•

We had a busy few weeks expanding our footprint and launching new customers. At the same time, we visited our team in Delhi, India! The team got together and talked about the future of LendAPI, a family styled dinner as well as tone of group pictures and selfies. We will share that with you shortly.

Platform News:

We’ve been accepted into the Curql Accelerator. This is one of the most coveted credit union backed accelerator programs in the world. 160+ credit unions are limited partners of the Curql fund and we are very grateful to be part of the cohort (five companies in tow) and begin our venture into the credit union space. Check out this announcement here.

We just launched in all of Dallas/Fort Worth area Sunglasses Hut stores. We are aiming to launch nationwide by April with their core POS integration completed ahead of time. As spring and summer shopping season is in front of us, we are getting ready to make sure our customers and their retail branches are ready for shoppings to swarm their stores.

We are also engaging with various new clients in the debt settlement industry, card collections industry as well as the point of sale financing industry that’s part of one of the biggest asset management companies in the United States. We are excited and grateful for these opportunities.

We’ve also released new features and platform upgrades across the board. We will have these details below as usual.

LOS Platform Update: v3.1.1

Platform performance is key to our success, not only does our infrastructure need to stay on top of our customer demand, our software needs to be reactive. Every click on the platform needs to be responsive and return accurate results.

We’ve gone through an extensive platform upgrade as well as infrastructure upgrade to give the overall platform an average 50% boost in performance. Our platform is already one of the fastest in the industry and with this release, we will aim for that crown in terms of speed of our platform and accuracy of our delivery.

If you are an existing user of our platform, you will experience a notable speed improvement as you navigate throughout the platform.

We’ve been asked to have even finer control around the look and feel of their application. We heard you and we’ve implemented a brand new theme studio to match any styling needs that you desire.

New Theme Studio

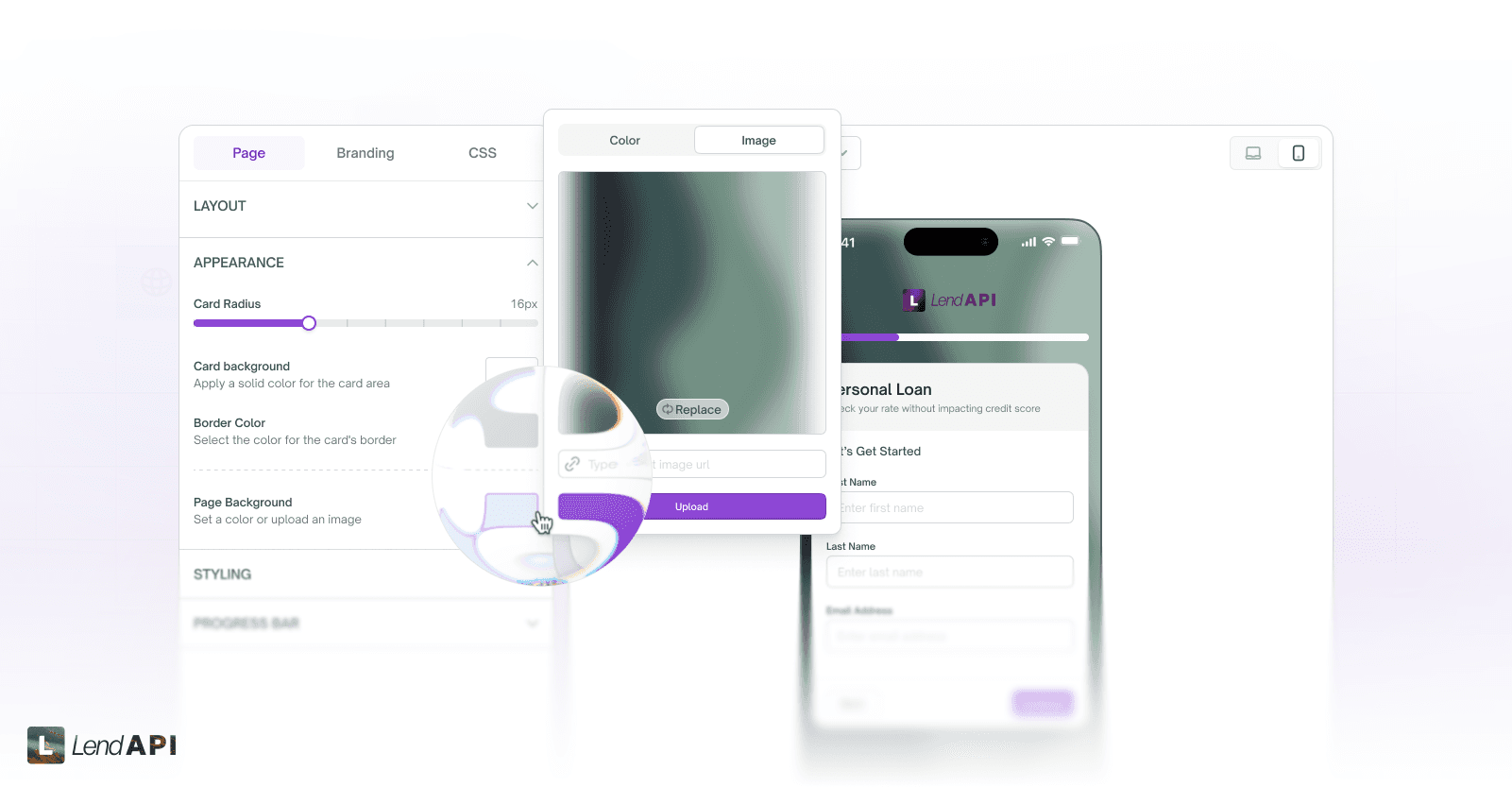

Complete background control

One of the features we’ve released in the new theme studio is the ability to mesh your background color, styling with the application produced from our Product Studio.

This styling tool gives you the ultimate control of the look and feel of the application background. You can even upload your own design and we will render the background design to completely match your style guidelines. We can’t wait for you to try this and give your application the ultimate look and feel.

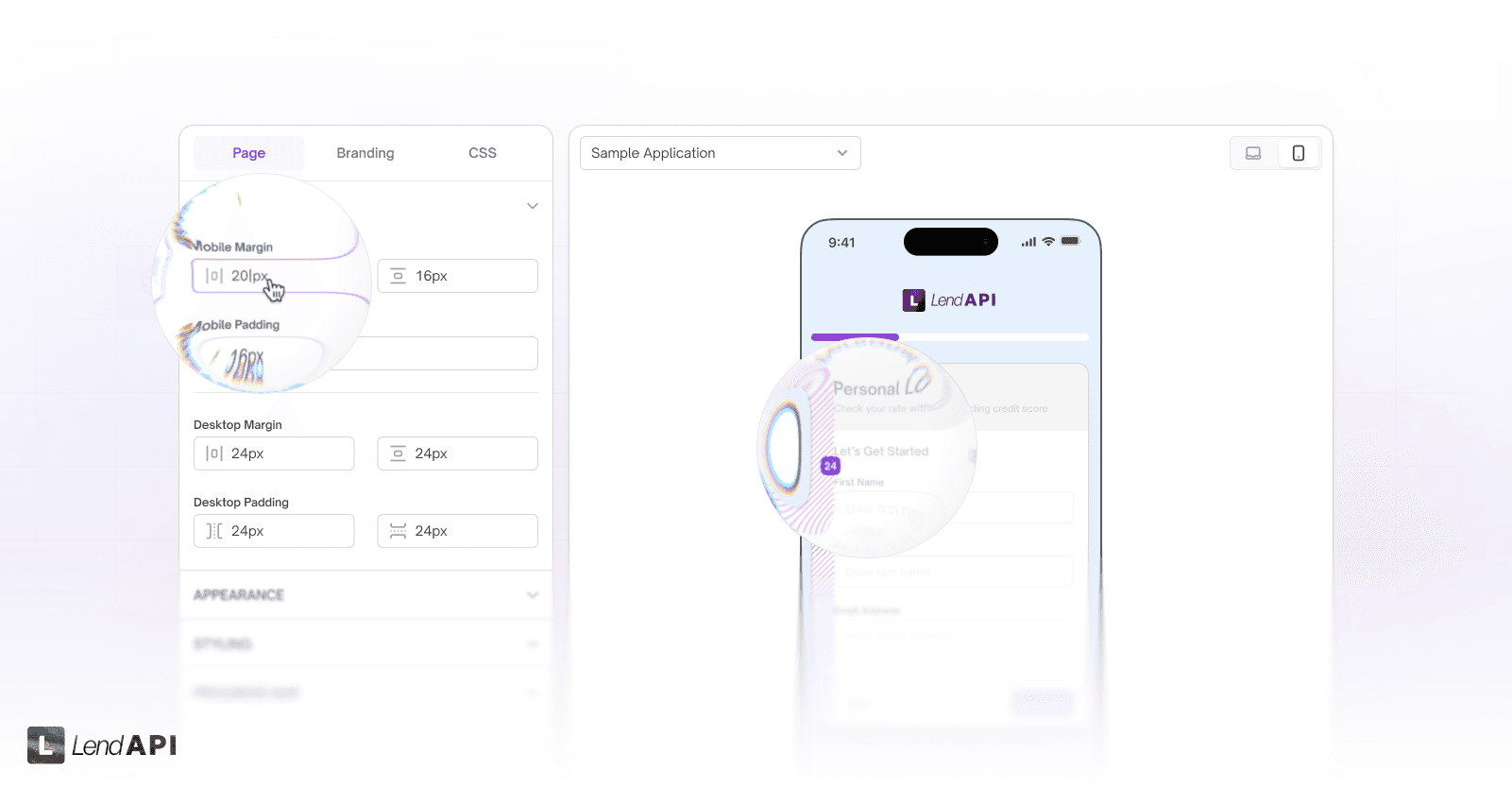

Margin control

When it comes to controlling the width and height of your application that matches your overall design, we’ve implemented Margin control features within our new Theme Studio to give you pixel perfect control.

From margin padding control with respect to your desktop and mobile design, we’ve thought of all of the things you can do with your application.

Previously, the application inherited the mobile and desktop padding settings. But now, you can adjust them as you see fit, pixel by pixel. We think that this will give features that will make your application as unique as possible. We hope you will enjoy this much requested feature.

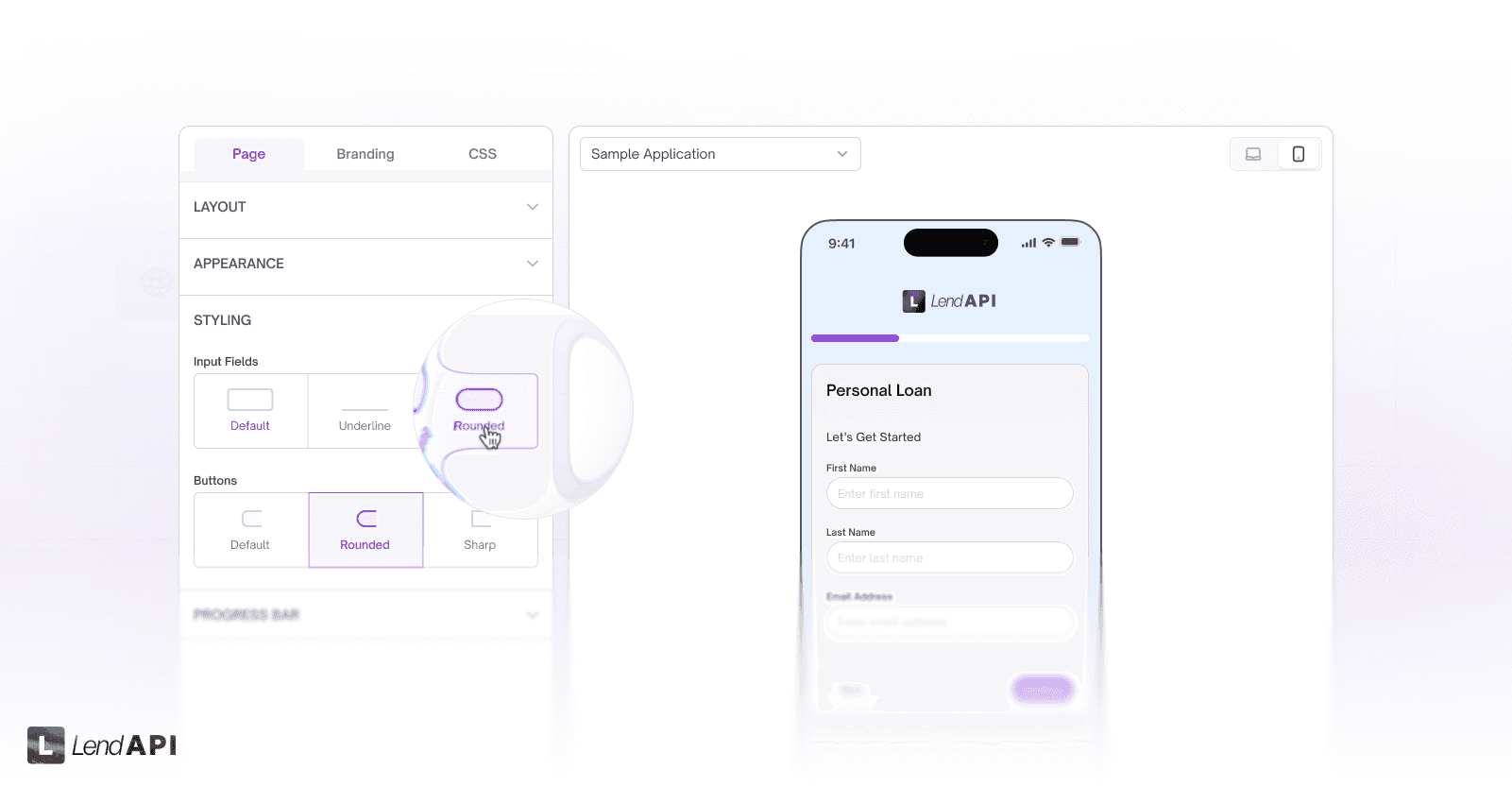

Field and Button Styling

We’ve refactored the styling of how fields and buttons are displayed within the application so you can tailor the look and feel of your application along with the rest of your web experience. You can now select all sorts of field and button presentation styles.

From the roundness of the buttons to the overall look and feel of each field being displayed, you can tweak them as you wish all on your own. Our clients have never had these types of control before in a credit application design tool. We think this will set you apart from the rest.

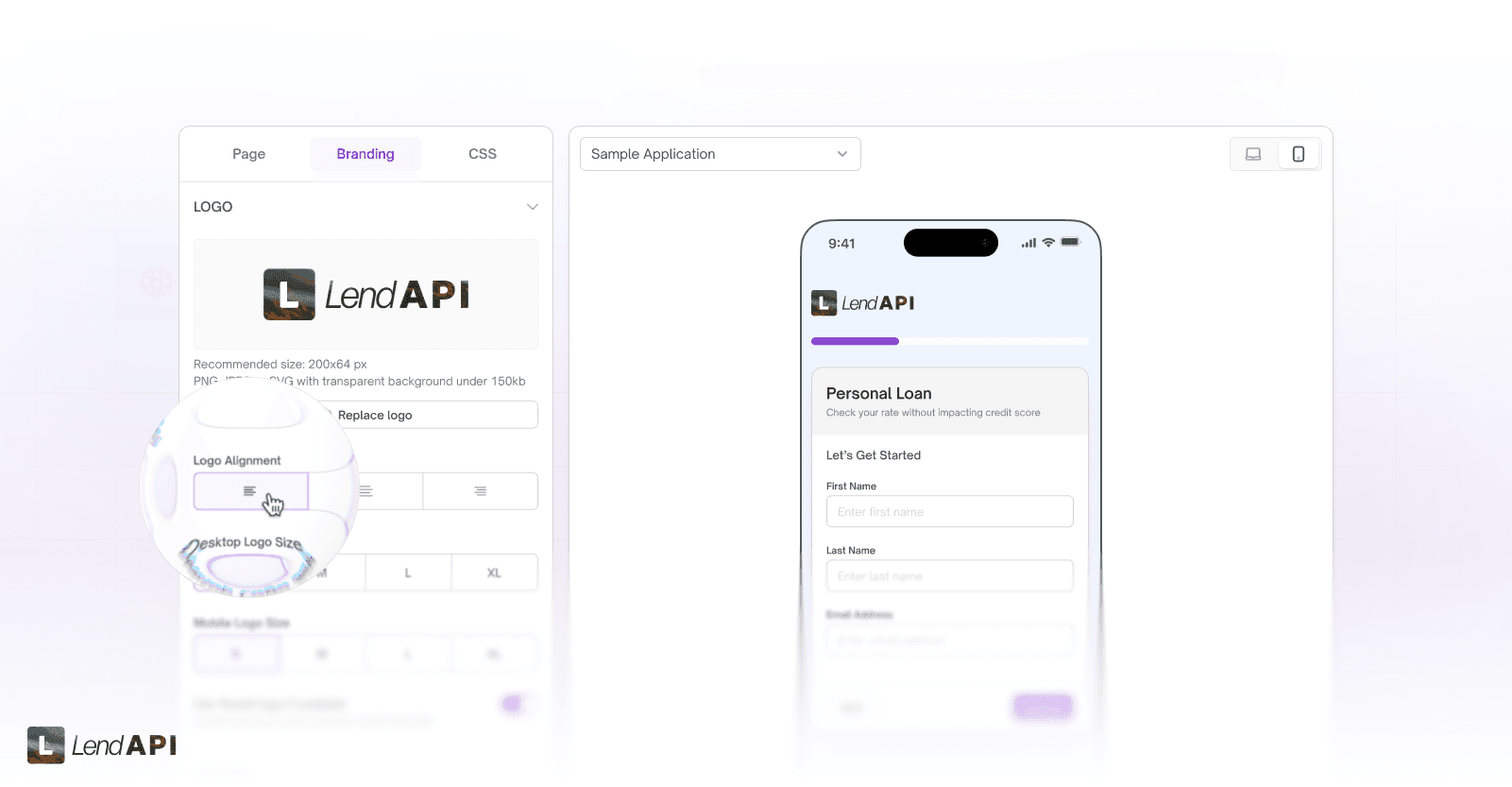

Logo Alignment

We love our logo and so do you. Logo positioning and alignment on a web application as well as in a credit application is an art and we want to give you full control of where you would like to place your logo.

This new feature gives you the flexibility to style your logo with size, placement and alignment that works with your mobile experience as well as your desktop experience.

Now, you have the ultimate control of logo placement that’s never been done before. We hope you enjoy all of these features within our new Theme Studio within our Product Studio. Please let your project manager know if you would like to add more controls around the new Theme Studio. We would love to hear your thoughts and feedback to make this even better.

Auto Lending

We’ve completed our integration with RouteOne and DealerTrack. We’ve fully integrated with their communications API, contract API as well as the traditional credit API.

Some of the incumbent players have refused to integrate with RouteOne and DealerTrack’s new APIs to make the customer experience better due to lack of motivation and resource constraints.

We’ve done it when no one else would and we’ve completed it in record time. RouteOne and DealerTrack’s normal integration time with a new Loan Originations System is typically 6 months and we’ve completed the entire integration with all of their APIs and newest APIs in four weeks.

If you would like to switch from MeridianLink or Defi Solutions, please contact us and we will get you onboarded asap and restart your auto lending division. We understand that the indirect auto lending space is heating up and we would be happy to launch this with your credit union at a moment's notice.

What’s Next?

“Flow Builder” is the working title of the brand new LendAPI vision board we are building for you. This will tie together all of the functionalities within LendAPI.

These “flows” can be instigated with an API call or built into an action button. These “flows” will trigger events, rules, emails, sms and any other types of APIs imaginable. We will introduce new concepts such as “delay” to give even more control to your overall customer experience and product behavior.

We think our new Flow Builder will become a new playground for unlimited creativity when it comes to customize your entire lending experience. We are aiming to release this product ahead of the FinTech Meetup 2026 in Las Vegas.

This ultimate orchestration layer is finally coming together within your finger tips. We can’t wait to show this to you at the show.

About LendAPI

LendAPI is a complete Loan Core platform that helps banks, credit unions, fintechs and retailers to launch any finance products instantly. Request your demo at www.lendapi.com and follow us on Linkedin.