•

The United States is one of the biggest consumption based economies in the world. Based on the 2024 Capital One study, the total retail spending is over 7 trillion dollars. And according to the National Retail Federation, total consumer spending in the retail section is over 5 trillion dollars.

Retail spending is on the rise

Excluding Auto Dealerships, Restaurants and Gasoline Station spends, the “Core Retail” number is at US$ 5.29 trillion dollars according to the National Retail Federation. The NRF is forecasting a 2.7% to 3.7% increase in core retail spending in 2025.

Over 81% of all retail spending is in a traditional Brick-and-Mortar or In-Store spending. e-Commerce represents about 19% of all total core retail spending. The growth of e-commerce spending is outpacing in store spending, but brick-and-mortar stores represent the largest lion share of total retail spending in absolute numbers.

While online shopping is over a trillion dollars this year in the US alone, retail spending remains the dominant channel for consumer spending.

The birth of BNPL, embedded and point-of-sale financing

With consumer spending on the rise and a still unchecked inflationary pressure in the overall US economy, alternative financing methods to increase consumer buying power is on the rise. Inflationary pressure has increased prices of consumer goods by multiple factors but the rise in wage has been stagnate and certainly not keeping up the pace of inflationary pressure and higher prices.

Traditionally, consumers have relied on credit cards, unsecured personal loans and perhaps home equity loans to bridge the gap between their free cash flow and their purchasing needs. As interest rates or bank borrowing rate is still hovering around 5 to 6%, credit card interest, personal loans and home equity annual percentage rate put consumers in a disadvantaged position. It’s simply too expensive to borrow and use the loan proceeds or credit card balances to make large purchases.

Popularity of BNPL

Buy Now Pay Later has been a popular choice for Gen Z and now Gen Alphas. This generation of people are being taught to stay away from debt and credit cards. They understand the gravity of compounding interest on a credit card vs interest free payment plans.

Perhaps, they might have seen their parents, the millennials and Gen Xers struggle with personal debt stemming from overspending on their credit cards and their inability to pay off certain loans such as student loans and car loans.

Gen Zs and Gen Alphas represent 35% of the US population, sitting at 130 million mark. They are the future of our consumption based economy and their spending habits are completely different from their parents' generation.

Some have called Gen Zs the digital native generation and Gen Alphas are the true digital generation. This generation of people expect major transactions to take place on their mobile devices. The trust and the bond established between them and their screens are unbreakable and businesses are all prying for their attention digitally.

From social media, to shopping and financing, these digital generations and another 74 million millennials represent a formidable spending cohort.

BNPL captures this trend and this generation of attention. BNPL emerged initially as a checkout function. These BNPL lenders are integrated or have presented themselves as a checkout button. It’s easy to hit a button without making a payment or make a partial payment then pay the remaining balance over time.

One of the major features of a BNPL or Buy Now Pay Later product is that it’s 0% or interest free. This is a giant shift from a consumer’s mindset to how they think about credit cards and store branded cards. All of these credit card based transactional instruments carries a heavy annual fees as well as compounding interest where you will pay interest on interest if you don’t pay off your credit balance after each statement cycle.

Over 40-50% of the credit card carrying population in the United States are what’s called “revolvers”, meaning that they carry a credit card balance from one statement cycle to another and pay compound interest on their balances. And again, interest accrued in the previous statement cycles are added to the balance and therefore you are being forced to pay interest on the interest accrued in the previous statement cycle. Many of these credit card carrying consumers have a difficult time getting out of debt and must rely on their credit card to keep them stay afloat.

One of the ways that credit card companies combat the stigma of compounding interest are reward points. Every dollar you spend, you earn some form of rewards to encourage people to keep on spending and psychologically induce endorphins to keep the consumer happy and loyal.

Between BNPL’s 0% interest free payment plan or loans versus a credit card balance that you might have to pay a 24% to 29% compounding interest and check-out with an easy BNPL button, it’s a no brainer that this BNPL prone audience of 200 million people in the US are pushing this type of financing to an all time high.

According to research conducted by Capital One, between 80 to 90 million Americans have used BNPL in 2024 and 2025, representing a 7%+ increase year over year.

And according to J.D. Powers survey, over 40% of digital first generation have used BNPL in the recent past. These numbers are astonishing but not surprising. As this trend continues, more BNPL lenders have emerged and are competing for consumers' attention.

Embedded Finance and Point of Sale Financing Use Cases

Embedded Financing and Point of Sale financing is another term for paying for products and services over time. These terms along with BNPL are sometimes used interchangeably. However, one of the differences between embedded, point of sale and BNPL is that fees and interest rates are often added to embedded financing and point of sale financing.

Sometimes these other types of financing instruments give a 6, 9 or 12 months promotional period where there is a 0% interest period to encourage borrowers to pay off the loan but if they still haven't paid off the loan after the promotional period, the agreed upon interest rate is then gets retroactively reinstated from day 1.

Embedded and Point of Sale financing are more popular in situations where the product and services delivered are priced higher than normal BNPL transactions. A typical BNPL transaction are around $130 and point of sale transactions could be in the tens of thousands broken down into much longer payback periods such as 24 or even up to 36 months.

Some of the popular Point of Sale financing transactions are used for car repairs, elective medical surgeries and home improvement type of product and services where the cost of these products and services are much higher than the usual BNPL transactions. And because the financing amount is high and the duration is long, lenders or banks behind these financial products typically would require a higher down payment and a nominal interest rate to cover for the additional risk they are carrying.

Most often, these point of sale financing transactions are also done in person if not in a store setting. We see these in store experiences often in furniture and mattress stores where the shopping experience takes place inside of a store and there are store staff helping shoppers to decide which product is right for them.

While the shopping experience is taking place, a discussion around how to pay for the product and services can take place and the consumers typically would be okay to dwell for a few minutes to fill out a full credit application and perhaps paying a fee or some interest rate to increase their buying power is psychologically acceptable.

In-Store Financing Experience

For in store financing to work, the store, the brand or the parent company has to want it. If there are third party financing companies interjecting themselves inside of a process that doesn’t have the incentives aligned with the store or the brand, it is doomed to fail.

The in-store experience needs to be easy, frictionless and if all possible, integrated into the point of sale terminal or software. This will make the shopping experience and the financing experience much more aligned without having to have the end customer spend more time than necessary to get approved for financing or a payment plan.

There are multiple parties involved in an in store financing process. Sometimes the process starts with the consumer but in an in-store experience, we prefer that the conversation and actions start with the store staff.

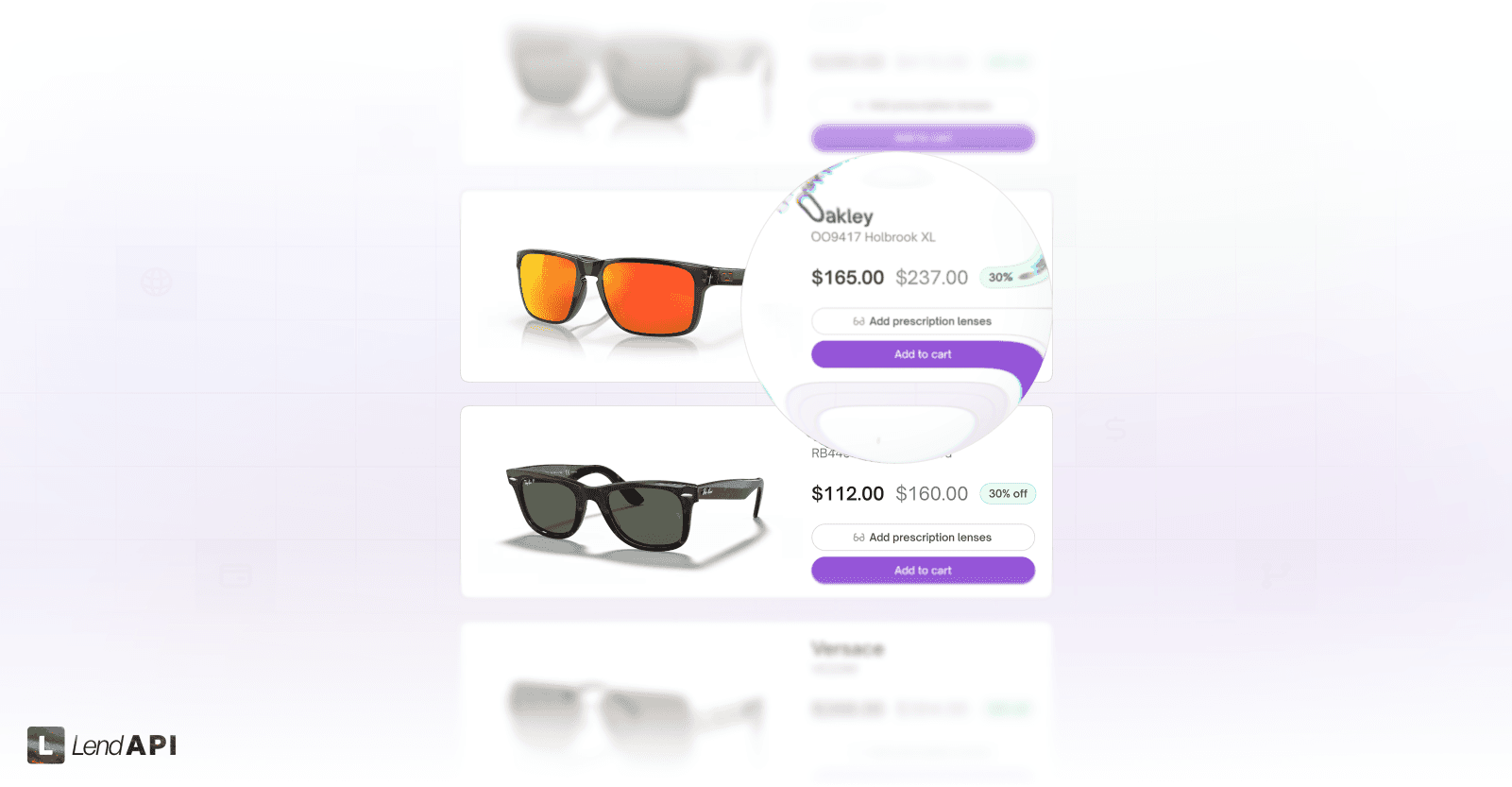

A quick search into the inventor system will allow the staff member to grab the make, model and cost of the merchandise in question. In the following example, store staff can easily browse through the pair of sunglasses a consumer is looking for and grab the MSRP or finance amount. Then add the merchandise to a virtual shopping cart in anticipation of additional purchases.

Once the shopping experience is complete, the staff can help the customer tally up the total cost of merchandise sold and begin the process of getting the shopper approved for financing or a payment plan.

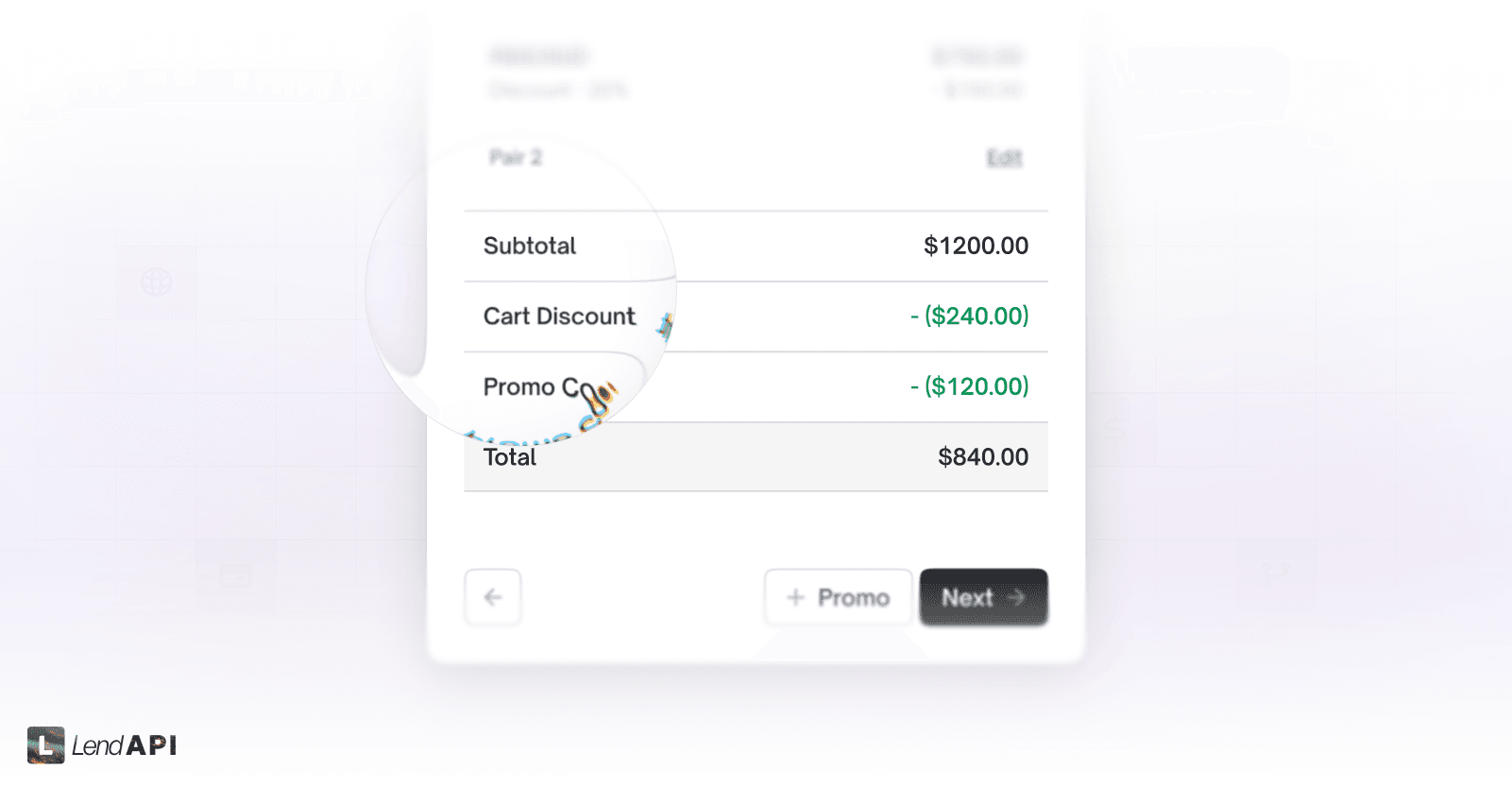

The appropriate tax, promotional discounting and other itemized information on a receipt is then displayed on the screen to show to the customer before finalizing the store staff facing experience.

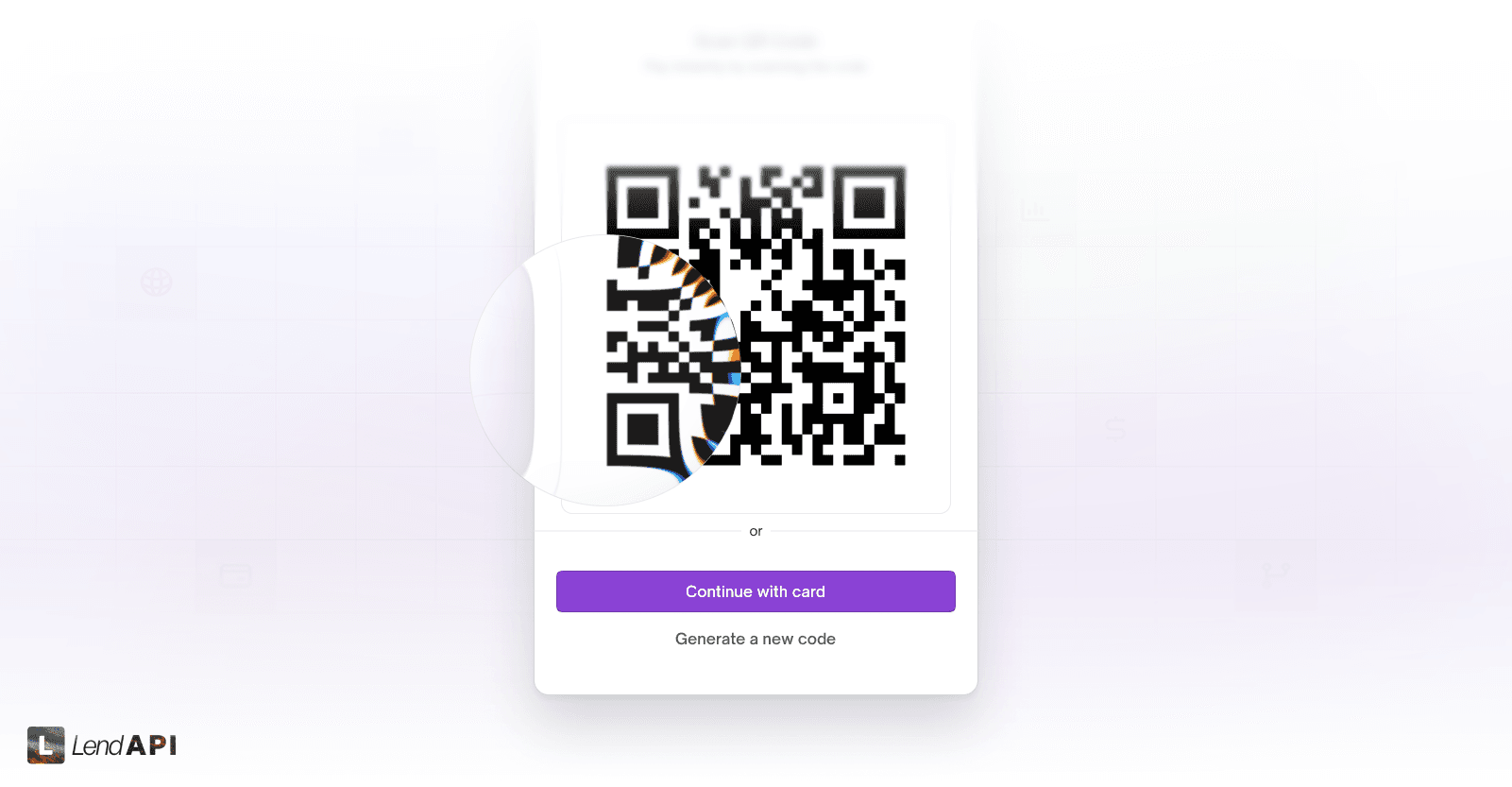

At this point, the store manager’s activity is complete and a transfer of action or responsibility is then taken place in a few different ways. First, we can send a link via text or SMs for the shopping to pick up where we left off.

We find that using the camera app and capturing a QA code is probably the most effective way to grab hold of this experience from the consumer’s point of view and from the safety of their mobile device.

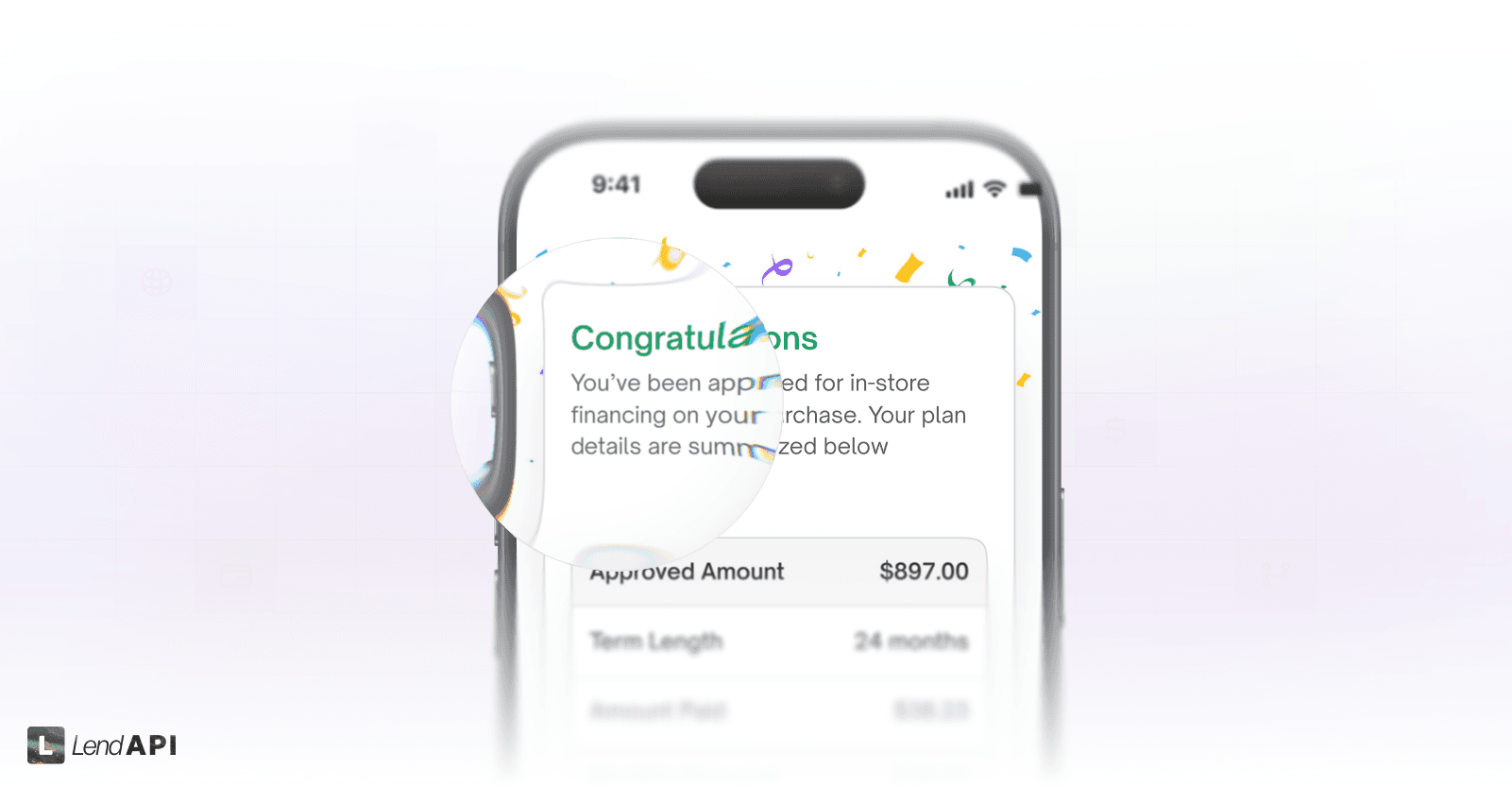

Once an approval of the credit application is taken place, the staff member can clearly communicate the result to the shopper for them to complete rest of the application.

At this point a QA code is generated for the shopping to scan, sign and pay. By scanning the QA code from the shoppers mobile device, the rest of the transaction is safely transferred to the consumer to allow privacy and security.

After reading the financing contract, the shopping is just a few steps away from completing their financing experience, a signature is captured and taken from the shoppers mobile device.

The shopper is then directed to use a debit or credit card to make their first installment payment. After the payment is successfully processed, the shopper walks out with their purchased product and services. The remaining payments are then processed on a monthly basis with their debit or credit card on file.

New Trend: Private Labelled In-Store Financing

The new trend in the retail space is private labeled BNPL. Just like store branded cards of yesteryear, private labeled financing is all the rage these days. With technology provided by LendAPI and the willingness for brands to take on their own risk, having your in-store financing program has never been easier.

Brands offering products and services with high margins are the best candidates to launch their own in-store financing program. This will allow them to upsell and move more inventory and give their customers even more buying power and have them pay over time.

If you have BNPL options in your e-commerce websites, you can also launch your own private labeled financing experience. The process in which your own customer gets financed is more streamlined than the in store experience and you can private label LendAPI’s in store financing platform for yourselves.

Three Benefits of Private Label Financing

To operate your own private labeled financing option, you can retain all of your margin without giving away any fees or interest to other independent BNPL providers.

You can also control your own experience with your own brand guidelines and ways you want your customers to interact with your staff, your product and services.

And perhaps most importantly you can control your own approval rate. Working with other independently operated BNPL lenders, you are always guessing as to what their approval rate and underwriting criteria are. These outfits can change their underwriting without notifying the stores causing the brand owners to restate their sales goals and sometimes at a complete loss of confidence in the program.

Having your own platform and controlling your own pricing, underwriting gives you the flexibility to approve or adjust for downpayment. You can essentially give yourself a 100% approval rate by adjusting risk on your own.

The financing amount and pricing is also controlled by the brand, you can finally sync up your inventory, make, model and cost to the financing amount that works best for you and your clients. There’s no more one size fits all.

The BNPL industry is shifting from a handful of players that’s centralized and opaque to brand operated, decentralized models where the brands, stores and operators gain ultimate control in customer experience, financing amount, duration, downpayment and fees.

We are seeing more and more brands leveraging technology provided by LendAPI to run and operate their own private labeled financing programs that can properly incentivize their store staff and ultimate drive more sales.