•

We have some exciting news to share. We have been selected to be part of the most coveted startup accelerators with four other companies in the banking space. After rounds of interviews and pitches, we got in! We are keeping this under wraps and the news will be announced by the organizer in the next few weeks.

We are onboarding more credit unions and large embedded financing firms. We couldn’t be more thankful for these fine organizations to join our platform to reduce the cost of entry and increase their competitiveness with new product launches in record time.

Platform News:

We’ve surpassed 100 million transactions. When we first built LendAPI, one of the most important decisions we made was the core architecture of our platform. Our aim is to be able to handle up to 1 billion applications a day.

We are also continuously upgrading our core platform and just last week, we made an off cycle upgrade to boost our platform speed by another 50% in certain situations. Our client will notice a significant speed boost when they are navigating the platform and using our tools to service their clients.

Our Auto Lending vertical is near complete and we are looking for credit unions that are interested in testing our RouteOne and DealerTrack integration to replace MeridianLink. We know that there are concerns about a wholesale upgrade but a new platform with all of the RouteOne and DealerTrack endpoints integrated will greatly increase your competitive advantage and provide the latest automation from credit application to document exchange.

Contact us if you want to discuss your requirements, please use our contact us page.

LOS Platform Update: v3.1.0

This is one of the biggest releases to date. We’ve consolidated all of our risk management tools into one place. Features such as A/B Testing, Shadow Testing and Back Testing are now consolidated as LendAPI Labs!

LendAPI Labs will grow in the future with more tools, but we’ve completely revamped the workflow of these experimentation tools for you to set up and monitor tests in one spot with refreshed user interface. We hope you will like it

We’ve also done a few upgrades to our integration panel to provide more information and details. We added some other features to embARC to make our users' lives a little easier. We are putting more focus on our servicing tool to give complete control to our clients.

We’ve also completed the last stretch of our Doc AI - document scan module to our main platform. Previously, we connected document uploads with Doc AI for a fluid path from user action to content scanning. In this release, we allow the variables of the scanned content to be mapped into the variable library.

This is a powerful integration which will let our decision engine do math on top of the scanned content. We hope this complete integration process will help you navigate through the rising cost of open banking tools and client privacy concerns.

Once again, if you would like to discuss how LendAPI can help you with launching your new product, please email us at info@lendpai.com.

LendAPI Labs

At LendAPI, we pride ourselves in understanding all of the functionalities each department at the bank would need. Be it technology, product, risk management, marketing or compliance. We have tools for everyone to collaborate on launching new products.

Risk management folks often have a lot of specific tools they need to manage their portfolio. For instance, there are a lot of room for experimentation with different algorithms when it comes to dialing in your underwriting process.

In this release, we have consolidated these experimentation tools into one spot which we called it LendAPI Labs.

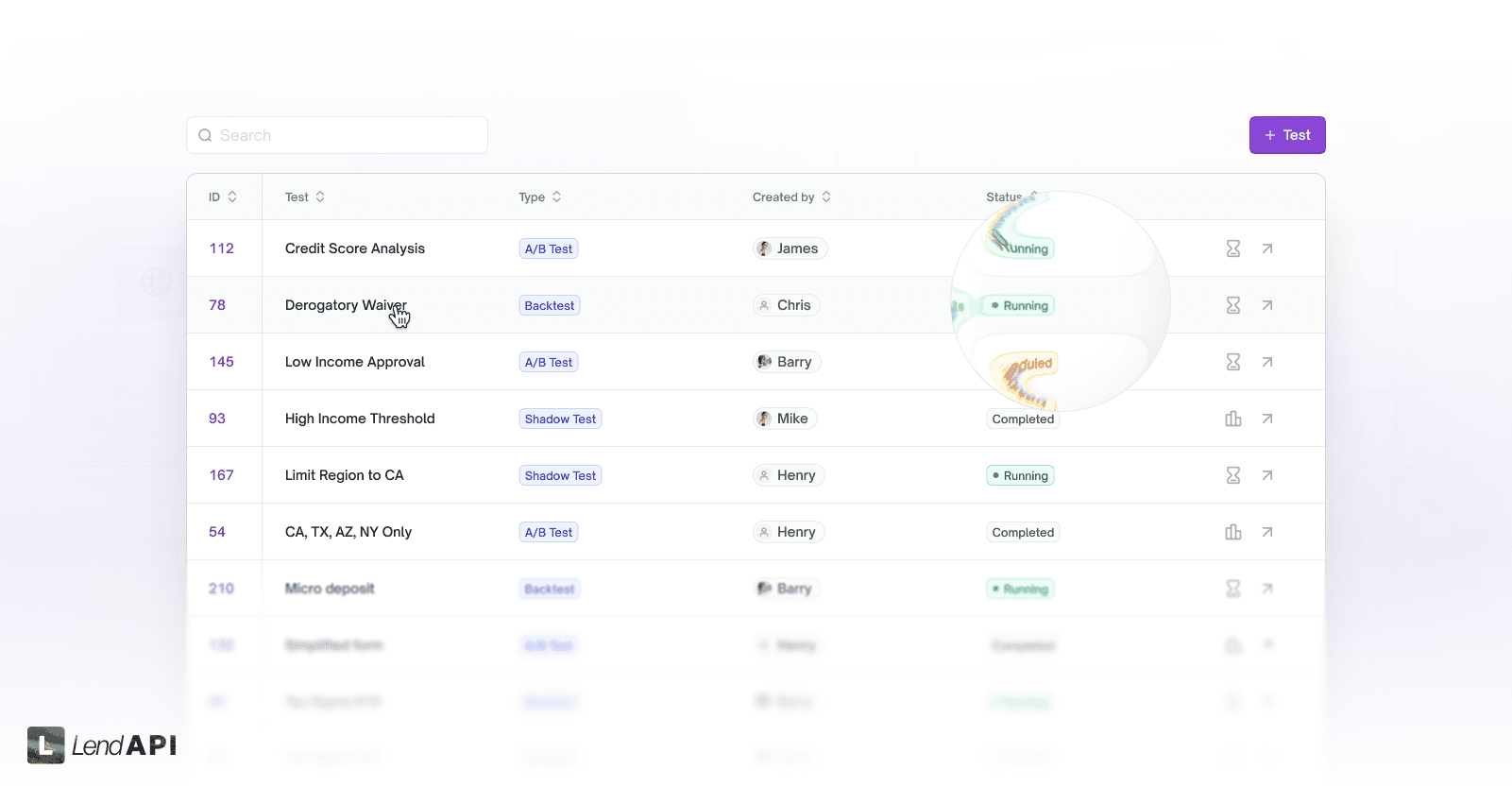

First, we combined all of the risk management experimentations into one combined list view. You can then launch or add a new risk strategy with the +Test button.

In this consolidated view, you can easily navigate to various tests in one spot as well as reviewing results of these tests.

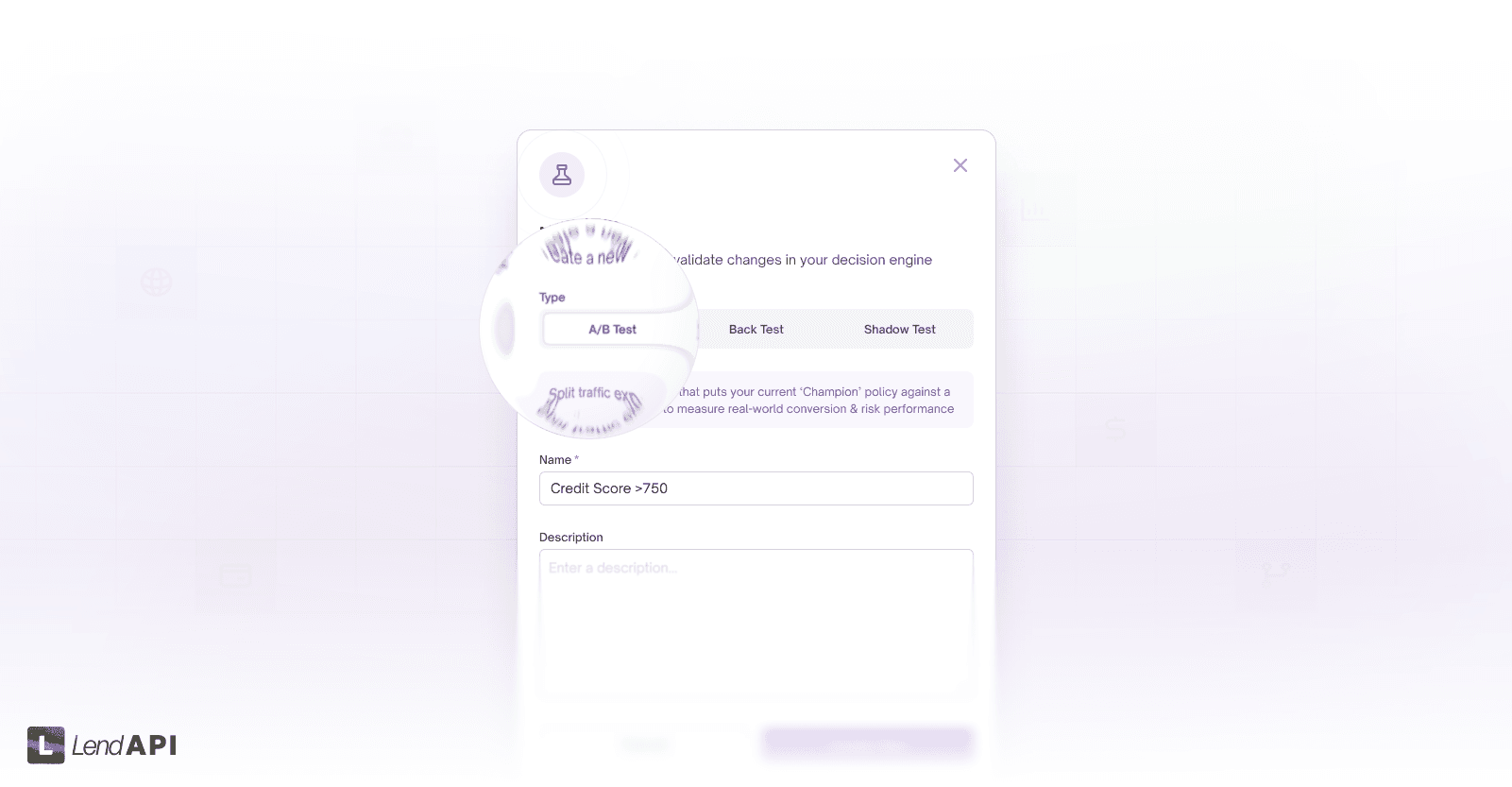

When you are ready to add a new test, you can click on the +Test button. We designed a new prompt to guide you through the test setup. We consolidated Shadow Testing, A/B Testing as well as Back Testing in one intelligent workflow.

You can create a name as well as giving a description of the test as a journal of why this test was set up and expectations.

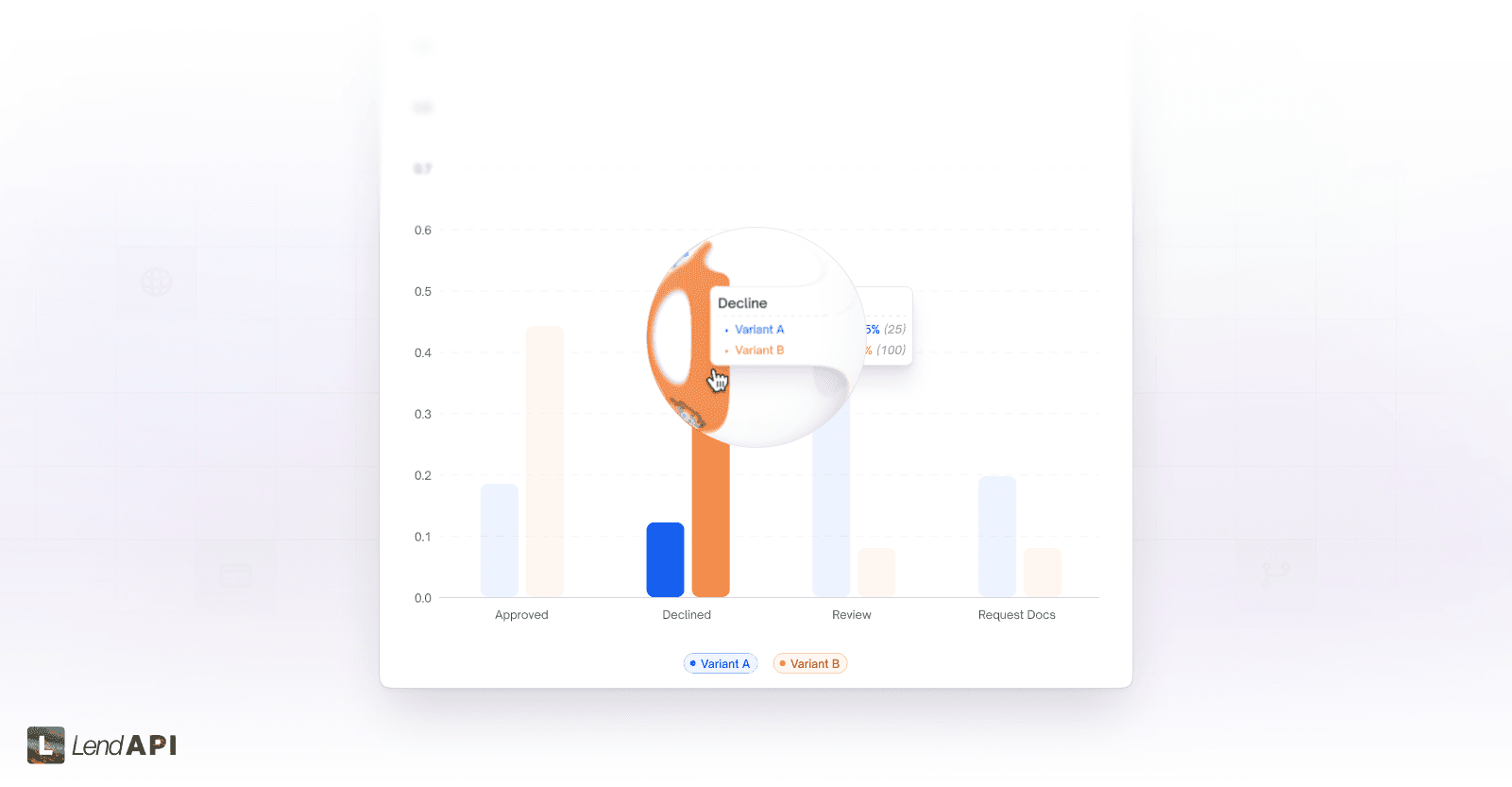

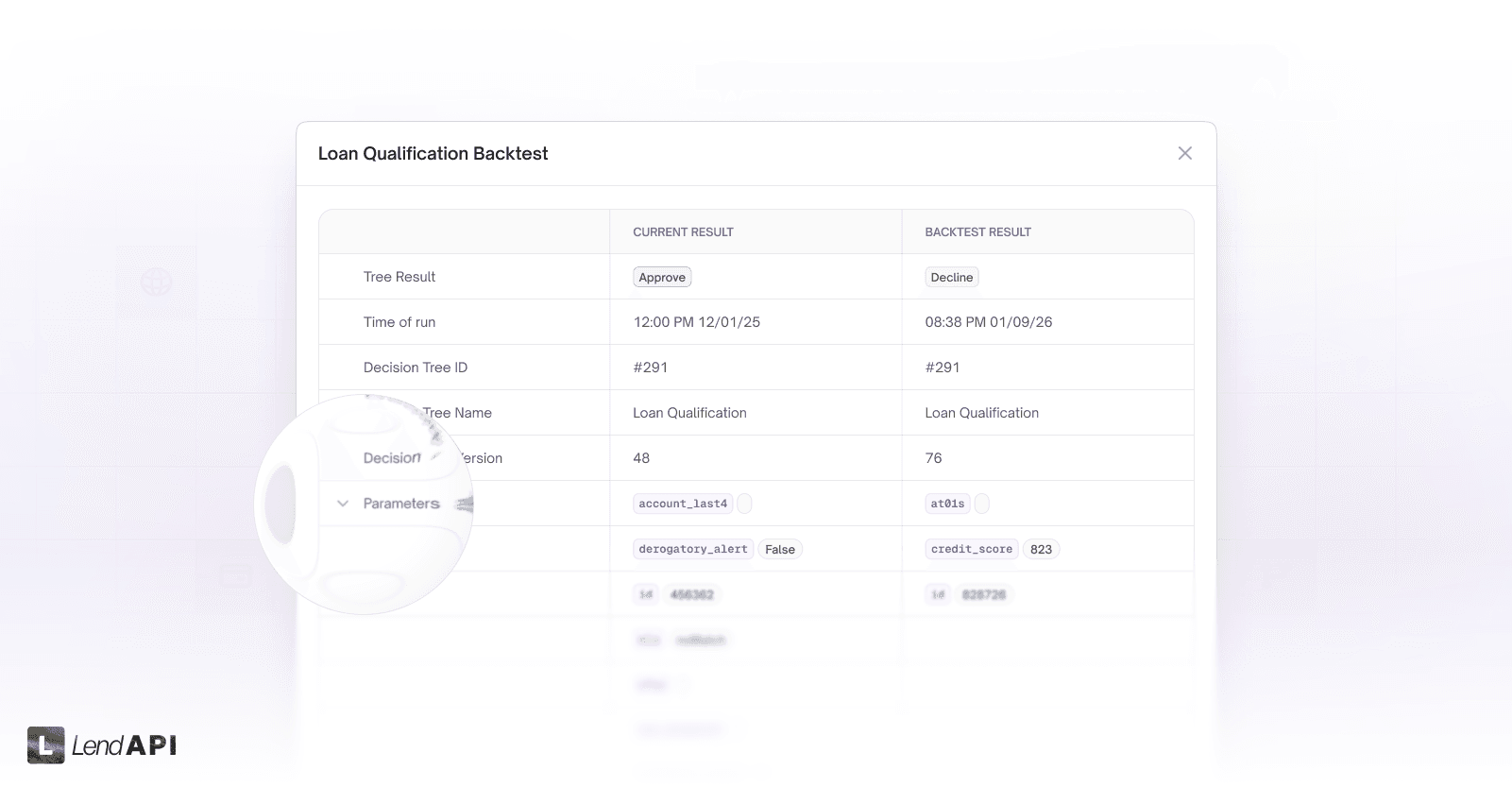

After the test is completed. You can easily browse through the result of the tests. For example, you can define a back test experiment to run about a thousand previous applications. The result of this test will show you the result of the experiment between a champion and challenger risk underwriting rules.

Our testing environment is comprehensive and complete. For instance, you can run multiple versions of the same decision tree in a back testing situation.

We provide the maximum flexibility when it comes to running comparisons between multiple versions of the same rule set or running multiple rule sets against each other. We think you will enjoy this new workflow and new user experience.

Integrated Partners - Refresh

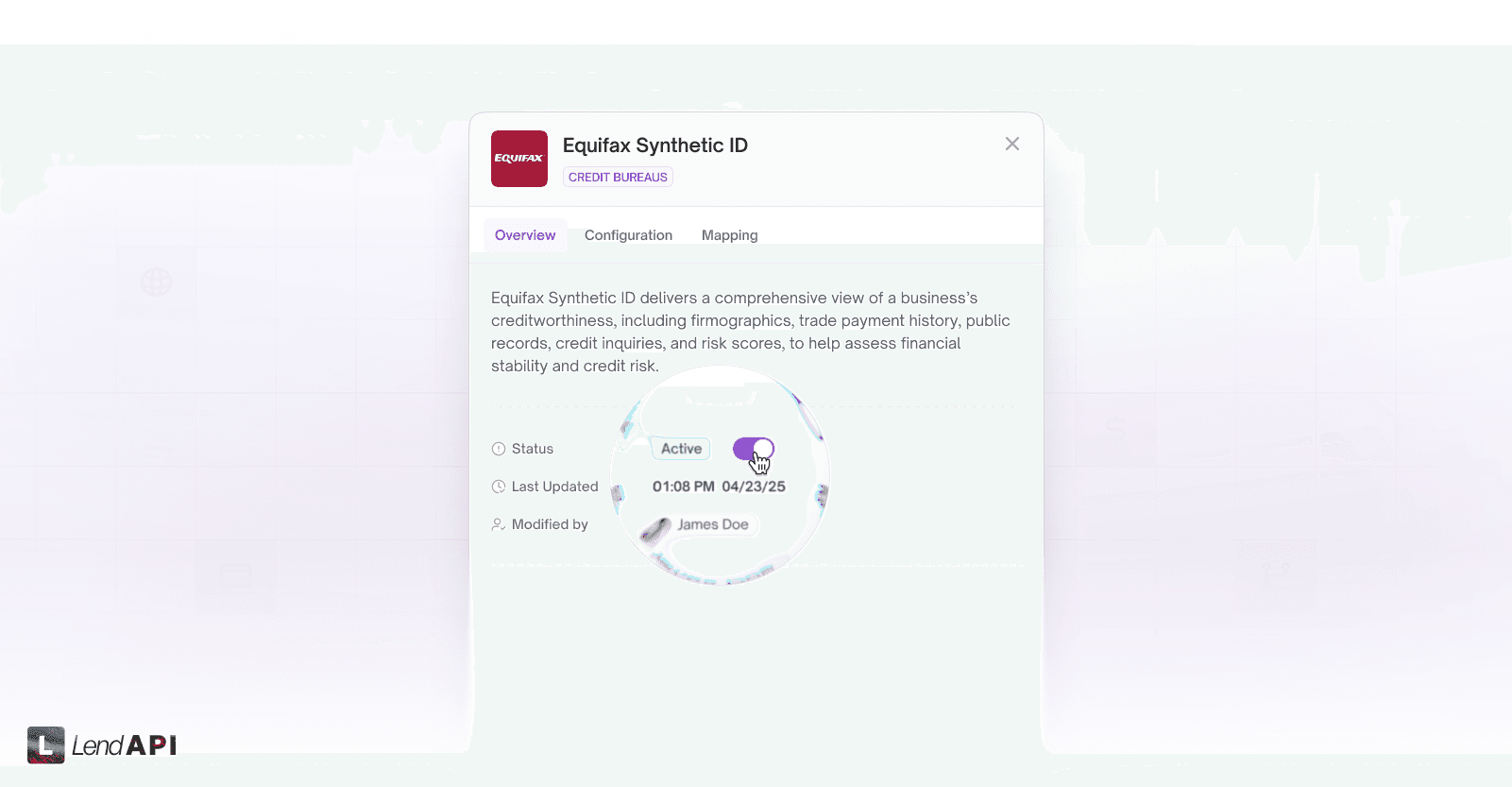

One of the most popular features at LendAPI is the ability to connect any third party integration partners and start using them right away. In this release, we completely rewrote the Integration Partners’s user experience and interface.

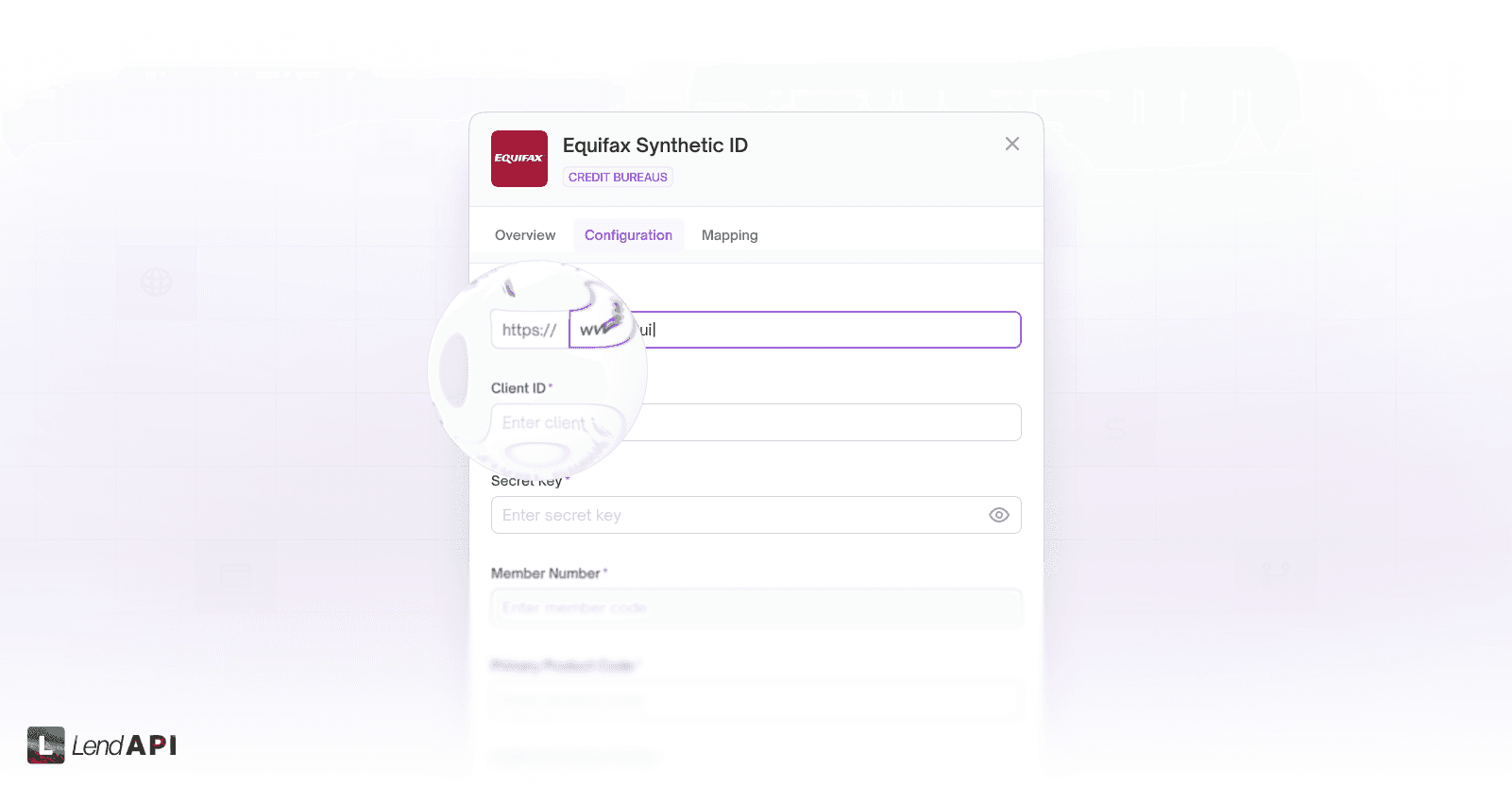

In the new Integration Partners page, each integrated partner will have a brief description of what it does, configuration credentials as well as variables such as scores, attributes that are mapped from the third party integrators to LendAPI’s decision engine.

We believe that this unified user interface will give you more confidence in picking the right third party integrations to spruce up your underwriting and pricing strategies.

We’ve also updated the specific configurations to enable third party connections. These credentials are specifically for each enterprise user and not shared. LendAPI also represents some of the top third party data providers, we are resellers of credit and open banking data. We can pass the savings to you, our clients.

Application Automation Enhancements

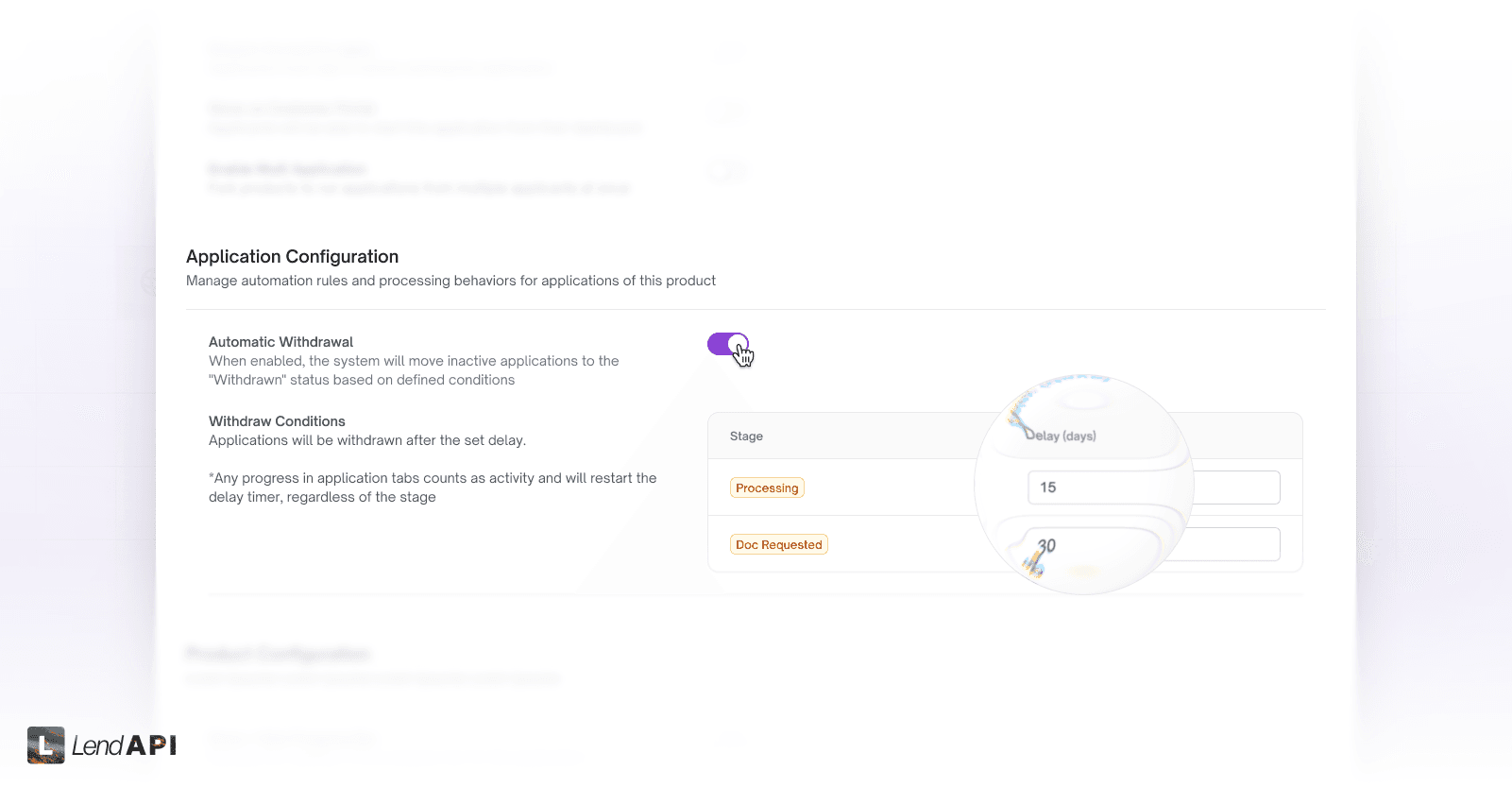

We also brought you additional application automation enhancement features in this release. For instance, if an application is in an incomplete or any other status for a period of time, we can set an automation trigger to move these applications to a withdraw status which will trigger other events such as adverse action emails or templated end-customer messages.

We believe these levels of automation will bring a new experience in your workflow for both administrative staff as well as to end clients.

Implementing these types of automation triggers will bring an additional level of user experience never seen before without having to manually move these application status. This will save a ton of time and stay consistent with respect to the bank’s compliance policies.

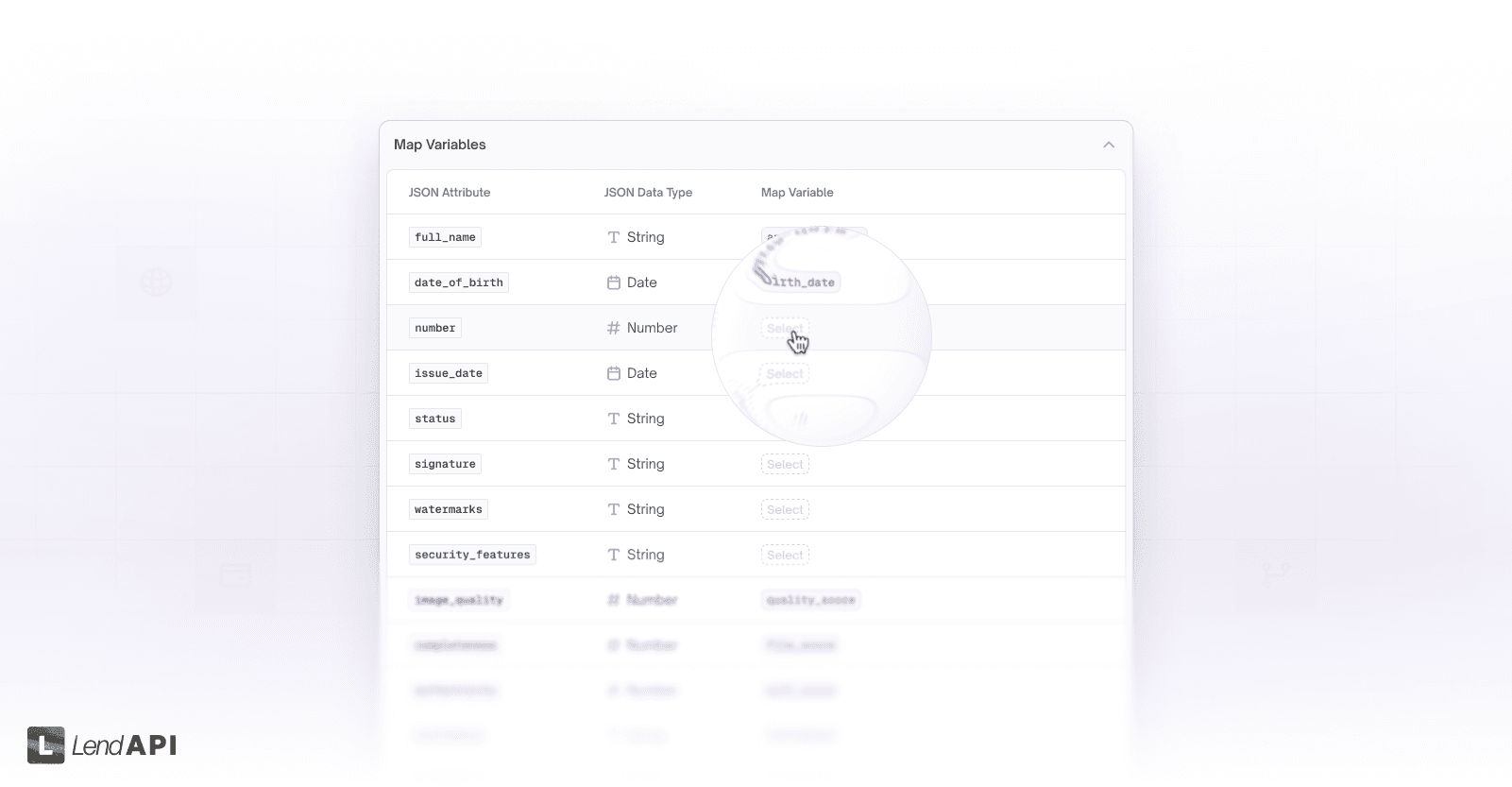

Doc AI - Variable Mapping

In our previous release, we linked Doc AI with our Document Upload process. This is an industry first level of automation which reduces human intervention and enforces compliance.

In this release we brought another level of connectivity which is another industry first. When our Doc AI system scans a particular type of document, our enterprise client can then map the scanned content such as words, phrases, numbers etc to LendAPI’s decision engine.

This means that not only the scanned document’s content is displayed and transcribed, the content can also be used for further mathematical processing.

For instance, if the end user uploads a bank statement and the content of the bank statement is extracted by Doc AI, our Decision Engine can then further process mathematical rules against the element of the bank statement, say executing a rule against the beginning or ending balance of that particular monthly statement.

We believe that this level of automation will make banks even more efficient and brings another layer of consistency in credit underwriting.

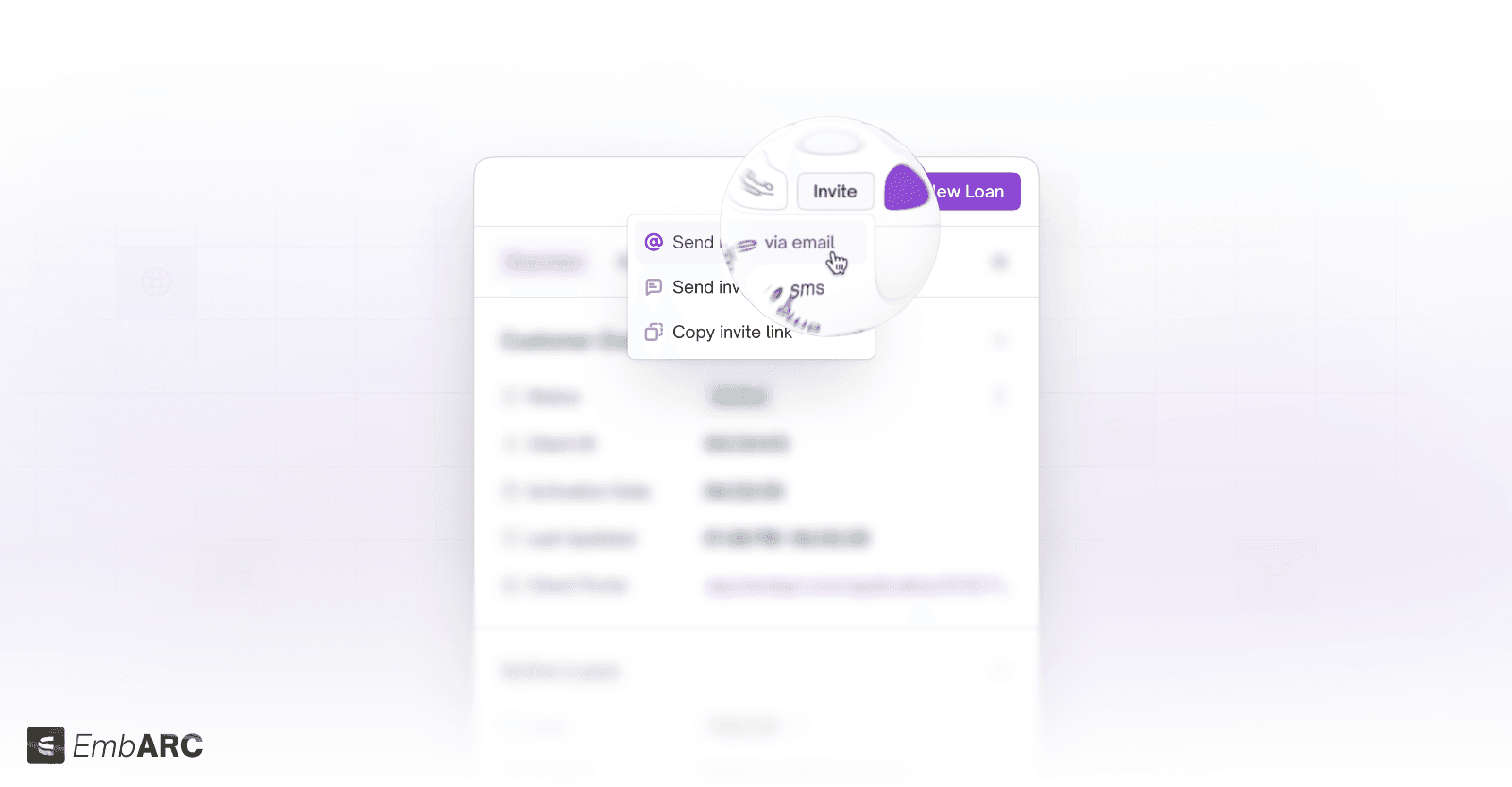

embARC LMS Enhancements - Email Invitation Process

We are making our embARC LMS (Loan Management System) more independent by adding an invitation to apply email triggers to the platform.

This way, an email invite will be sent to a potential client for loan onboarding. Even in the absence of a loan origination system, the embARC LMS will be able to onboard a client all on its own.

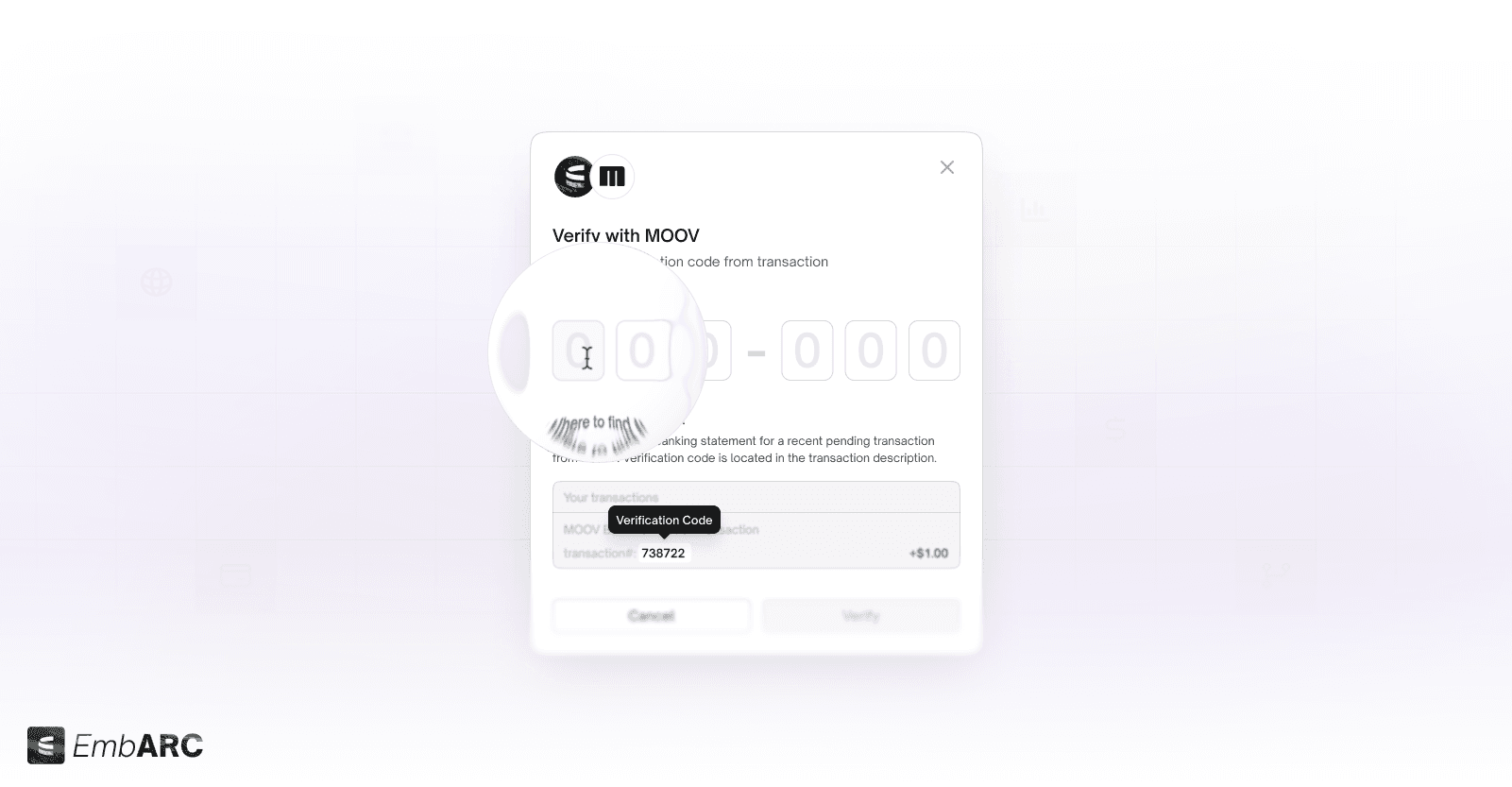

embARC LMS - Payment Method Verification Process - Micro Deposits

Yes, micro deposits are back. Micro deposits are a way to verify the ownership of a bank account before Plaid and Yodlee opening banking platforms are introduced.

Because of the rising cost of open banking, banks are now using micro deposits to verify the applicant’s ownership of a newly established bank account.

We are working with Moov to add this old but newly refreshed process of verifying a newly connected bank account.

For instance, when a customer added a new bank account to be used for making repayments. We will leverage Moov to make a micro deposit to the newly established account. The end user will verify the micro deposit amount back into the system to verify that they have control over the newly established account.

What’s Next?

We are working on an unified vision of our entire platform with the new Workflow Studio. This studio will tie our product, rules, pricing and outcome studios into one connected experience.

Banks can use this new studio to visualize the entire workflow of an application and how each step of the process can trigger creations from other studios.

This new Workflow Studio is now under development and we can’t wait to show you this new design studio in the next few months to come.

About LendAPI

LendAPI is a complete Loan Core platform that helps banks, credit unions, fintechs and retailers to launch any finance products instantly. Request your demo at www.lendapi.com and follow us on Linkedin.