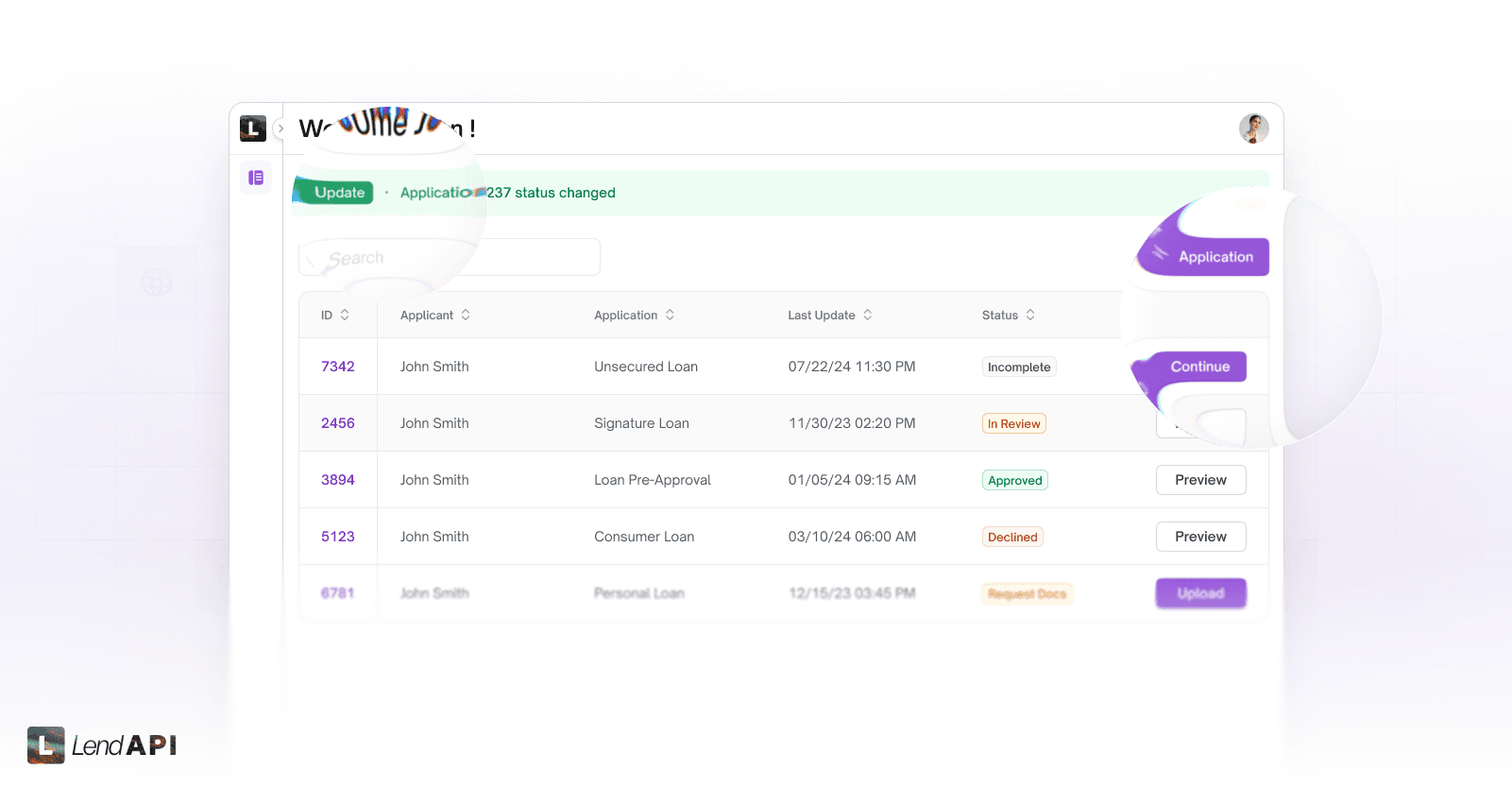

Customer Portal and User Dashboard

User centricity has been touted by all major big tech companies such as Netflix, Amazon of the world. Their entire business success depends on their interactions with their customers. From selecting a product, service to making payments, these big techs have invested billions of dollars to make their customer’s experience as frictionless as possible.

Banks and fintechs have done a great job when it comes to customer service and portfolio servicing but clearly there are a ton to do because no one that we’ve interacted with sings praises of their bank or lender’s user interface.

We provide a customer portal that’s easy to use with clear instructions on to-dos from the application process to catching up a payment while the loan is in some sort of repayment process.

Customer Portal - Must Haves

Let’s be honest, the customer portal for a pure-play lender is not that exciting and customers aren’t rushing to login and see a lending decision or looking at payment reminders as well as their statements.

Nevertheless, the customer portal is sometimes your second impression other than the initial application process. A broken, opaque customer portal erodes confidence and therefore decreases conversion rate. If you want your customers to be confident working with you, your customer portal must look like a million bucks.

Logging In

Surprisingly a lot of loan management and loan origination systems just simply don’t have a customer portal. They still think that lenders and banks themselves will come up with engineering resources and mend their shortcomings. Those days are over.

Banks and lenders demand their platform providers to have a great customer service portal that carries advanced features and functionalities to be able to interact and communicate with their clients. This is now a tablestake and no longer a “not my responsibility” and “you have to build around our platform” discussion.

As soon as the application process has some identifiable information such as email, mobile number and names, the system should automatically send out email invites for the customers to set their passport and start engaging the client right away.

There are several reasons for an early engagement. It shows that you acknowledge the client and you care about them enough to have a private channel established with them.

From a compliance perspective, there are consents of all kinds when you are first engaging your client whether they ultimately become a borrower or not. A space where all of the consents are stored where clients can easily retrieve them is not only good form but creates a secure and private channel to retrieve these sensitive information at any time.

Security around setting up a portal is also important, complex passwords, two factor authentication and other methods of keeping the customer portal secure is a must when it comes to setting up a customer portal where sensitive information such as payment methods might be stored.

To Do Lists

Even the simplest type of loans requires a bunch of to-dos at various stages of the loan process. We will describe a few of these in this article.

Consents, waivers, additional documents generated from the banks and lenders need to be acknowledged and signed is one of the biggest hurdles at the beginning of a lender/borrower relationship.

The ability to clearly communicate who’s doing what is important not only reduces the amount of confusion but also a must to speed up the application process and nail down that conversion rate.

An email, SMS with a deep-link to the customer portal is a given when it comes to modern LOS (Loan Origination System). The customer then proceeds to log into their customer portal and complete their to-dos.

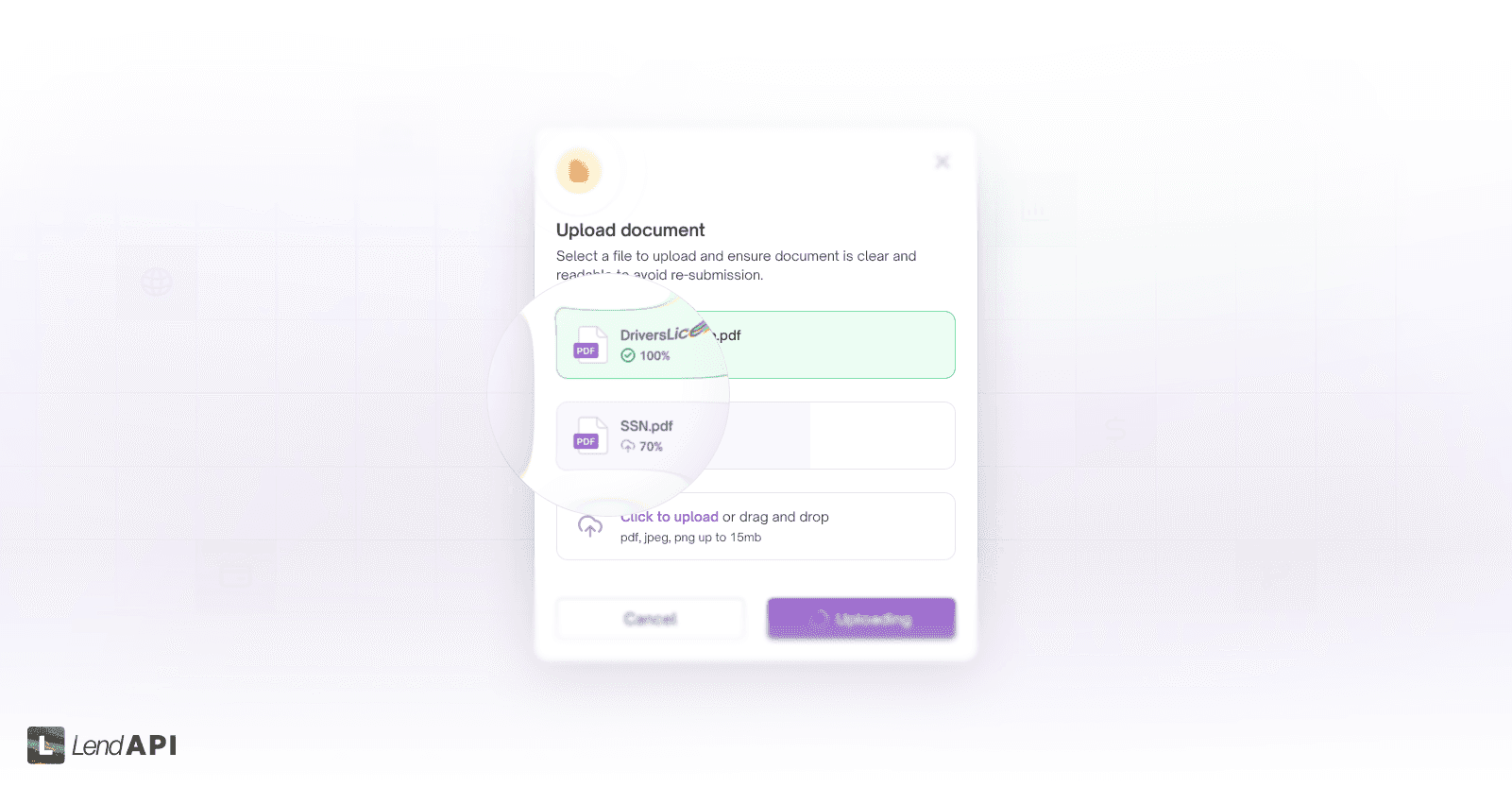

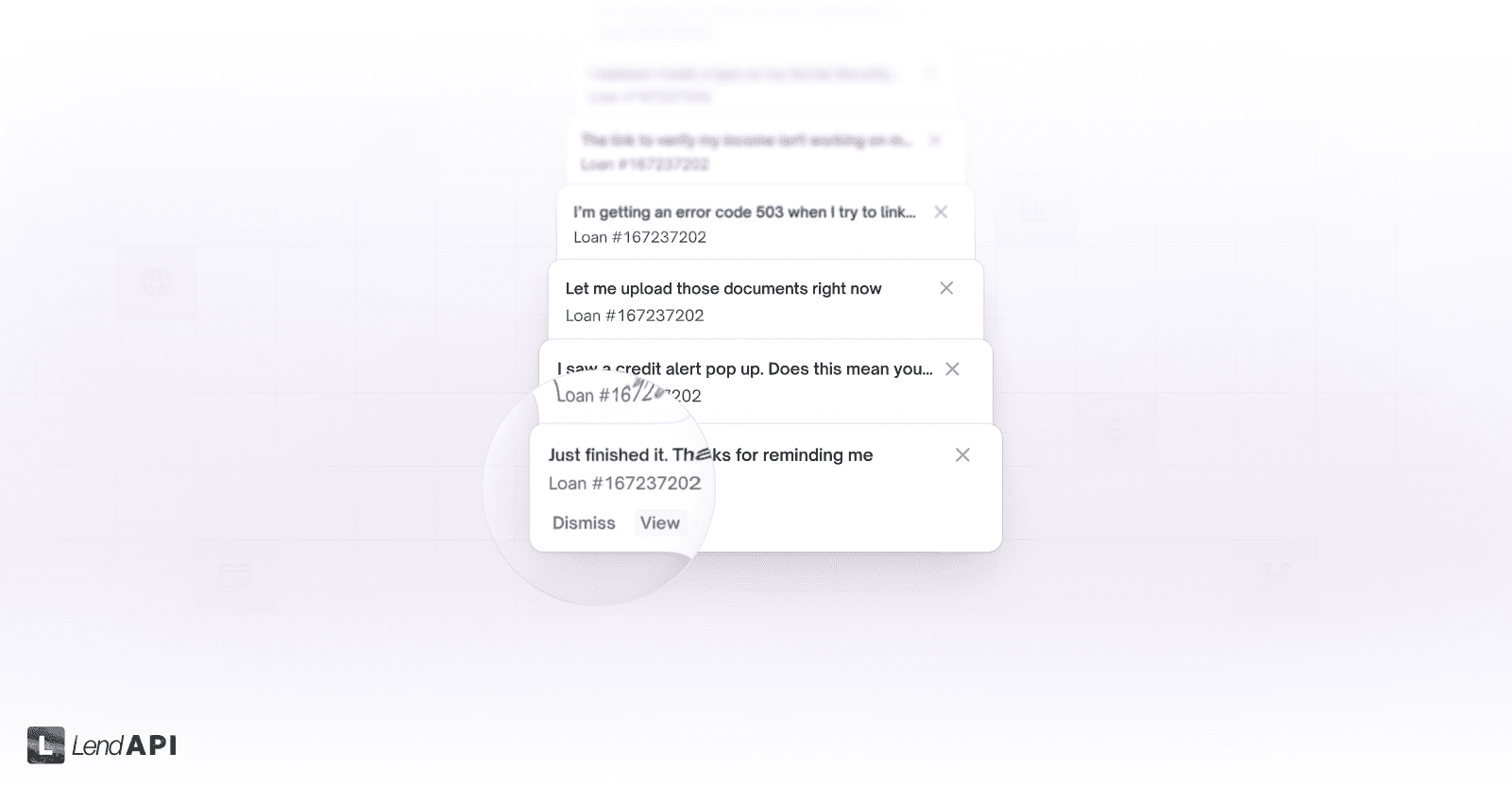

The alert process needs to be super clear as well, when a customer logs in, they need to have whatever that needs to be done tastefully in front of them. And if the to-do is multi-staged, a clear instruction must be given step by step to reduce the amount of issues that might arise from any misunderstandings.

Once the task is complete, the system or the dashboard need to let the customer know that their task has been completed and give them clear expectations on what will happen next. Many times, the customer completes a task as if they are completing a simple computer task. But in lending and banking, you should let the client know what will happen to the consent they just resigned and how long it might take for someone to look at the complete to-do list to set a clear expectation.

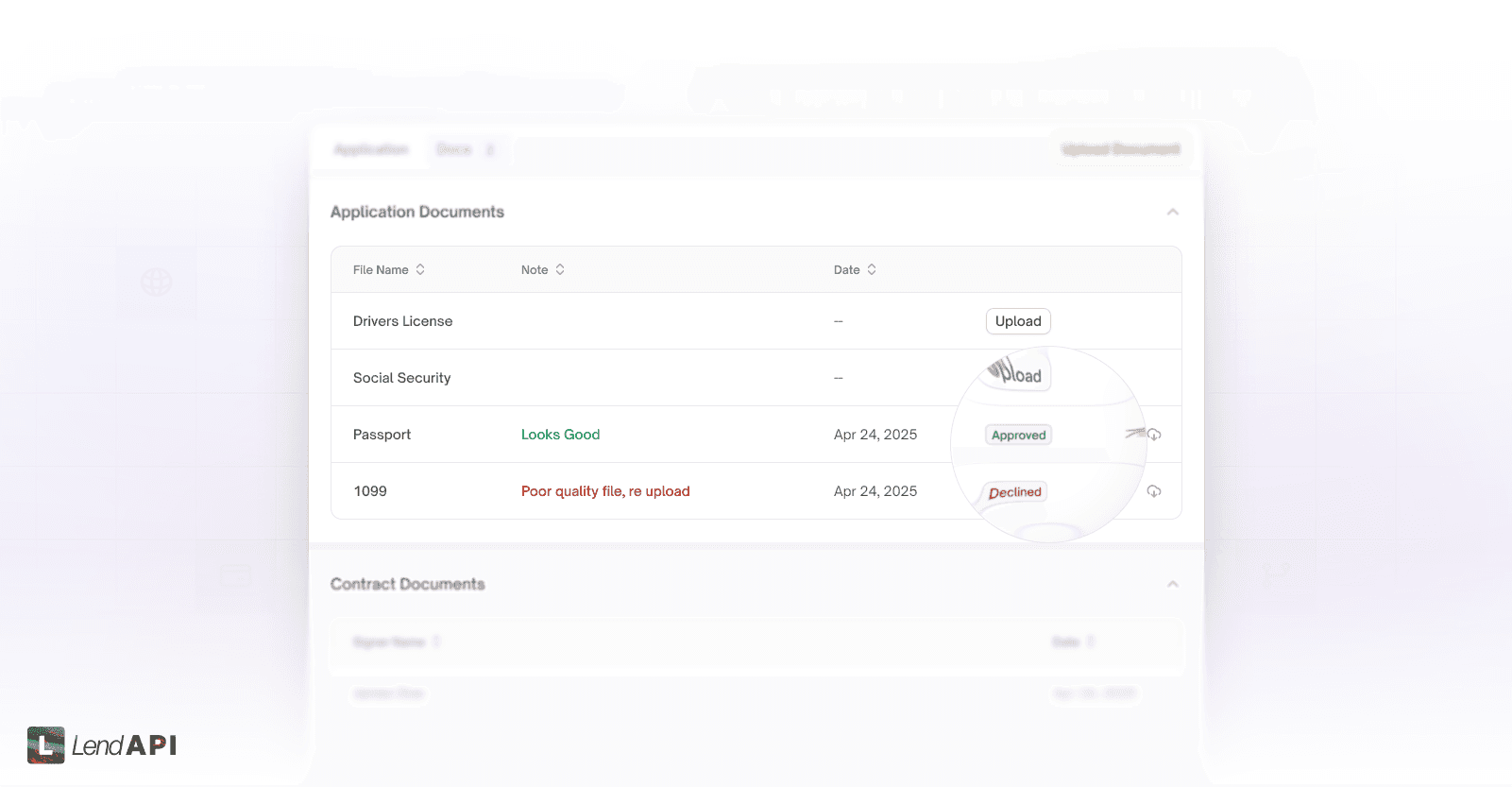

Document Upload

One of the most interactive to-dos a borrower and a lender may have to perform is a bunch of back and forth when it comes to document uploads and document adjudication. Whether a loan is a simple personal loan or complex mortgage application, there’s always an ask to upload a document to affirm or verify the applicant's identity, income and assets.

Before we talk about document upload needs, let’s talk about the decision engine for a second. Most of the lenders and banks blindly request the entire set of documents for applicants to upload regardless of their status. This induces unnecessary burden on both borrower and the lenders. Borrowers will have to search high and low for documents and lenders will have to spend needless hours to review documents that may or may not need to be reviewed.

A more intelligent and risk based approach is warranted in today’s environment where time is precious and accuracy rules.

LendAPI has a powerful rules engine which not only executes rules, models and algorithms but it’s also used to decide other outcomes such as what type of email, sms and even document needed under various circumstances.

This is a more intelligent way of notifying clients and informing back office folks on the type of document needed to reduce the amount of friction and decrease the amount of busy work back office folks need to review.

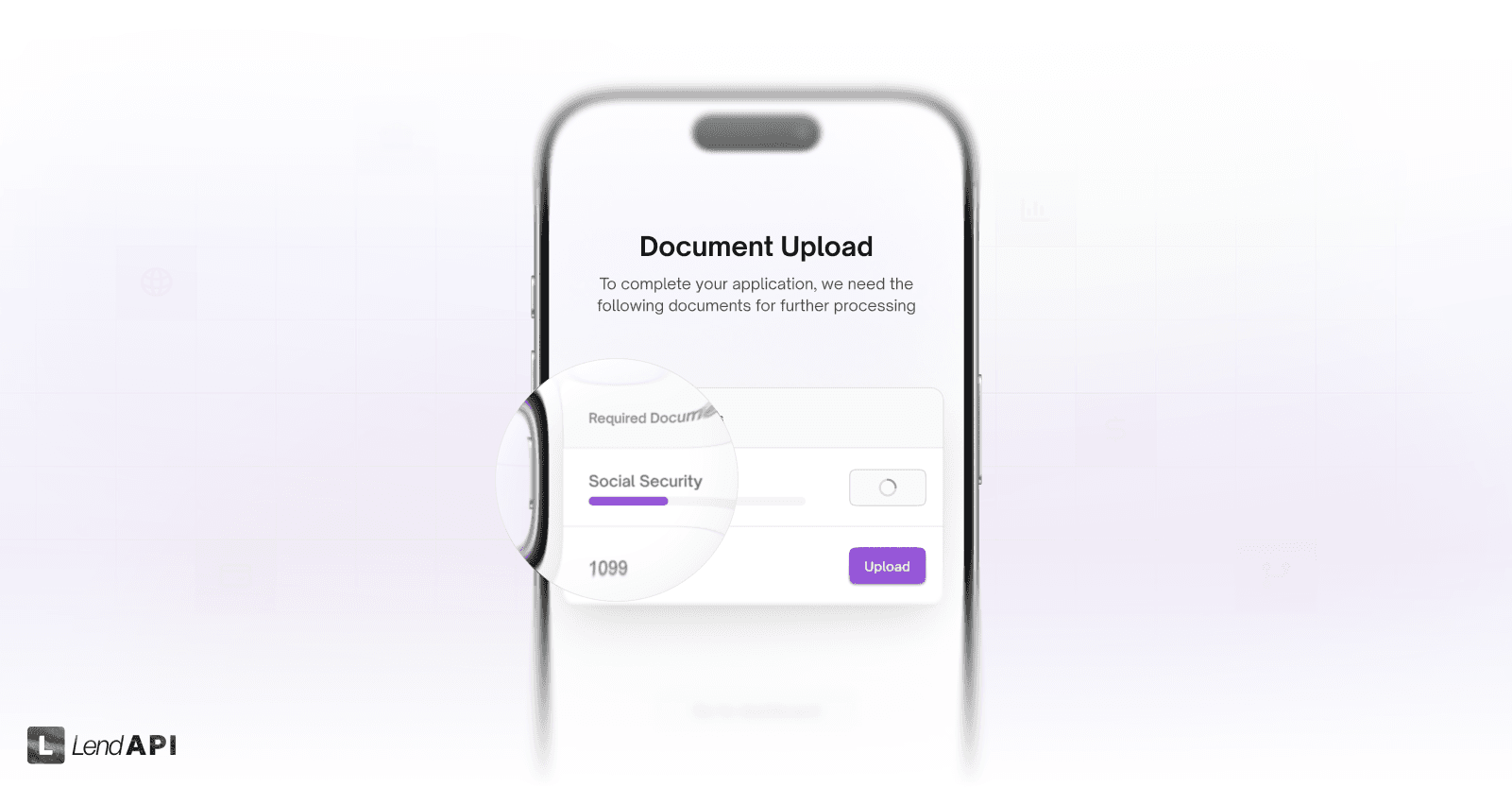

Again either a deep link is sent to the client or an email is sent to the client letting them know exactly what to upload. Since everyone has a mobile device nowadays, the Loan Originations System and the built-in customer portal must be able to take in a picture, photo or an image of the document being asked.

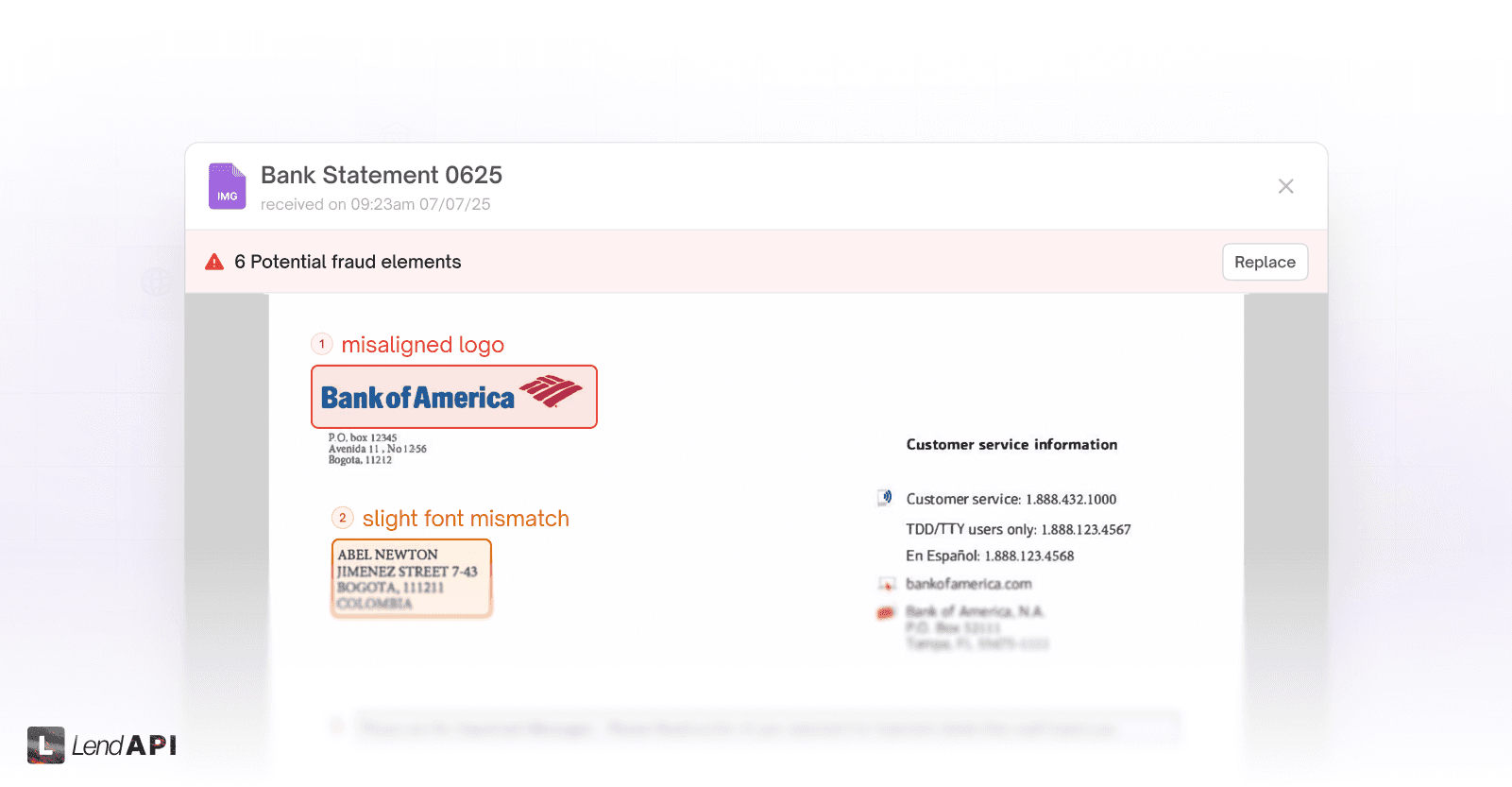

The consumer believes that a human will read the uploads and therefore a photo of a bank statement or a driver licenses should suffice, but in today’s environment, lenders and banks are simply overwhelmed and don’t have enough staff to look through every document that aren’t a standard PDF file downloaded from banks and other authorities.

Even if the bank, credit unions and lenders have enough staff, a person gets tired and the outcome of their review might be inconsistent and misses key fields that causes an erroneously underwriting decision.

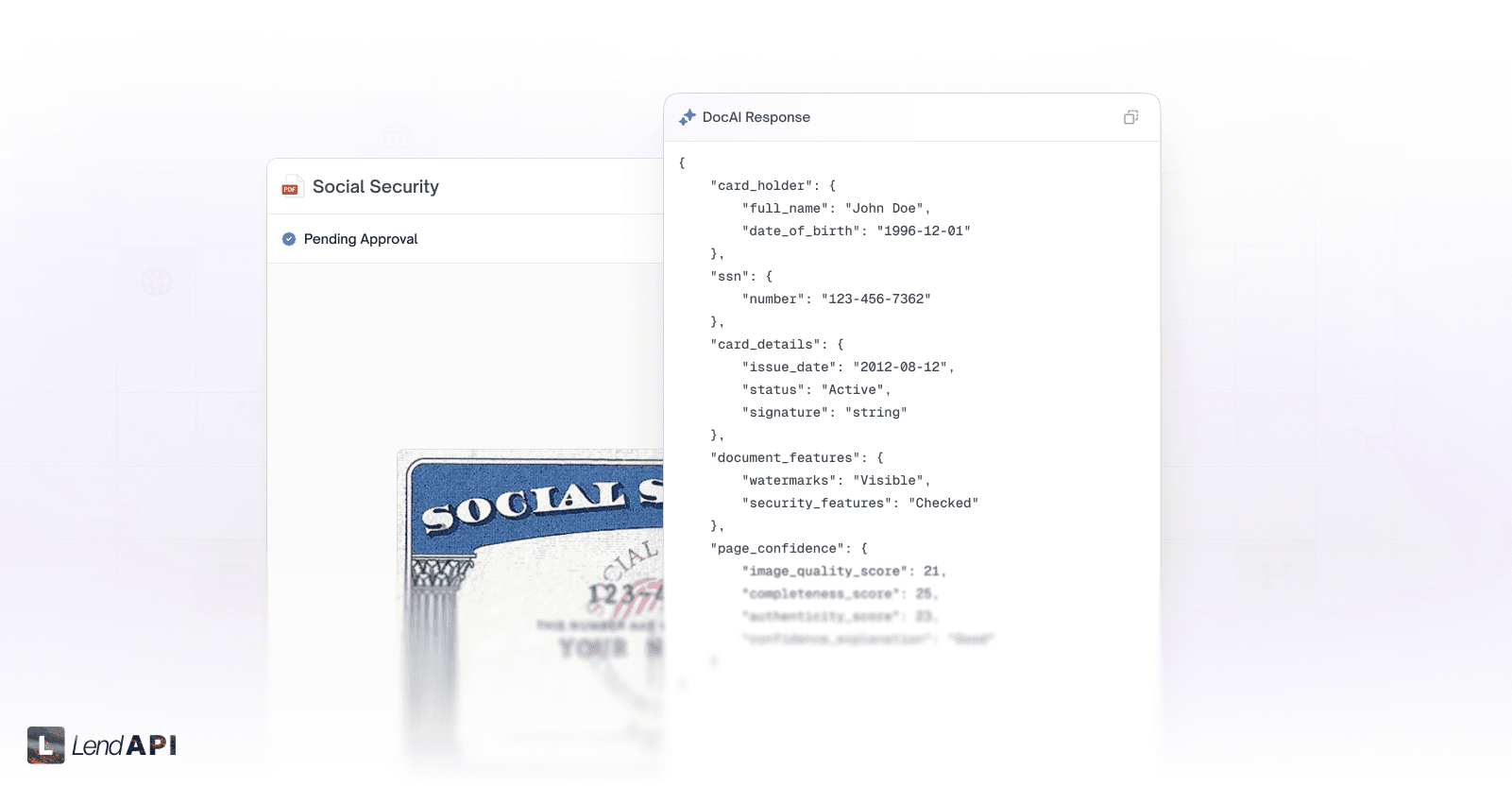

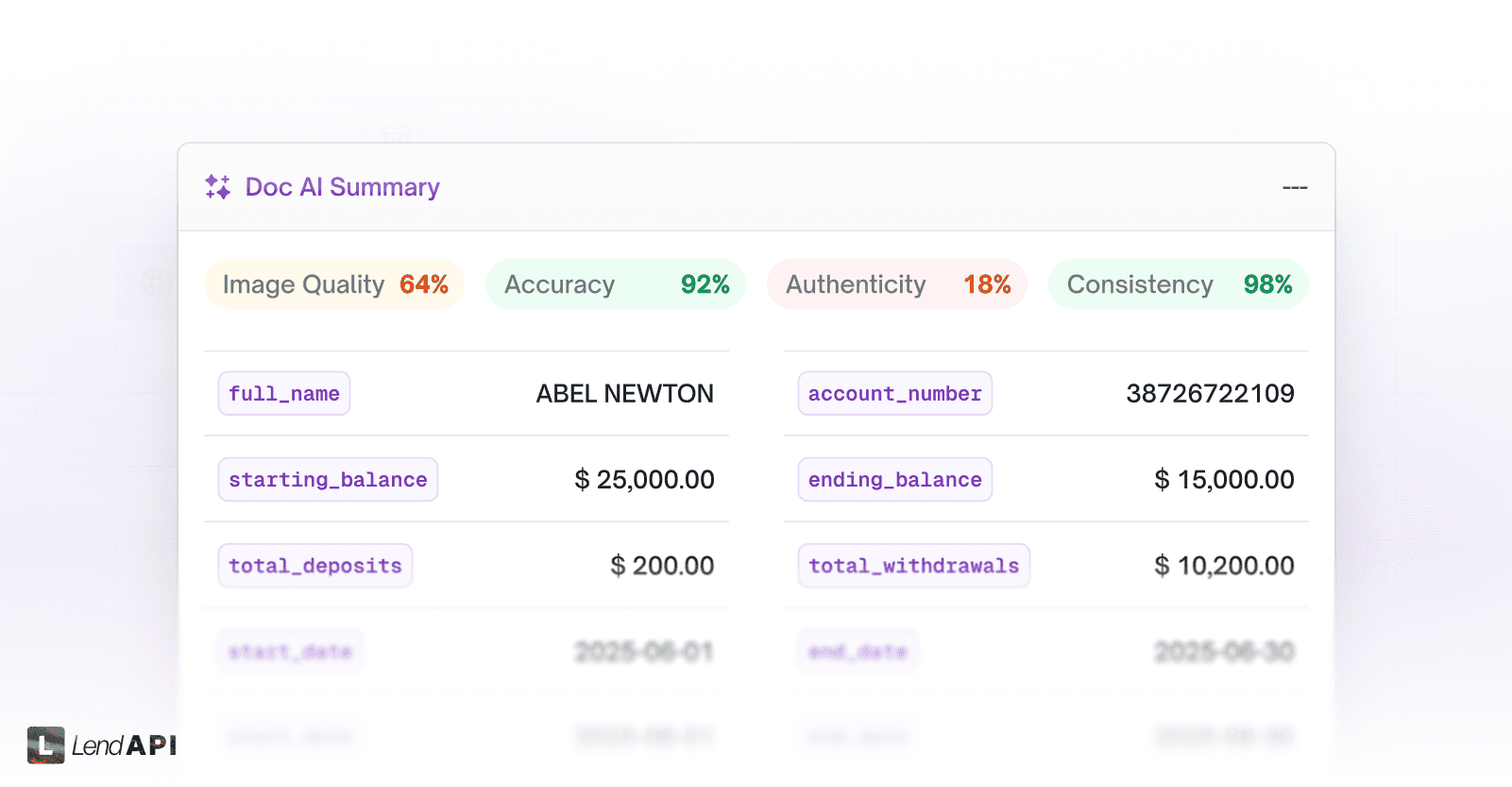

Today we must rely on A.I. to reduce our workload and increase efficiency and accuracy. We’ve developed algorithms to scan through documents and extract all of the pertinent information from these documents using AI.

Most of the time, we can extract this information from in real time or near real time environments. Each element of an identity verification document such as driver license and itemized data from bank statements are extracted.

Each of these elements are then mapped to our decision engine for further processing. If itemized data in a bank statement doesn’t add up, the system will alarm the back office for discrepancies and other types of actions need to be taken based on the AI assisted scan in concert with our decision engine.

Communication

Communication is key, we’ve heard that phrase before and it’s no different when it comes to lending and finance.

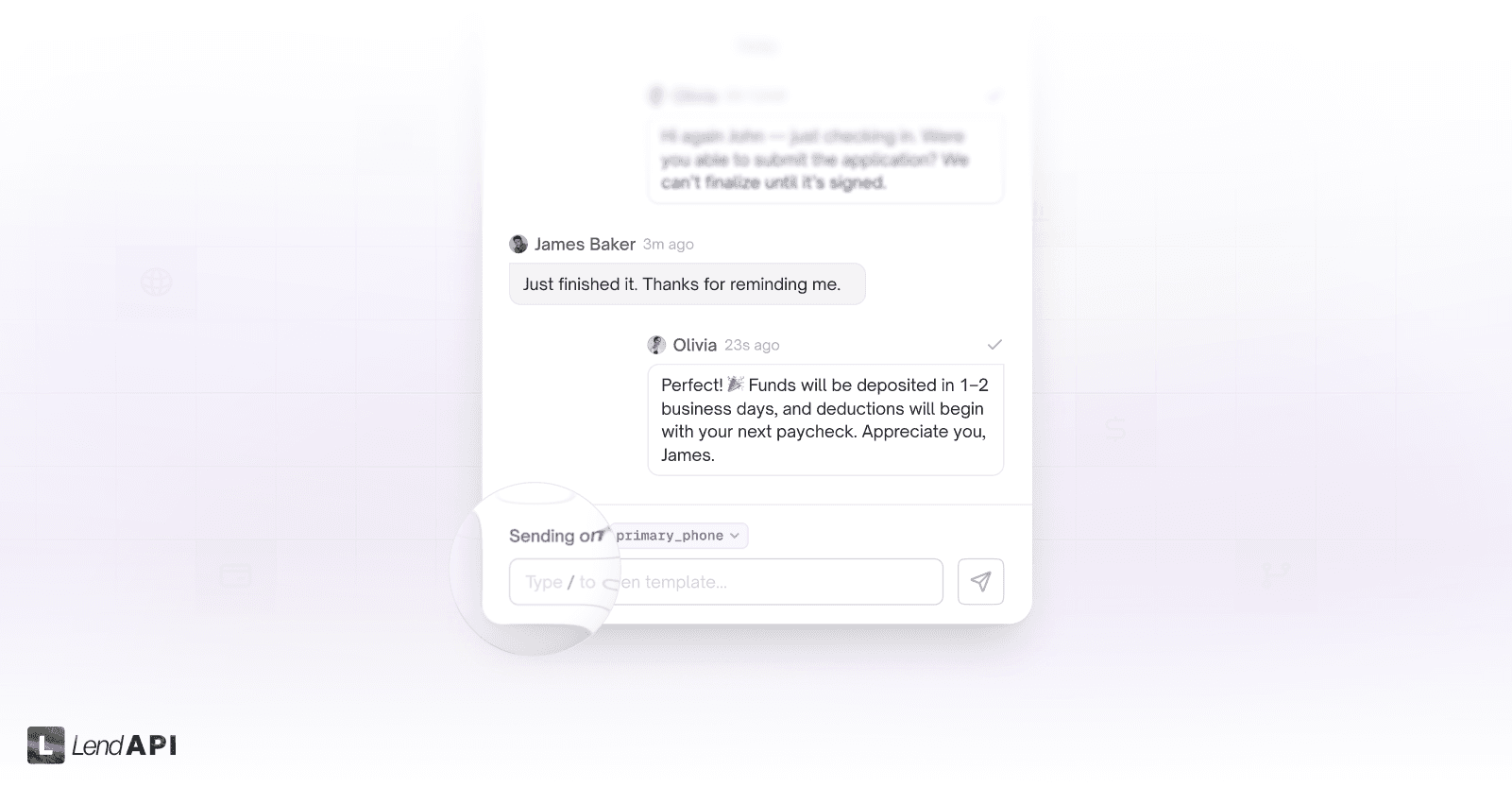

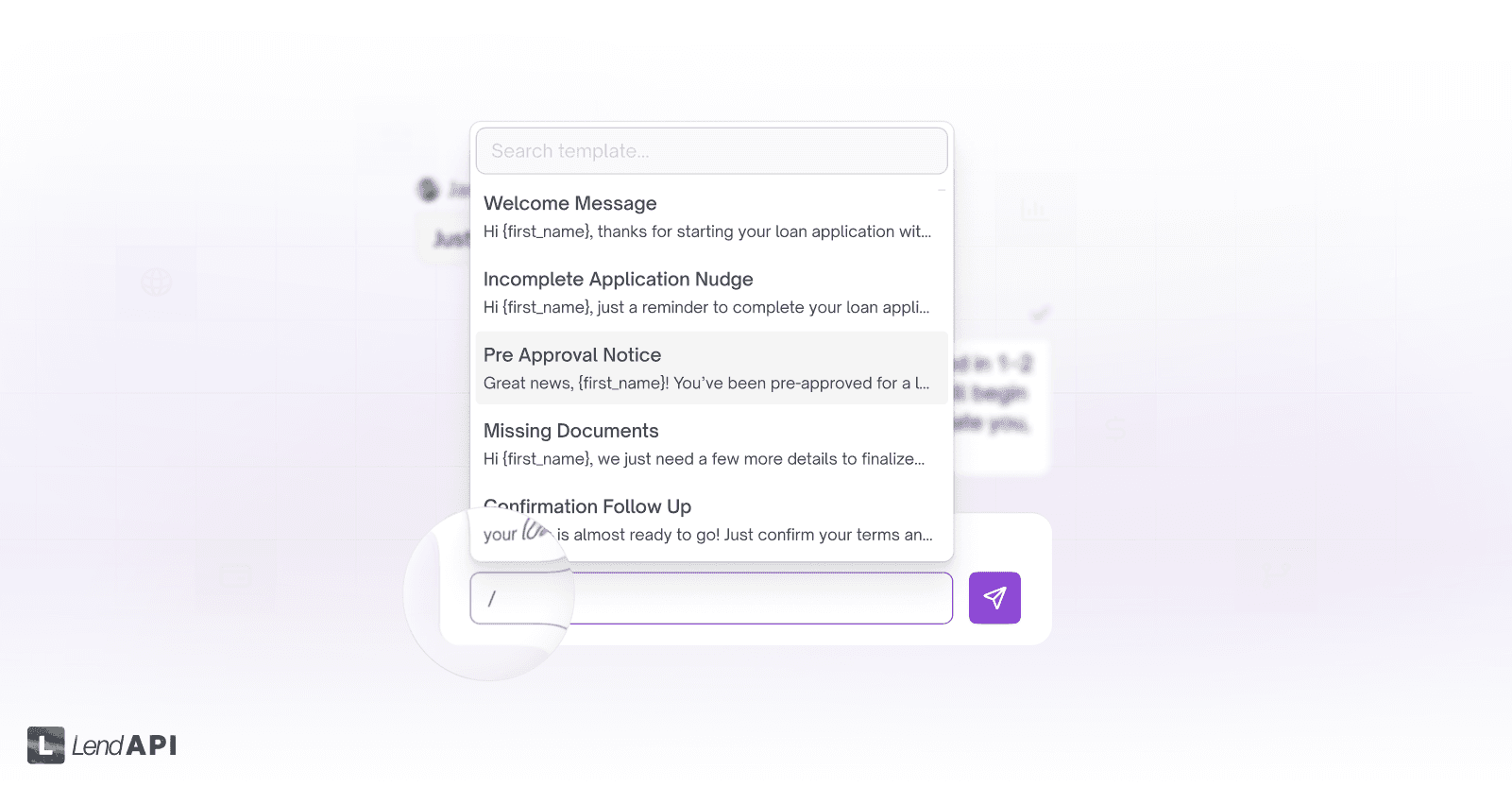

Email, SMS, or in-portal messaging are just some of the ways banks and credit unions should be able to communicate with their customers. Communication is not the only solution here but delivering the right message and the right time with the right request is key.

We will bring the conversations of the decision engine again. Decision Engines on the market today is limited and only executes rules around credit reports. We think this is a limiting factor and banks and lenders today need a lot more than just a credit decision engine.

A decision engine must drive all events related to the entire financing life cycle. Emails and text messages with the right content must be delivered by an intelligent decision engine that asks for information from the borrower with the right reasons.

Once your messaging or method of communication is defined, intelligence that drives key messages from emails and SMS are the only way to communicate with your consumers.

The customer portal and the Loan Originations System must capture all of the responses from the customers as well. For instance, if the conversation started via SMS.

Customer Portal Central Command

Customer portal is the one of the most overlooked features in a modern Loan Originations System. Because how closely the application process involves customer interaction and participation, a great customer experience starts with a decent customer portal.

Whether it is continuing with the application process, signing additional documents and consents or passing files such as uploaded documents, all of these functionalities must work with clear instructions to the clients at every step of the process.

About LendAPI

LendAPI is a high-speed, cloud-based digital banking and lending infrastructure provider designed to empower financial institutions to launch products at the speed of thought. Headquartered in Irvine, California, and backed by leading venture capital firms (including Techstars and AlleyCorp), we are redefining the "Bank-in-a-Box" category.

Our mission is to democratize fintech innovation by providing a secure, data-driven platform that streamlines compliance, onboarding, fraud detection, and credit risk management. By 2026, LendAPI has surpassed the milestone of 100 million credit applications processed, cementing its position as the backbone of modern digital credit for banks, credit unions, and fintechs globally.