•

We are heading towards the end of 2025 and our v3.0.8 platform update is the last release for this year. 2025 has been a great year for us and we released countless features to help banks, credit unions and fintechs alike to compete for US consumer’s insatiable demand for credit.

Platform News:

We are wrapping up 2025 with a bang, this release packed with features that our clients really need to reach the best decision they can for their applicants. One of the features is the ability to update the application and re-run decisions on behalf of the customers or self-serve.

We created both ways for the banks and lenders to modify the application and give the applicant a second chance to get a different decision. More on that later in our LOS Platform Updates section.

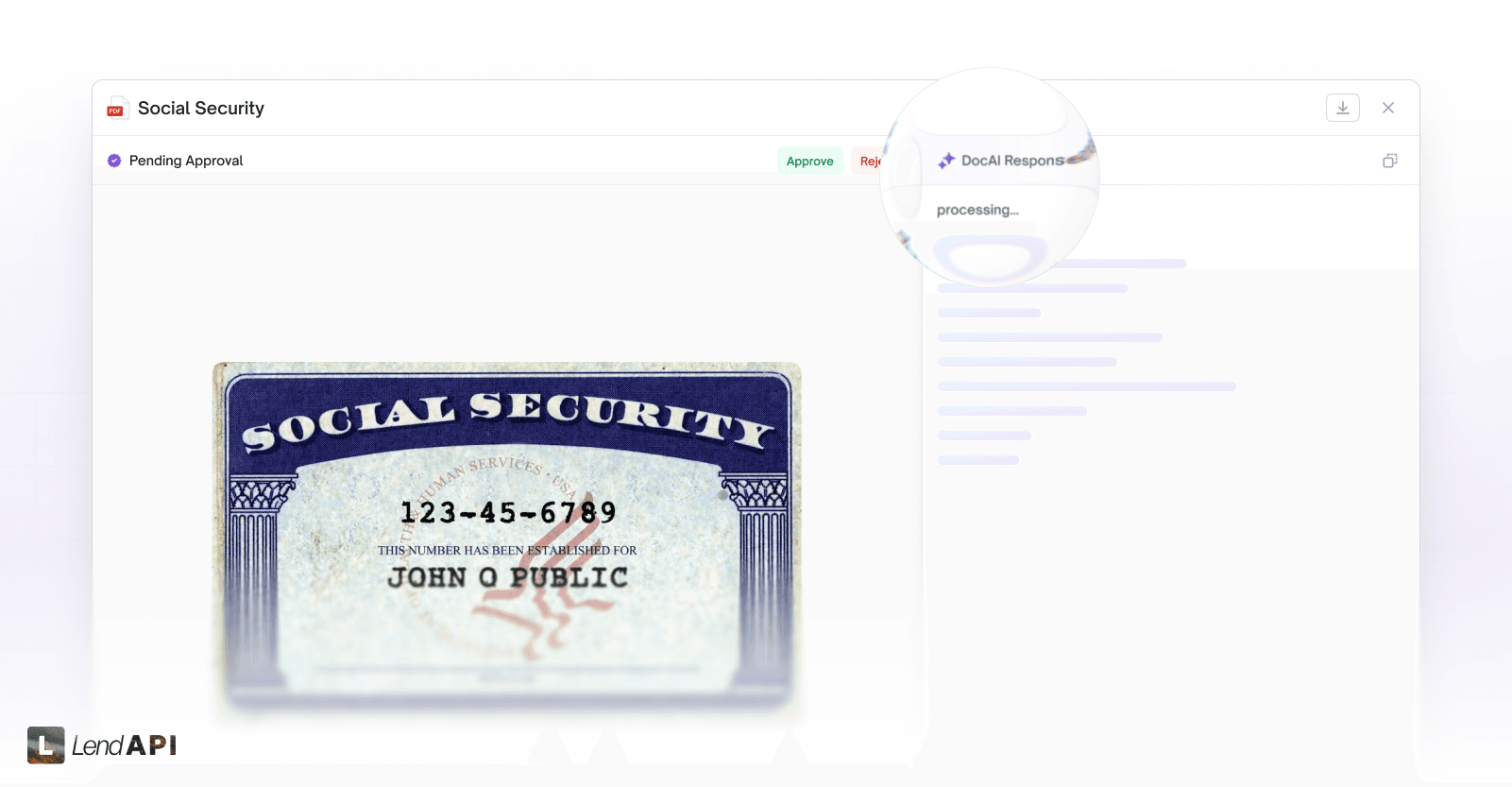

We are also working on bringing our Doc AI product even closer to our LOS Platform. Doc AI has been a crowd favorite to scan and extract information from customer document uploads. We are integrating this into the document upload process and we will discuss this a bit later.

Also, we signed up 3 more clients at the end of December 2025. Together we’ve served close to 60 clients and set us up for success in 2026. We look forward to working with larger banks and fintechs on launching new construction loans, point of sale financing loans as well as the auto lending vertical.

LOS Platform Update: Changelog v3.0.8

In the past few weeks, we’ve been working on a major functionality to help lenders to rerun applications due to a variety of reasons. This is a powerful process that gives lenders the control of giving their applicants another chance to get a different loan decision.

We’ve also heard it loud and clear that our clients want our Doc AI product to be deeply integrated into our Doc Upload process within the LOS flow. We’ve heard you and we’ve done the first step to integrate Doc AI into our platform in a powerful way. We will discuss this next.

Application Decisioning Re-run Triggers & Work Flow 1.0

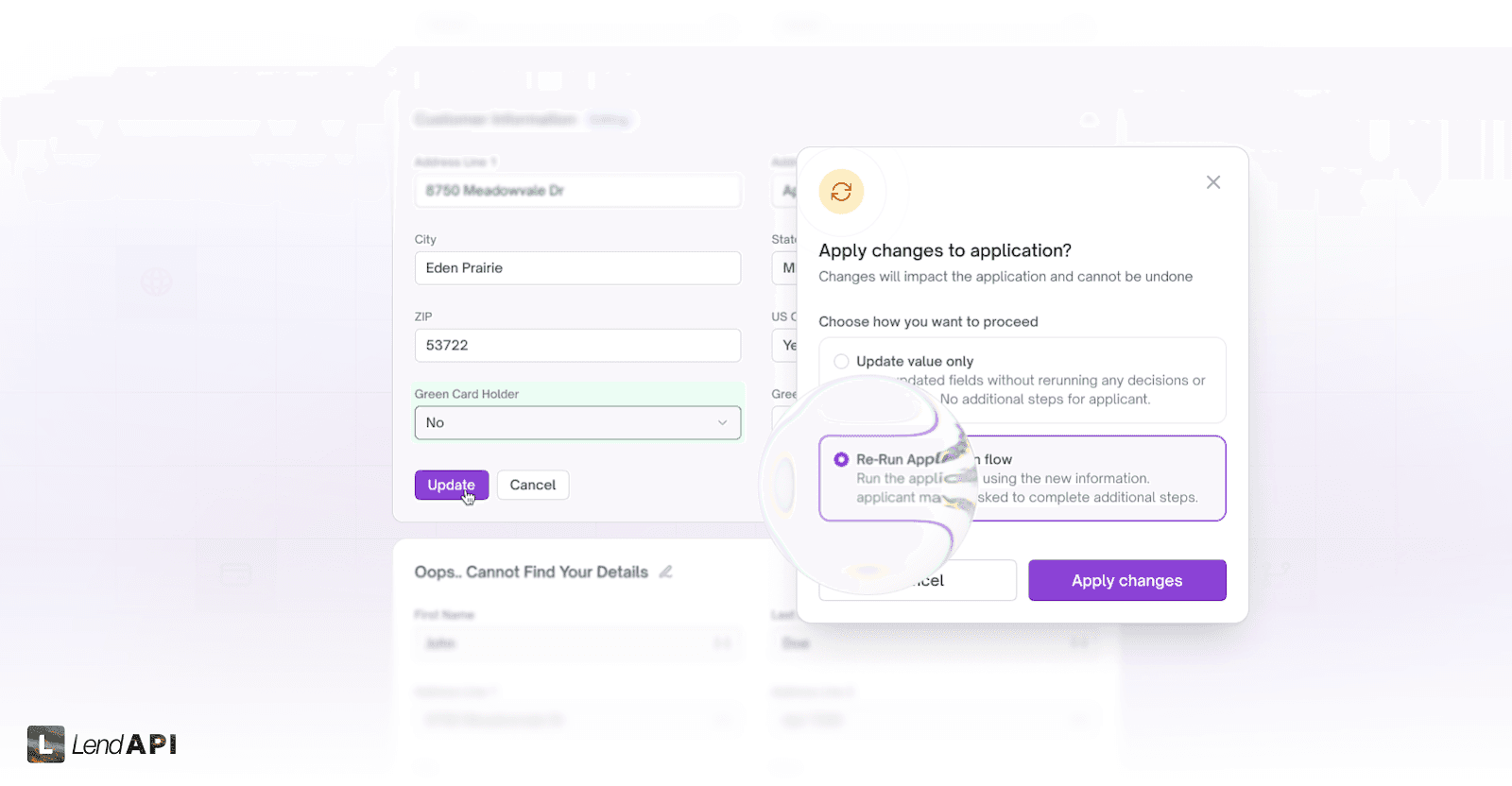

There are so many reasons why an already submitted application needs to be updated. Let’s start with the most common issue, the data itself. Sometimes the applicant mistypes their email, address, name, phone number or even transposing digits in their social security number, we get it and we need to do something about it.

We had an earlier version of letting lenders to update application data and we made improvements upon it. We can let you update any type of information and just simply keep a record of it going forward. No decisions are made or changed. This feature is now upgraded in v3.0.8.

But often, when updating data during the application process because something has happened and we need to re-run the application to get a desired outcome.

Most of the time, information provided that pulls someone’s credit or verifies someone’s identity is put in enormously and we need to give the applicant a second chance to re-run the underwriting decision.

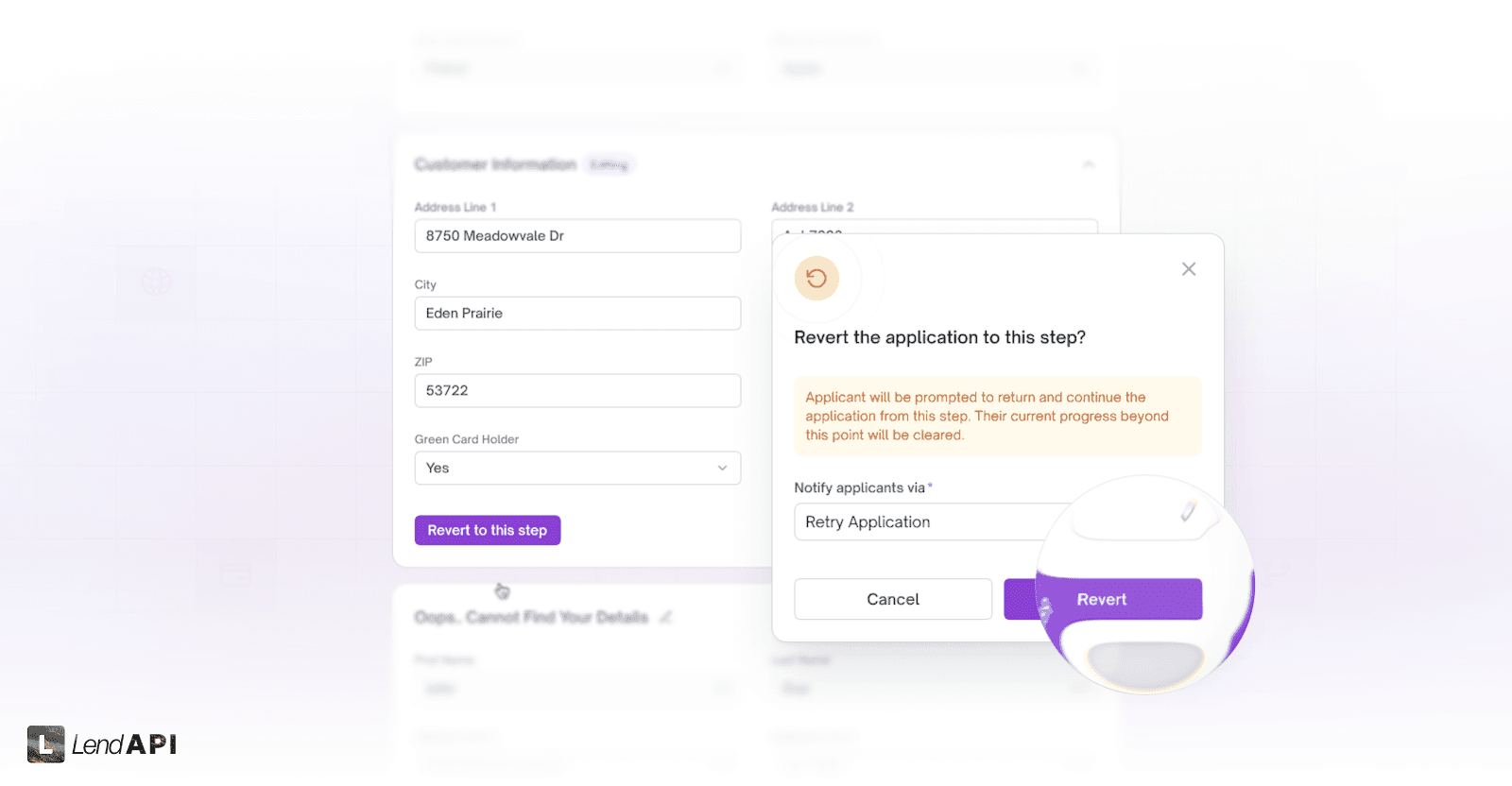

Sometimes, there are too much information that needs to be repaired or you don’t want your CSRs to go back and forth with your applicants on sensitive information, then you can also revert the application back to the step prior to the underwriting decision and have the applicant fill it out.

This reversion process will be very helpful for lenders to let their applicants know with an email to redo the application (but not all the way back to the beginning) and let them have another go at the application decisioning process.

Both of these paths to regenerate another decision based on new application data is triggered by the administrator so the applicant can’t just retry their application to see if they get a different result by filling in different information over and again.

We hope you enjoy this feature to help your applicants to unblock themselves and re-run their decisioning process with this little interjection feature. Although we made it easy and beautiful, it’s a complex process and we took the time to give you and the applicant the right user experience to have a second chance on their application without having to restart from the very beginning.

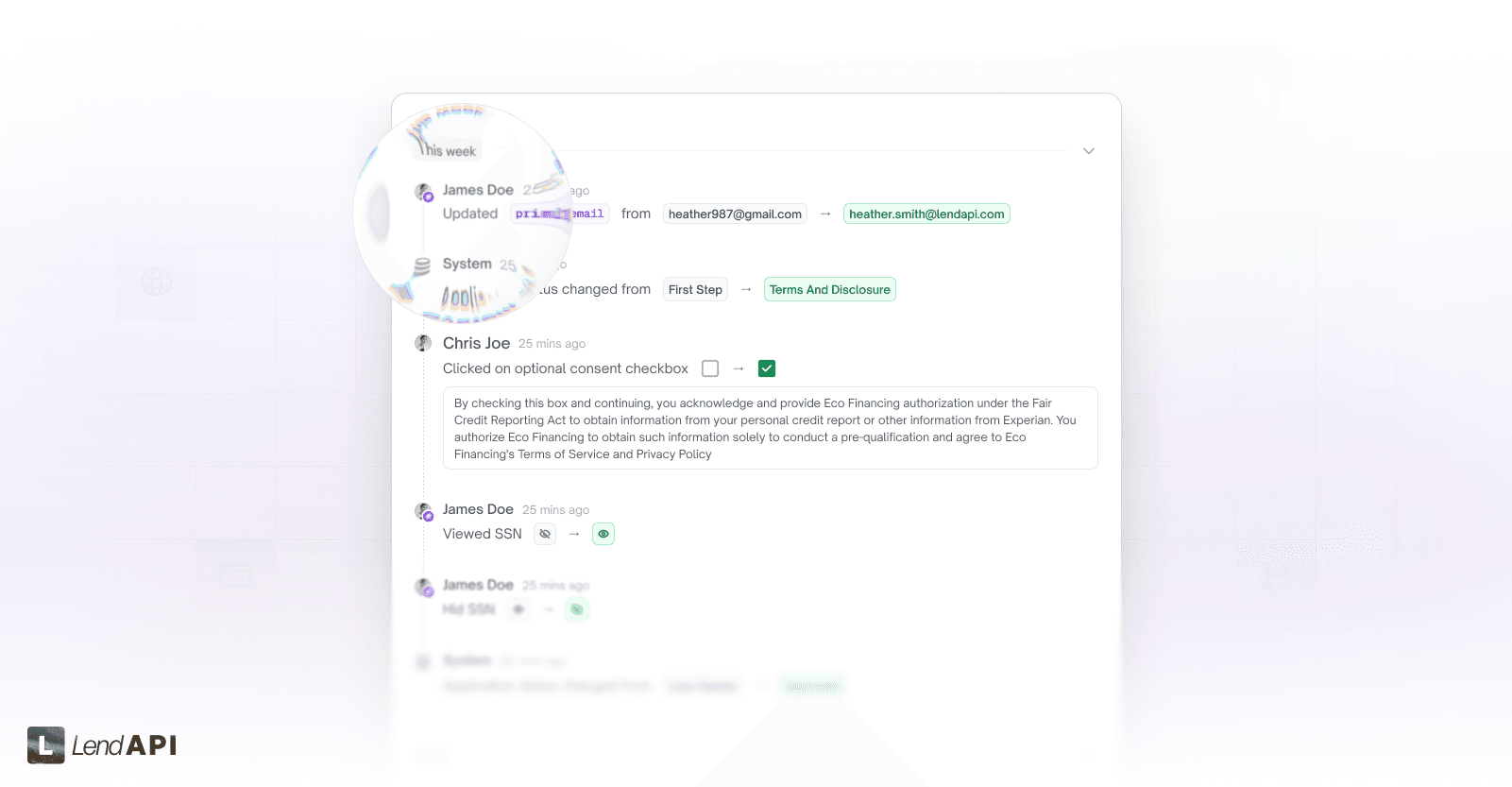

This Application Re-Run Process is complicated and therefore needs to be tracked intelligently. So we enhanced our logging process to give the administrator a real time view of all the re-run requests, triggers and results.

Doc AI and Doc Upload Integration

You already love our Doc AI product which you can use to upload, scan and extract pictures, PDF files of driver licenses, bank statements.

But what you’ve been asking for is a deeper integration into our Document Upload process and our entire Loan Originations Platform and completely take advantage of all of the workflow, decision engine to use the extracted information to further process the application. We hear you loud and clear.

To do this, we needed to break this process down into two stages. Stage one is to link up our core Doc AI engine to the document upload process. So that the Doc AI service can consume the upload document and process the elements within the uploads into something that’s digestible.

So in this release, v3.0.8, we are connecting our Loan Organizations System’s Document Upload feature with our core Doc AI process.

The second part of the process is to map all of the fields we extract from these document types such as Driver Licenses or Bank Statements into system variables which we can use to direct traffic and perform mathematical functions. This part is coming in a later release.

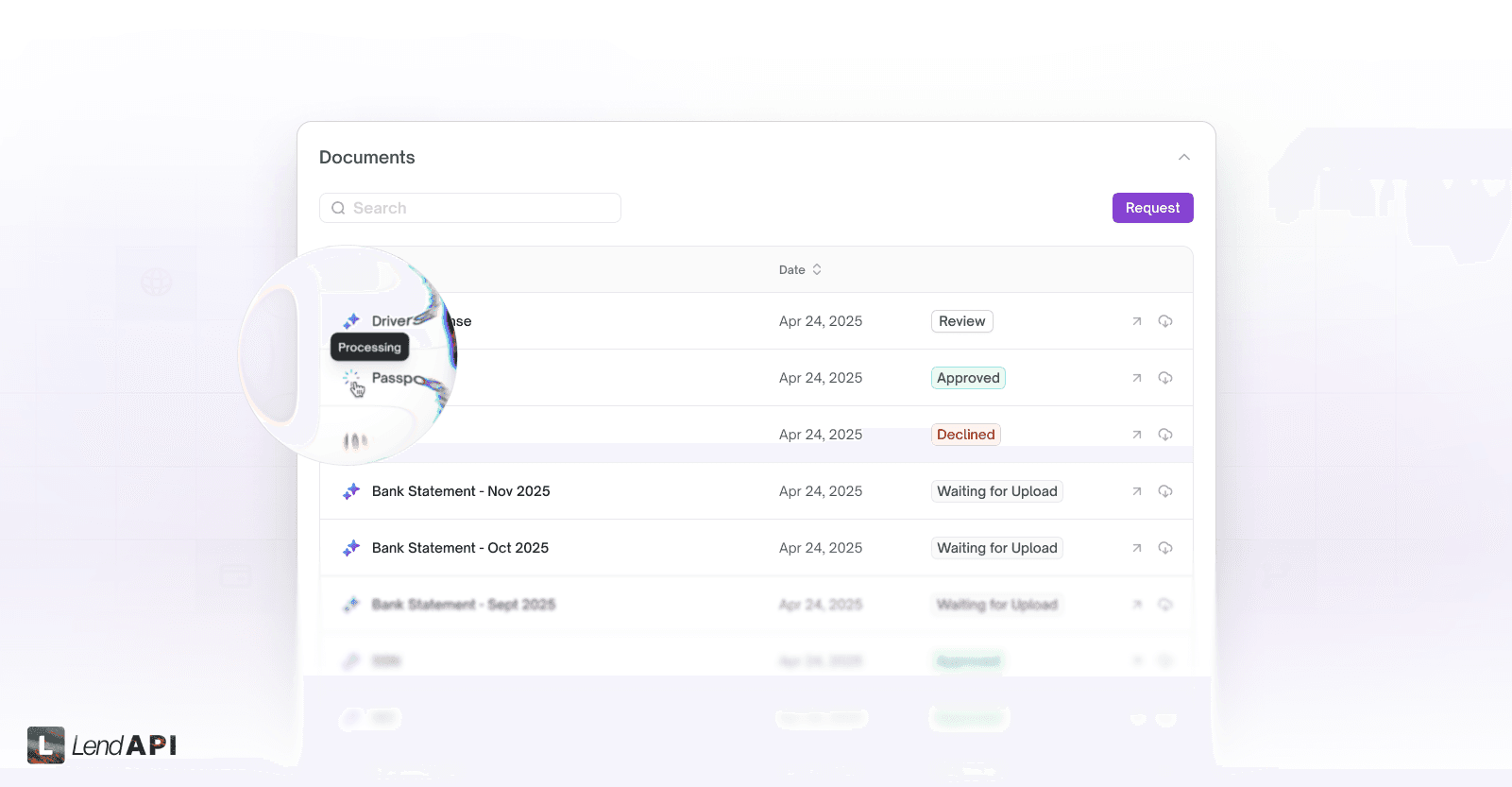

We also enhanced the Document Review tab to show which document has been uploaded and which ones are being processed by the Doc AI Process.

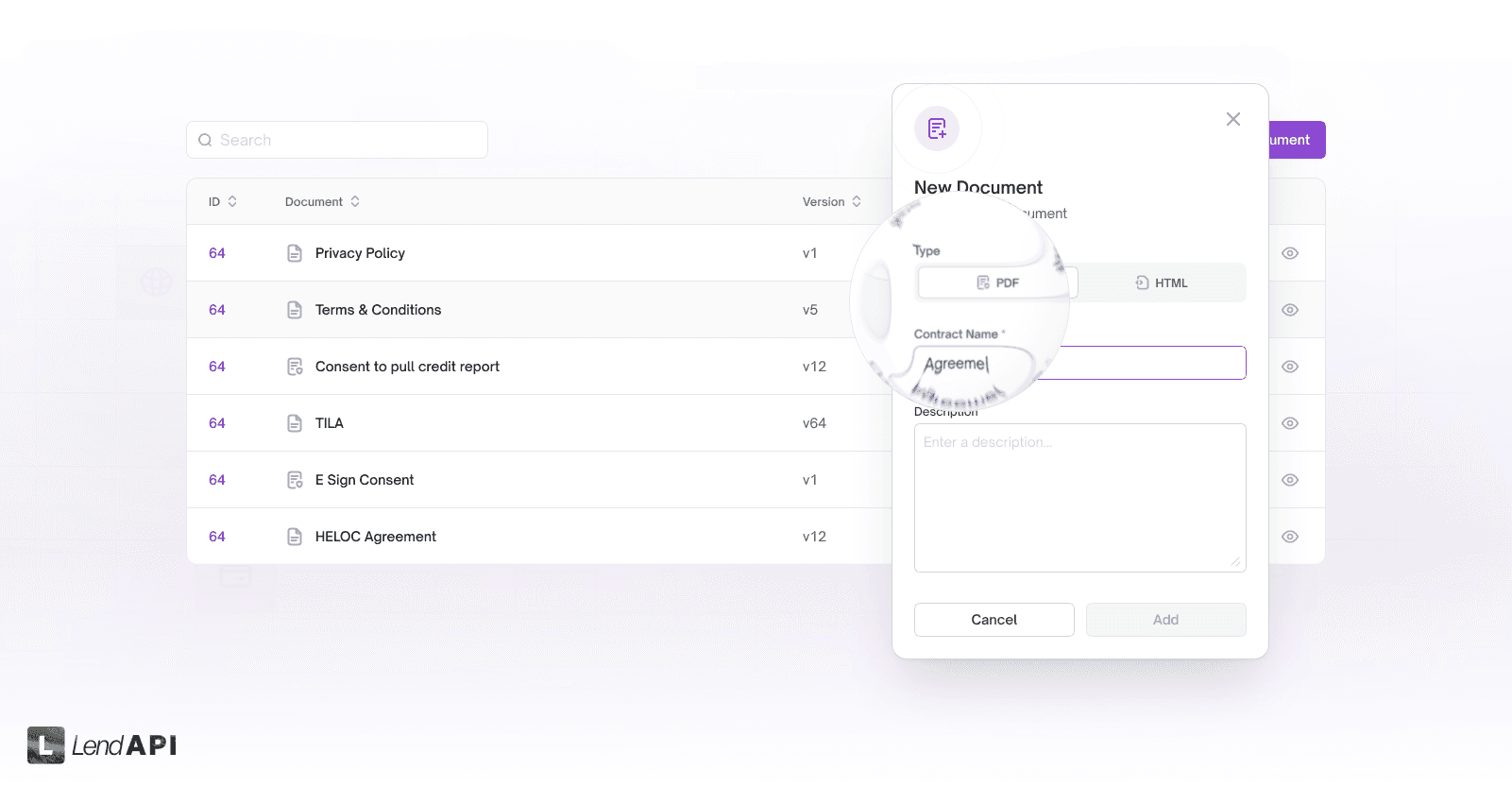

As part of the Doc AI integration feature, we went ahead and also refactored the Document Library with a new workflow and UI. This is now available in our v3.0.8 build and it’s been released.

LMS embARC Platform Update v0.9.5

We have wrapped up all of the core functionality and we are now working closely with our clients to add new features and optimize our platform.

LOS and LMS Integration

We’ve been working with our Loan Originations Team to tightly integrate into the embARC Loan Management System. Like all of our LMS partners, embARC is now one of the many choices when it comes to Loan Management System.

What it means is that if you use LendAPI to originate applicants, you can now port it right into embARC LMS to service these loans automatically.

OAuth 2.0 - User and Permissioning Process

We’ve completely refactored embARC LMS signup, password reset process and permissioning into a new streamlined process with the latest technology and security.

What’s Next?

We are working on something big that will unify all of the little workflows around product design, decisioning into one workflow studio. This way, you can visualize the entire process from customer interactions to internal decisioning.

We think this will be a better way to build your entire workflow with as little assistance as possible from our support team and getting LendAPI closer to our vision statement, which is to launch any financial product instantly.

About LendAPI

LendAPI is a comprehensive Loan Core with a fully configurable Loan Originations and Loan Management System that helps banks, credit unions, fintechs and retailers to launch any finance products instantly. Request a demo at www.lendapi.com. Follow us on Linkedin.