•

•

What do we look for when we look at a Loan Management System? Simplicity? Flexibility? Speed?

Honestly, we asked a lot of our LMSs or Loan Management Systems. There are some offerings out there that do the minimal or focus on a specific type of loan but lack flexibility when it comes to creating new loan types and for the modern world.

Today, we will talk about what we should expect from a modern Loan Management System and how it might single handedly change the world.

What is a Loan Management System?

A loan management system (LMS) is a piece of software that keeps a ledger of all things related to loan, such as principal balance, payment history, etc. Traditionally, it is a concept usually hard coded and hidden in the back of a bank’s mainframe computer.

Historically, banks were the only ones issuing loans to their customers. They are the only ones concerned with managing their loans. When it comes to loan management, we are talking about anywhere from presenting a promissory note for the client to sign, to send the loan proceeds to the client to collecting repayments to pay back the loan and generating statements.

These basic functionalities are well understood and most of us have had experience interacting with loan management systems. Some of us may have a home mortgage and perhaps most of us have an auto loan financed through our bank. These types of simple interest installment loans are tracked in some type of loan management systems.

On a monthly basis, we typically receive a statement letting us know the basics of the loan you’ve taken from the bank. This information might include the current balance of the loan, the next payment amount as well as interest accrued and other related information such as how many more payments are left to pay off the loan.

The statement and all of the information within the statement are all information that a loan management system tracks and then produces to inform the consumers about where they stand on their loans.

What are some of the main features of a Loan Management System?

From a customer perspective, we’ve already mentioned that monthly statements are one of the main ways of interacting with the bank’s loan management system. However this relationship is static and not interactive.

When banks stopped lending during the great recession of 2008-2010, other financial services companies, better known as FinTech picked up the slack.

However, what’s missing is a comprehensive loan management system that the non-bank lenders can use as well as provide interactive portals for their customers to use to reduce the amount of friction and meet the internet-enabled consumers of the 21st century.

There’s been many attempts to make a home built version of a LMS to suit the needs of new fintech lenders. Even some of the biggest fintech lenders run on Microsoft Excel or Microsoft Access DB based loan management systems that are limiting the growth of the company and make the back office operations extremely difficult and cumbersome.

By all means, there’s no written rule on how LMS should behave. Some of the bank’s homegrown LMS are built for their use cases and not universally flexible. Modern LMS needs to address the needs of the applicant, back office administrative staff and most importantly keep a clean and accurate ledger so each penny is accounted for and made visible for all parties.

Customer Portal

The customer portal has become a table stake when it comes to a modern LMS system. The traditional LMS aren’t built to have customer interactions such as adding a new payment method, downloading statements themselves or paying off a loan.

A modern system should authenticate the customer when a loan is booked. It should send the money or loan proceeds to the customers bank account and clearly communicate when the loan proceeds were sent and to where.

Subsequently, consumers need to have monthly statements sent to them via email or sometimes snail mail (depending on the legal requirements of the bank or lenders). The consumer loan portal should provide a real time principal balance, interest accrued and pay off calculation whenever the consumer chooses to log into the portal.

Payment Management

Historically, consumers need to call the bank if they want to update their bank account or payment method if their old account was closed due to various reasons. They might be on hold for a while before talking to an agent.

The consumer has wasted a tremendous amount of time doing this simple task and the bank also needs to hire expensive staff speaking multiple languages to talk to these consumers wanting to update their payment method.

The loan management system interfacing back office administrative staff should certainly have these functionalities but making these functionalities available to the consumer is something entirely different.

Modern loan management systems should have these features such as updating one’s payment method such as adding a new bank account or a debit card to be used to repay their loans. As well as selecting which account should be used as a primary payment source to repay the loan.

Average handle time for these calls are 6 to 10 minutes. The administrative staff in the call center have to verify the person, talking through the problem. Read back the bank account and credit card number. These issues can be solved instantly with a customer portal that’s secure and easy to use.

Payment Processing

Another wildly popular call center activity is to make a payment. These calls take up to 15 minutes to resolve without counting hold time that a consumer needs to spend waiting for an available representative.

Making a payment should be a hallmark of a modern loan management system. This functionality should be available in the customer portal. Taking a payment functionality should allow customers to make a statement-cycle payment, an unscheduled payment to pay into the principal balance and therefore reduce accrued interest as well as completely pay off the loan with proper up-to-date interest accrue calculation.

These features will greatly reduce errors introduced with a phone call, often transmitting numbers, digits, dates that might be incorrectly entered.

Giving this power to the consumers will greatly reduce the amount of staff needed to handle large scale transactions for any size banks, credit unions or fintechs.

Statements

Sometimes when the bank mails their monthly statements to the consumers, it might get lost or tossed away. Consumers will have to therefore call into the call center again inquiry upon key information about their loan.

The ability for consumers to easily retrieve their loan statement for various purposes online is a must for a modern loan management system. The consumer should have a secure portal to log into to review the finer points about their loan as well as retrieve statements for tax filing, asset/libality verification etc.

These statements should also be mailed to the end client periodically, so they can be searchable within their inbox. All of these features will reduce the need for consumers to call in as well as staff and even more call center staff to answer simple questions that should have been made available digitally.

Hardship Management

Most of us experience some sort of life event on a daily basis. Sometimes a consumer might’ve lost their job or unexpectedly underemployed.

Even an emergency event that disrupted the borrower’s cashflow might make it difficult for them to make that loan payment on time. Most of us will figure out a way to manage these difficult periods of our lives but a small percentage of folks need help.

Traditional and modern loan management systems have a hard time managing this type of workflow. And when a loan management system is inflexible dealing with the day to day cashflow issues of clients, it becomes detrimental for clients to catch up and make a full recovery from their cashflow issues.

Sometimes, a few days or few weeks late could incur additional interest and worst, be sent to collections departments and agencies that aren’t sympathetic to the consumer's situation and create unnecessary complaints and even arise to legal issues.

A modern loan management system should have functionalities made available to the back off staff to manage some simple requests from customers to give them time to recover from life situations that might impact their ability to repay their loans.

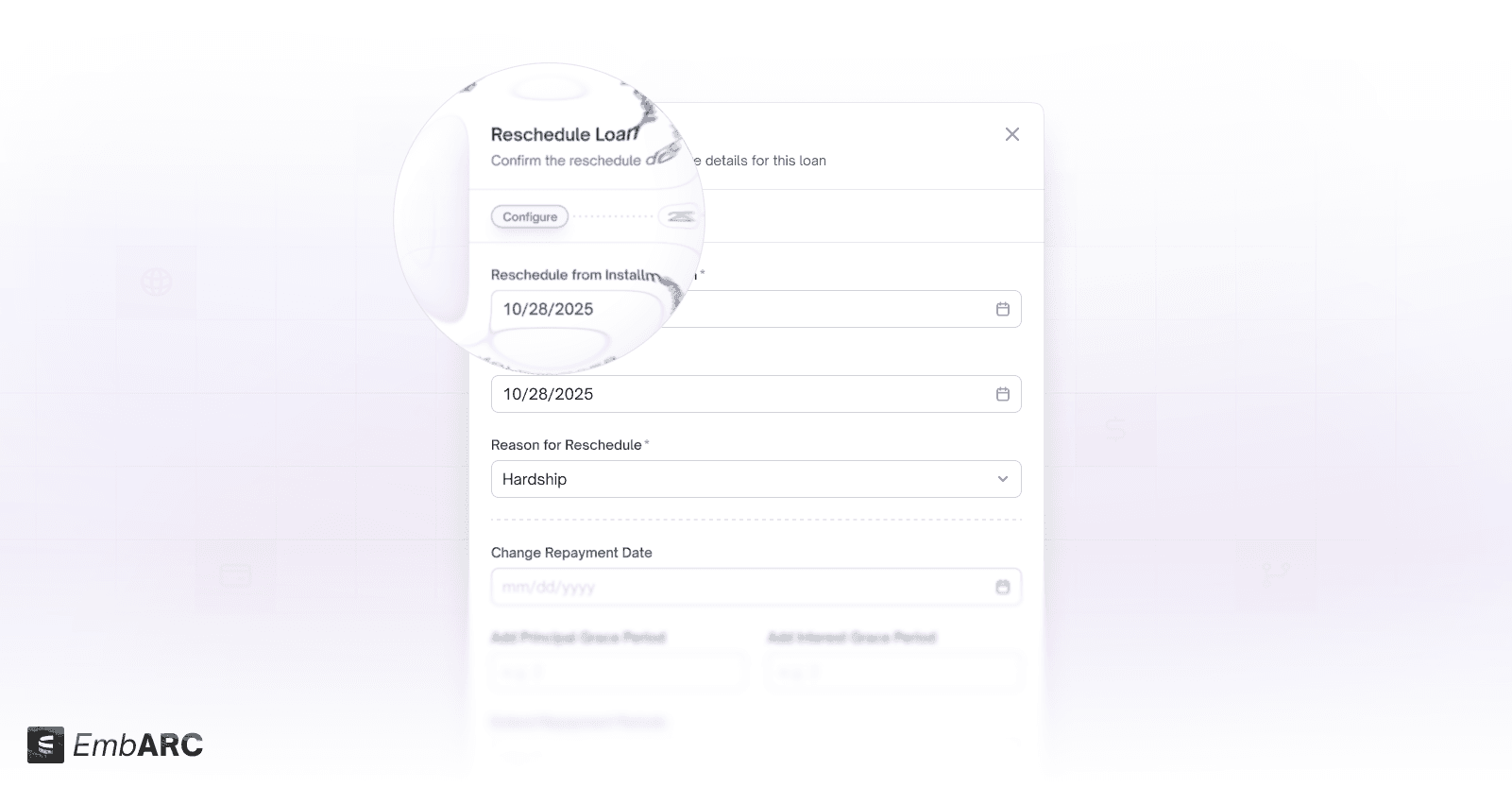

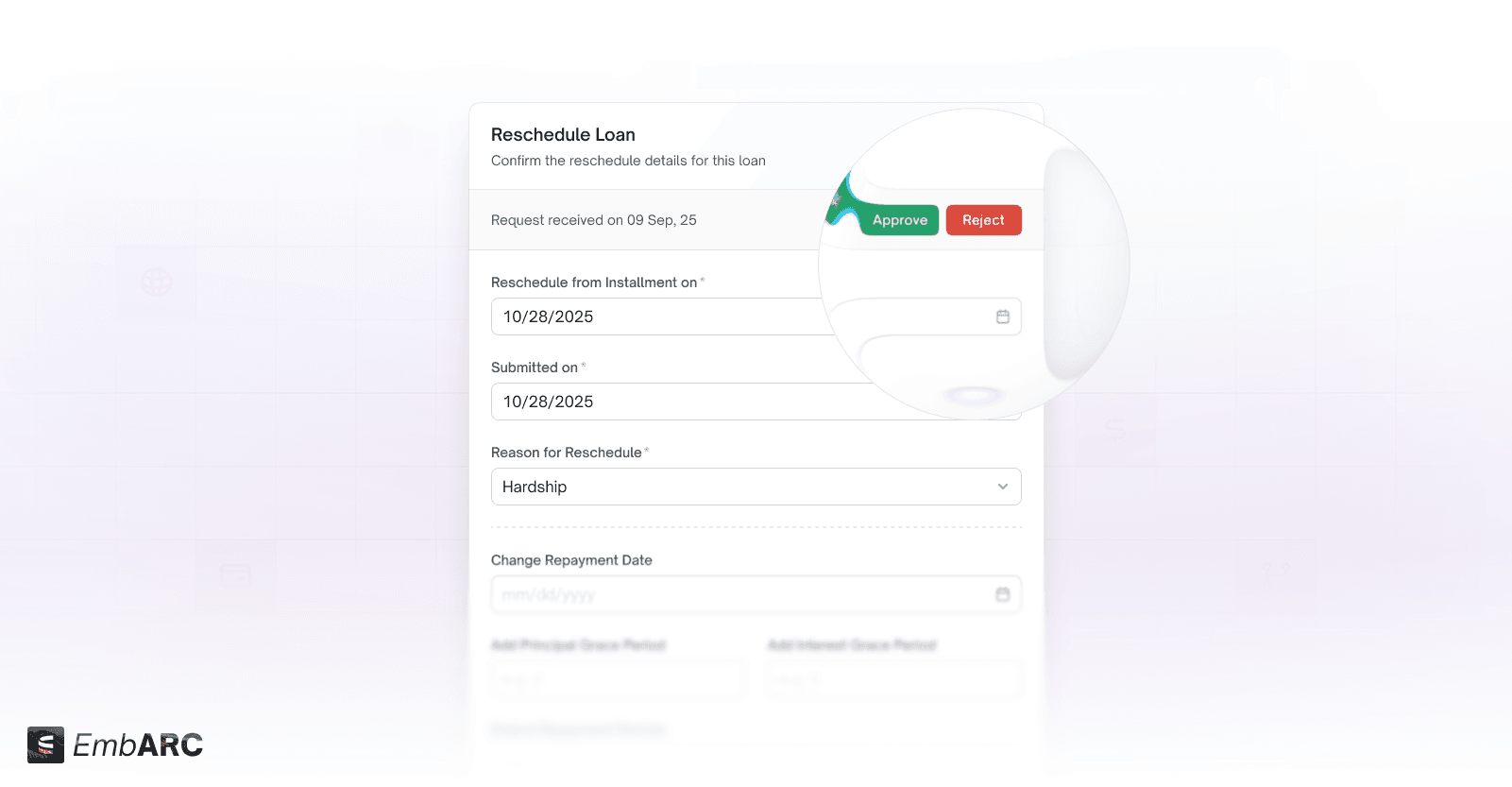

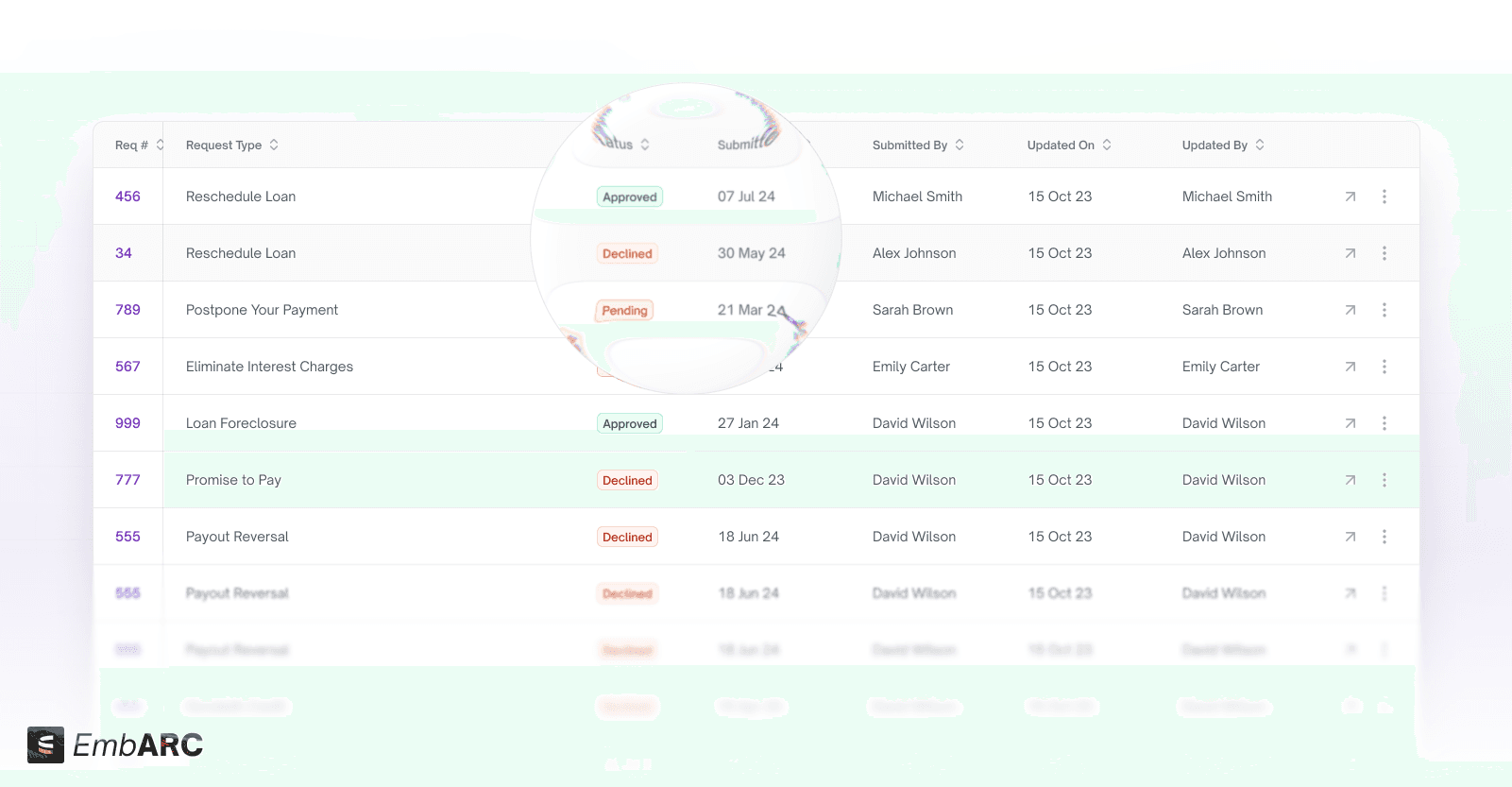

Rescheduling Payments

Sometimes, rescheduling of payment dates can give a consumer a tiny bit of break for their income to catch up. Sometimes their payroll date has shifted because of a new job and they would like their repayment dates readjusted to match their payroll date.

Sometimes they might want their next payment date to get pushed by a few days so the payment request won't cause an insufficient funds fee with their bank. These small adjustments happen all the time and lenders can make a choice to forgive or freeze a few days worth of interest accrue to let their borrowers catch up with their payment obligations.

These features are not made available in the consumer portal to prevent consumers to reschedule their payments willy-nilly but giving the consumer the ability to request a rescheduling of payments and have a back office person approve it might be an advance feature that could be made available in the consumer portal.

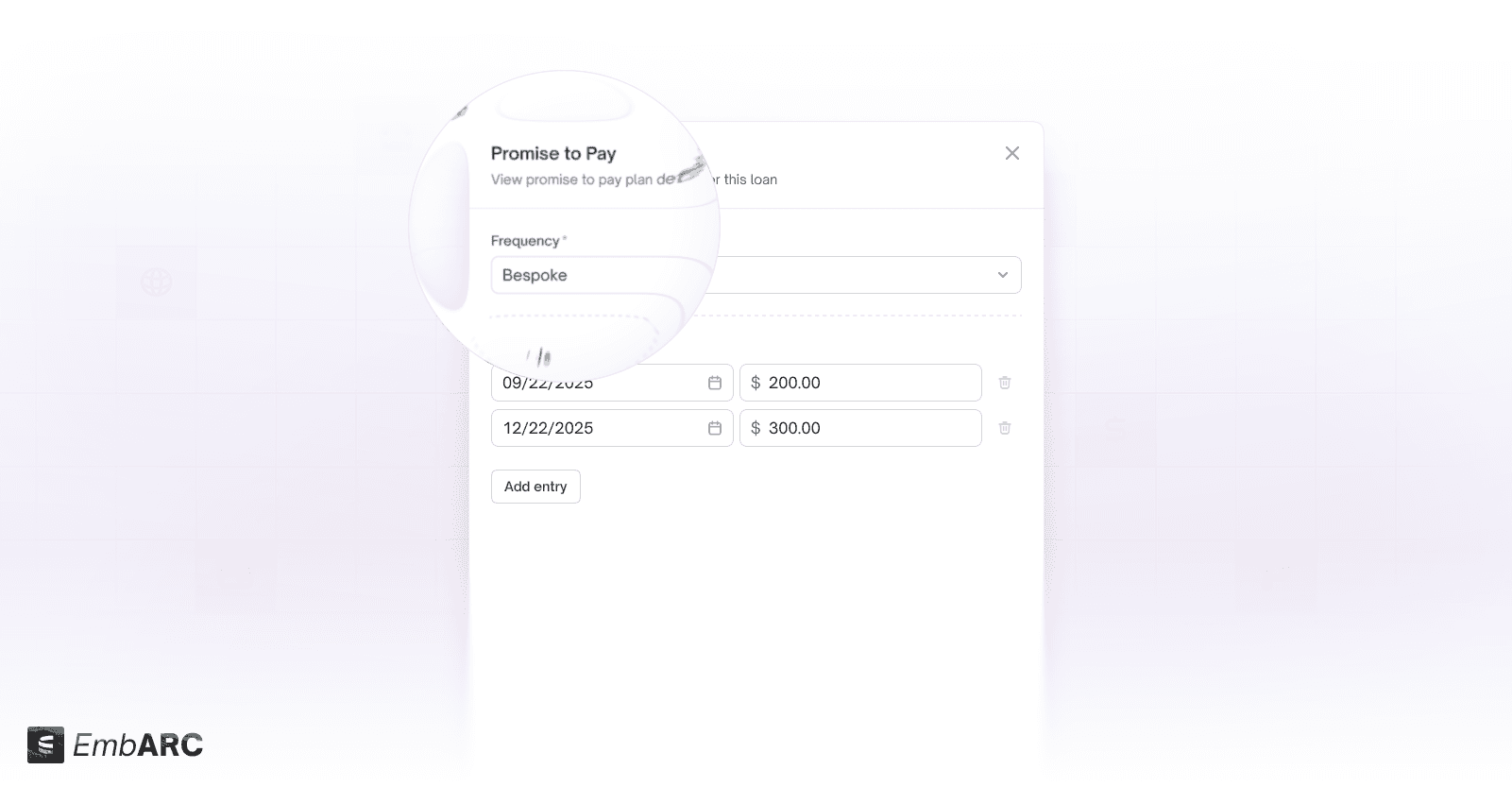

Promise to Pay

Sometimes the consumers are in a longer and more difficult financial situation and multiple attempts have been made from both parties to keep the repayment schedule alive.

However, the loan has not been repaid for a longer duration but the consumer is still communicative with the lender’s back office staff. Other than notes the staff member can write down in the borrower’s file, they can also create what is called a “Promise to Pay”.

Promise to pay is a temporary agreement between the borrower and their lender on a future promise to catch up with their scheduled, planned and missed payments.

A “Promise to Pay” is essentially a restructured payment plan that will execute at an agreement upon time. It could be a regularly scheduled future payment with a reduced payment amount to make it easier for the borrower to keep up with some sort of payment obligation.

Sometimes these promise to pay plans are more frequent than the original payment schedule but each payment will be reduced to make it easier on the borrower’s cash flow situation.

Whatever the form these promise to pay agreements end up looking like, a modern loan manage system must have a way to track and execute these payment plans.

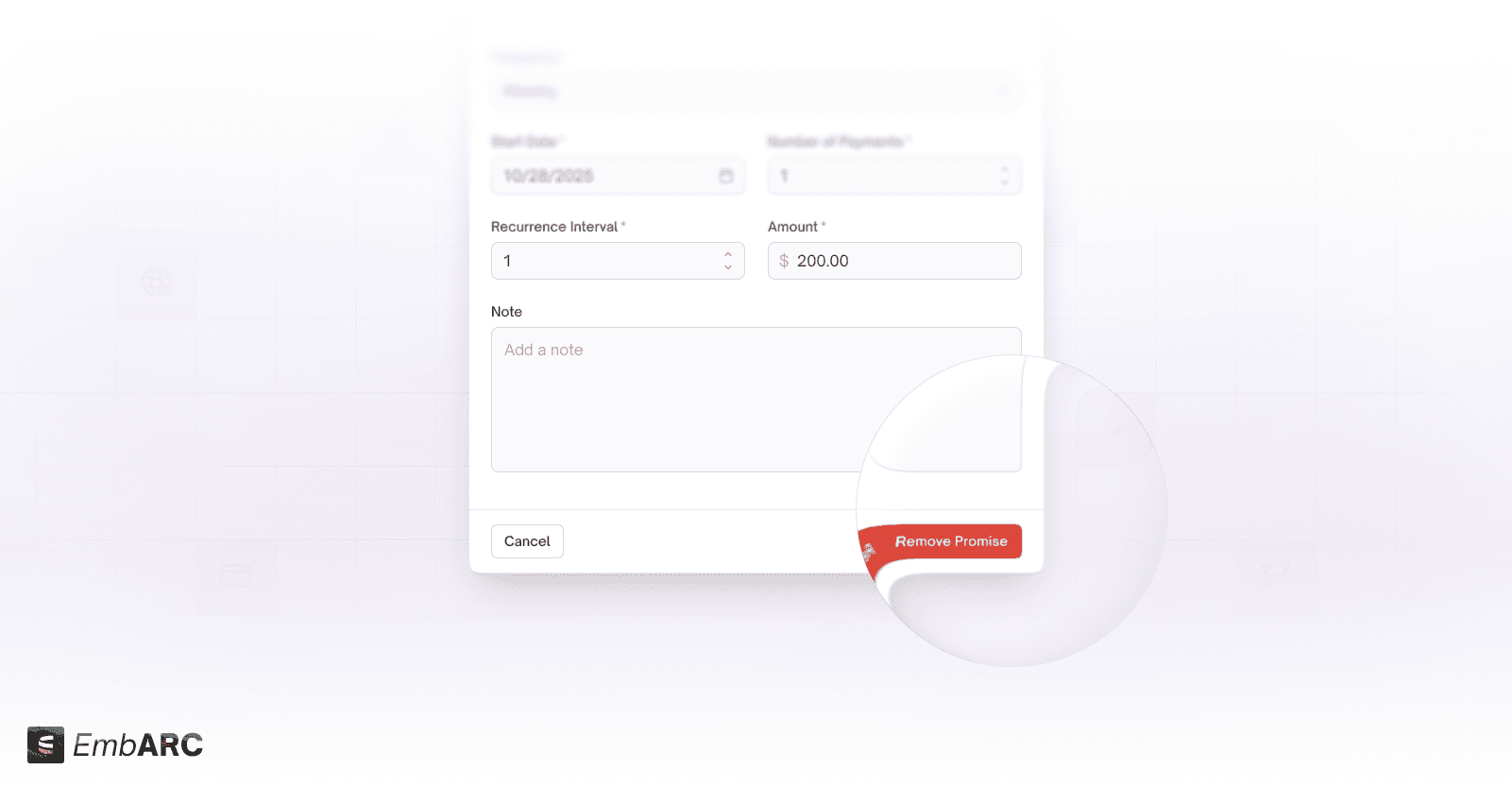

Sometimes, these promises are broken. These broken promises happen often because the borrower’s situation might get progressively worse before it gets better.

When the consumers call in with a new plan, the loan management system should have the ability for their back office staff to remove the previous promise and perhaps schedule a new promise to pay to keep up with the borrower's obligations.

Life happens and a well-to-do loan management system should have full functionality to take care of these customers and be able to adjust to their cashflow situation.

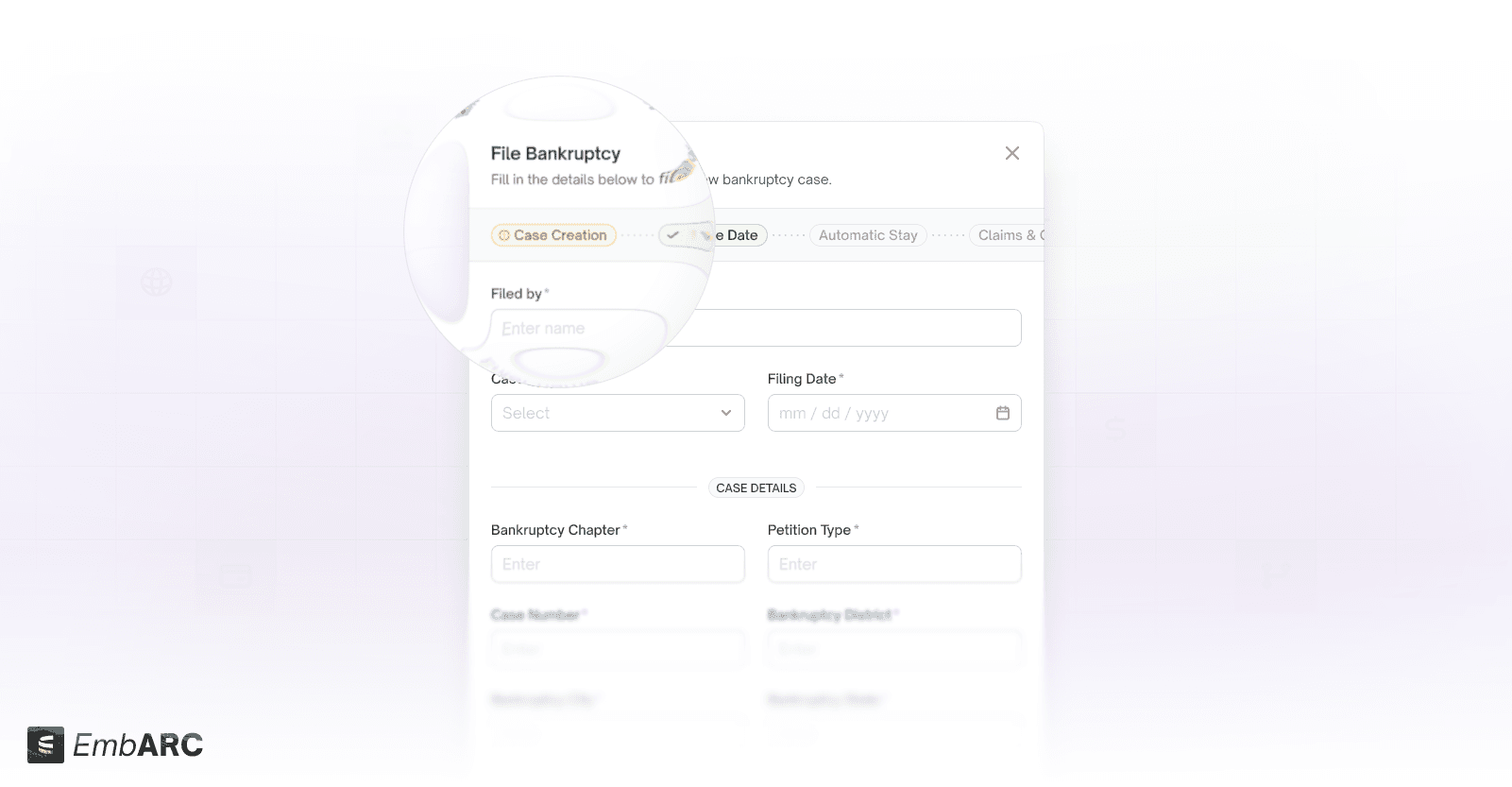

Bankruptcy Management

Sometimes when a consumer is in dire situation, the only way to resolve their debt and financial obligations is to unfortunately declare bankruptcy.

There are many laws and regulations that protect individuals while they are in a court granted bankruptcy proceeding. While they are working through their case through the bankcrypt court, lenders and banks should stop communicating with their clients directly. Any communication should then directly through bankruptcy attorneys and within the bankruptcy court system.

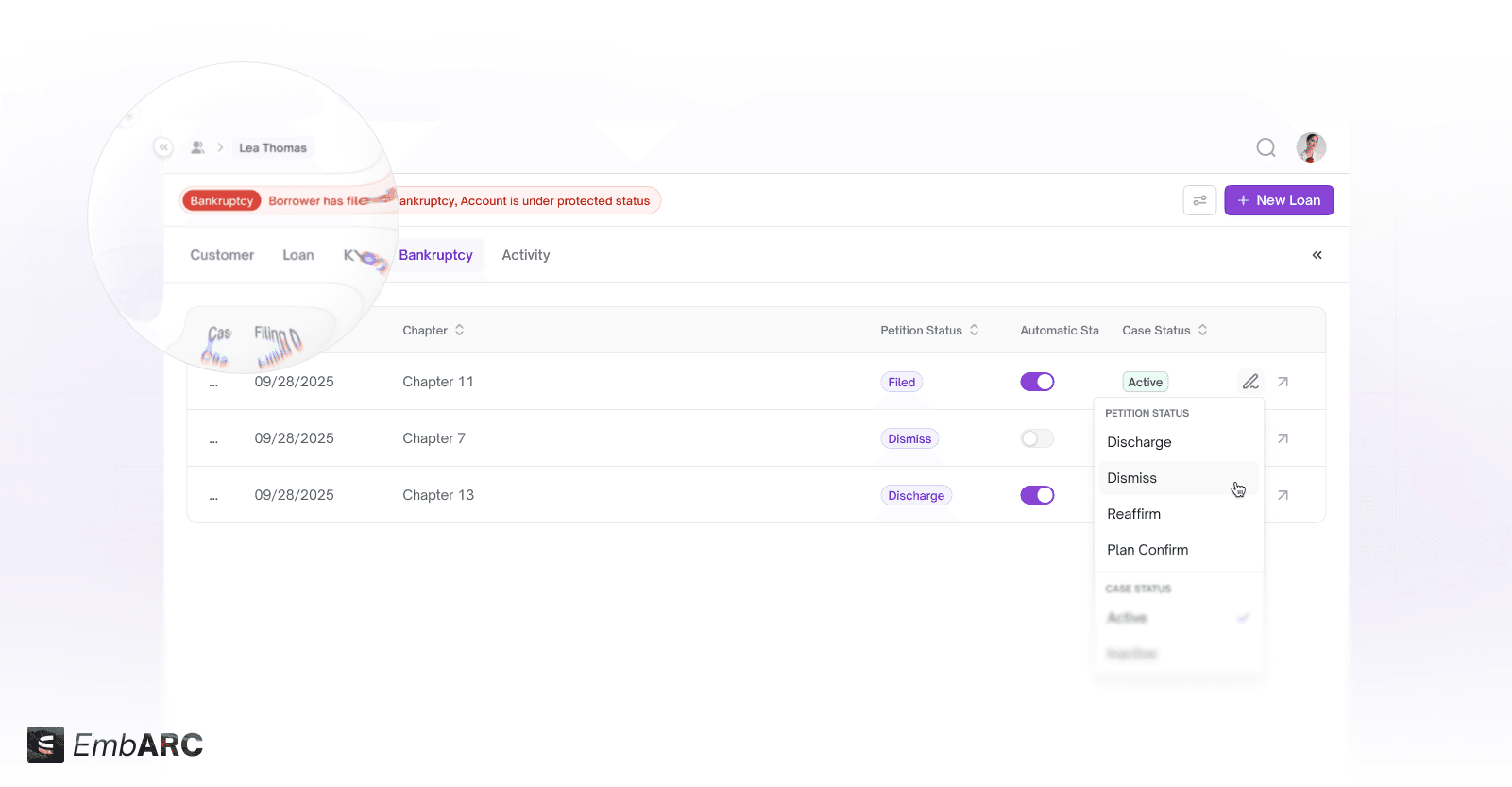

What this means is that the loan management system needs the ability to track the type of bankruptcy the borrower is filing and freeze all emails, SMS and lettering to the consumer on their loans.

In essence a big red stop button should be pressed when the lender or the bank receives a notification that their borrower is in bankruptcy. Most banks and lenders have a department for specialty situations such as bankruptcy. These features sometimes are only made available for staff working in those specialty situation departments.

However, the rest of the back office staff needs to be notified of a bankruptcy proceeding of their borrowers. These information needs to be made available, front and center for everyone else at the bank.

These alerts such as “this borrower is in protective status” needs to be made available for everyone that’s interacting with the LMS.

Control Room

At any given time, the back office staff could be actively managing thousand of loans and the LMS needs to be informative and intelligent enough to make every loan that needs attention available for the staff to act.

The LMS dashboard should be clear and concise so the loan servicing staff can quickly drill down to the individual loans they need to service whether the client is on the line calling into the call center or conduct a follow up on a promise to pay that failed to live up to its promise.