•

2025 is coming to an end but we are still full steam ahead. We launched two new clients this past week and we are gaining momentum with one of our largest retail clients that are expanding into another 100 stores. More below…

Platform News:

We are having tremendous success with our Sunglasses Hut Plus roll out right before the Thanksgiving and holiday shopping season. We collectively decided to roll out to an additional 100 stores out of their 1,000 store foot print. We couldn’t be happier with the results and both our product and engineering teams are working hand in hand on the next phase of this private branded BNPL trend to displace the likes of Affirm and Klarna.

We are also excited about our Credit Union strategy being implemented across the company. We are working with an amazing credit union also acting as somewhat of a CUSO (Credit Union Service Organization) to revitalize In-Direct Auto industry for the credit union space.

For too long MeridianLink has been the dominant player in the indirect auto space for banks and credit unions. As the newest breakout all encompassing digital lending platform, we are taking on this challenge to displace legacy players and the old way of thinking and working.

In 2026, we will launch our fully integrated in-direct auto lending platform plugging into DealerTrack, RouteOne and their newest API integrations including document presentation where some of the legacy systems refuse to implement.

LendAPI is leaner, faster and focused. You know longer have to live with a bloated, slow and distracted platform. They send an API do, we send you an engineer. We try harder at everything we do.

LOS Platform Update: Changelog v3.0.7

This week we’ve solved one of the most complex multi-tenant configuration tools to help lenders and banks to once and for all figure out all possible paths for applicants and their co-applicant to be presented and underwritten.

We worked through two generations of multi-applicant design to satisfy all of your complex Loan Originations Platform requirements especially involving complex financial transactions that involve multiple parties to supply critical information and comb through underwriting criteria with digital signatures.

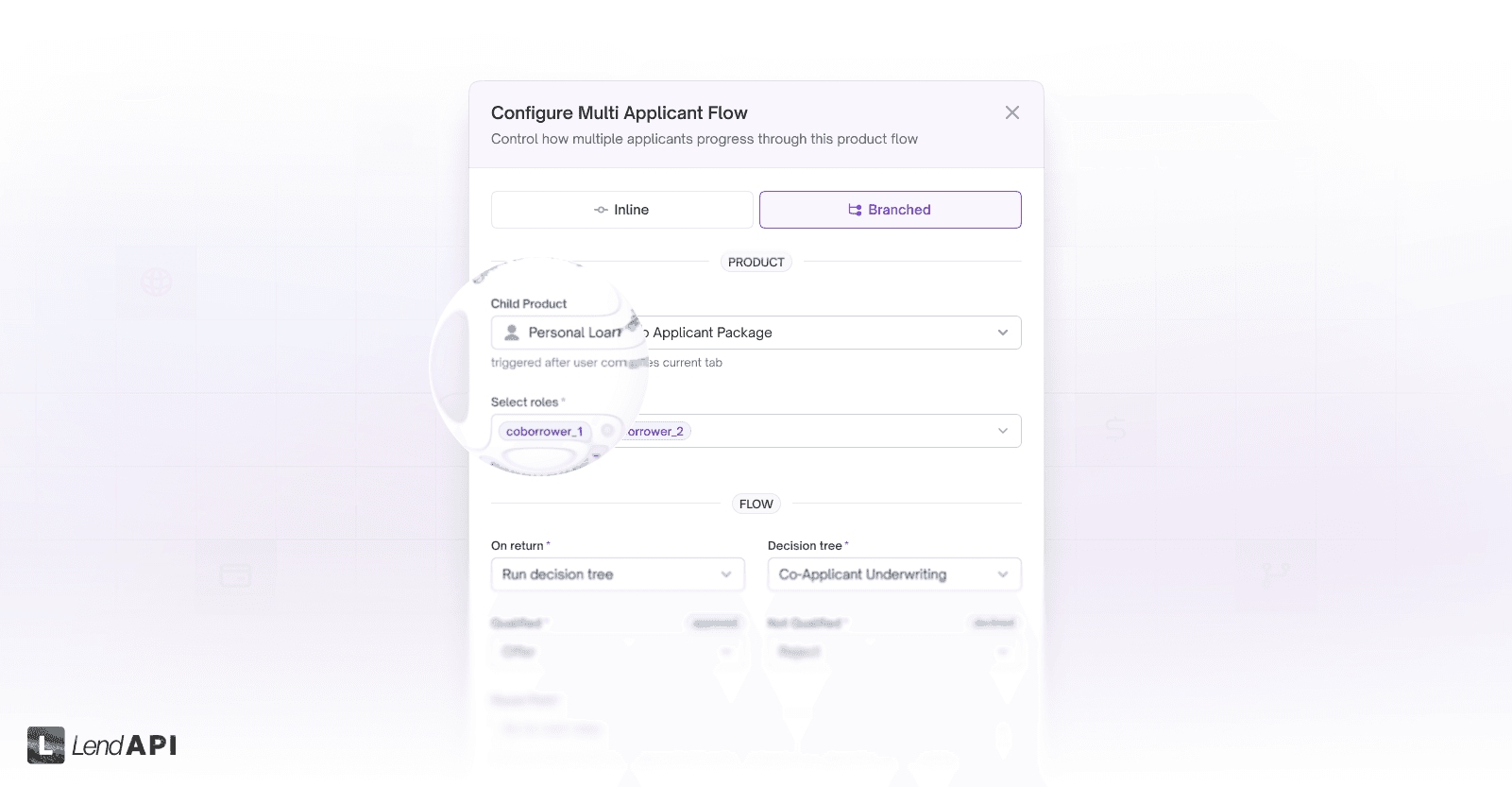

Multi-Applicant Flow Control v2.0

We made enhancements where you can configure your applicant onboarding flow with inline and branched out flows. This is one of the most complicated workflows of any Loan Originations System. It is especially difficult when you need to make this part of the LOS flow configurable. We will have a more comprehensive blow about this feature in our change-log section of our website.

We’ve also overhauled an important architectural design of the applicant and co-applicant process. With this new release, both the parent and child(ren) applicant flow and data can be exchanged bi-directionally. In other words, both the child and parent are aware of each other’s separate branched flow so the primary applicant and co-applicants are fully aware of each other’s space and activities.

This way, the entire application process containing multiple sub-applicants are fully aware of each other and therefore making it 100% clear to banks, credit unions and fintechs on their entire applicant process.

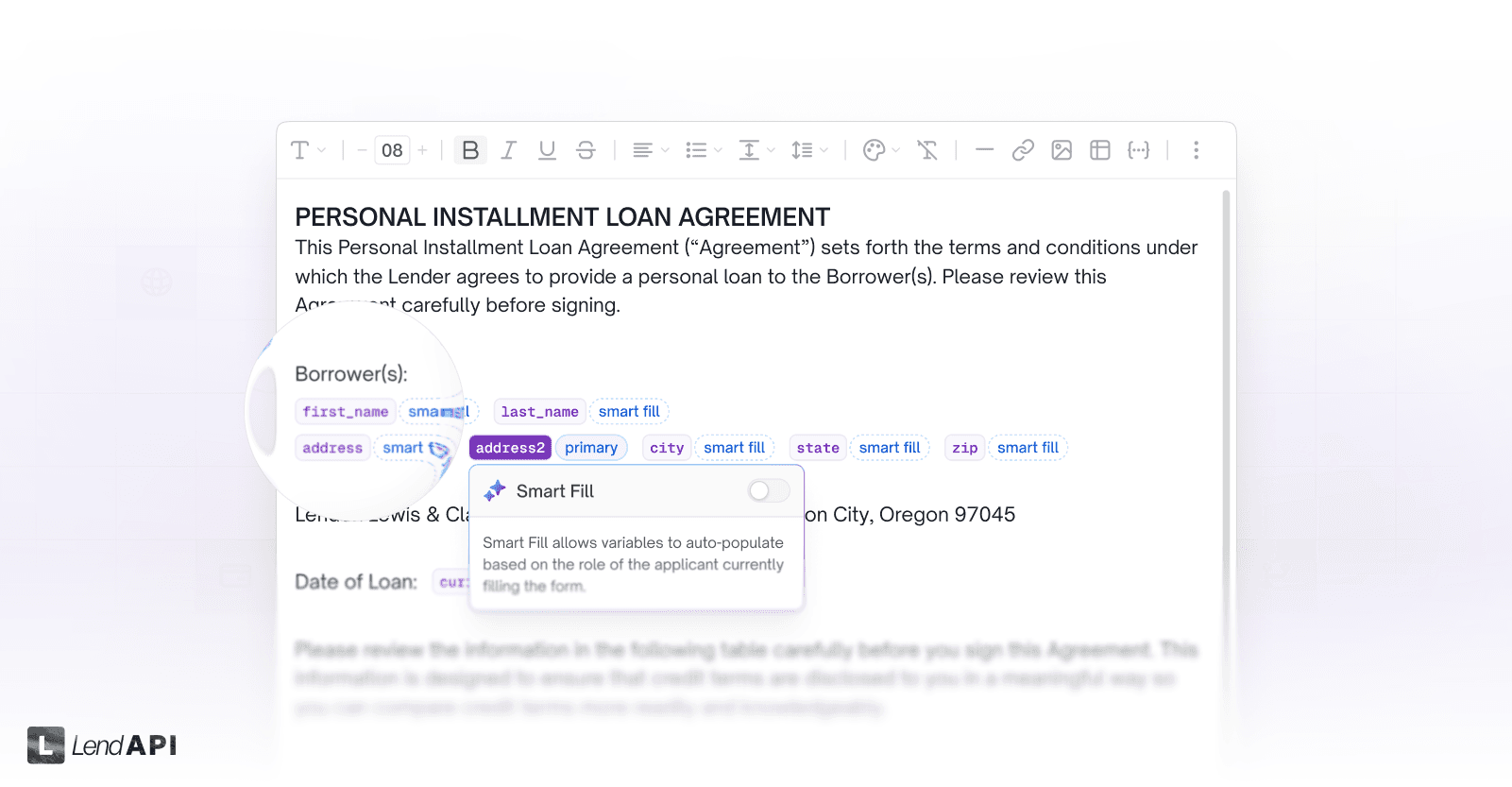

We’ve also made some major enhancements to our Rich Editor where new variables and tracking are introduced to collaborate with the new applicant and co-applicant flow. These variables are designed to track multiple branches of the application process.

Customer Communication Domain Control and Improvements

We’ve made some major enhancements to control each client's customer communication controls separate and distinct from each other. We’ve broken down configurations and dedicated each client’s choice, method and ways to communicate with their end clients clearer and more specific.

This separation of communication controls for each client will give everyone on LendAPI’s platform the ultimate control of the way they want to talk to their clients via email, sms etc.

Doc AI

Since the release of our Doc AI product, we’ve seen a lot of adoption to help banks, lenders and fintechs to scan pictures, PDFs and extract critical information from these images.

This week, we continue to work with our clients to add more mathematical operations at the time of scan like “Average Daily Balance” to reduce the burden of having our end clients to do additional mathematical manipulations after a bank statement is scanned.

LMS embARC Platform Update v0.9.4

The entire team at embARC Loan Management System is working 24 by 7 to launch new clients. This week a tremendous amount of work has been checked in and we will mention just a few in this week’s platform update.

APIs and Documentation

We are working everyday this past week to enhance our documentation especially around APIs and Endpoints that our clients need to interact with our platform from external enterprise systems.

Expect a massive update to our documentation section of the embARC LMS. Query parameters, request body, response and path variables of hundreds of end points are being documented and updated where we need to.

Customer Portal and Mobile Experience

We’ve also been working diligently to create an unique mobile experience for clients that need to manage their own customer portal.

From making payments, adding new payment methods and review their balances, all of these existing features are being upgraded to take full advantage of the mobile devices and their layouts.

We hope that with a modern design of an intuitive and easy to use mobile experience, it will lead to less customer service phone calls and problems that may arise from inaccurate and oblique information flow.

Statements and Statementing

We are working on making statements and the statementing process more visible to the end customers. We’ve integrated the statements fully into the customer’s full mobile experience. They can browse their statements right in their mobile phones.

Bankruptcy Management

We’ve also enhanced features where customer service agents and underwriters need to enter bankruptcy information into the system to clearly track their client’s standing and conform to local, state and federal regulations on communicating with clients in bankruptcy.

We hope this critical feature will make it clear for all administrative staff to enter, track and perform around customers working through their bankruptcy proceedings.

What’s Next?

We are taking on the biggest challenge and displacing some of the major legacy systems out there in 2026 and that requires focus. We aren’t everything to everyone, we are here to solve one thing and that is lending. Whether you are a point of sale financing lender, embedded financing lender, in-direct auto lender or just chopping up payments, we are here to help.

We might be the number two player, but we try harder.

About LendAPI

LendAPI is a comprehensive Loan Core that helps banks, credit unions, fintechs and retailers to launch any embedded finance products instantly. Start a free trial at www.lendapi.com. Follow us on Linkedin.