•

•

When Sam and I first set out to build LendAPI, we had a clear vision, embedded financing was going to be all the rage in the next decade to come. From the very start, how we architected our platform from head to toe had to be different.

Two years later, we are the only end-to-end “loan core” with international retail anchor clients on the market. Nothing of this scale has ever been attempted to disrupt a $500 billion global market.

In the Beginning

Sam and I met serendipitously during COVID at one of those virtual coffee meetups hosted by my friend at Interlock Capital. They ended up investing into our seed round some months later, but that’s another story. We have to thank Neal Bloom of Interlock Capital and we tell this story of how Sam and I met often.

I exited my business and Sam was on his way of exiting from his business and timing for working on something new was perfect. Sam came from a deep technical background having to work for Bell Labs on the cusp of image processing and I worked in finance for my entire career.

Software, SaaS, AI is all the rage back in 2024 and as founders with deep product and engineering background, we landed in building something that combined all of our knowledge in deep tech and financial services to launch a platform to challenge the big and slow incumbents and target the $500 billion dollar embedded finance industry from the ground up.

The Birth of LendAPI

March 1st, 2024 was the date we launched LendAPI with a small team of three engineers which we assembled to move fast like never before. Both Sam and I are bootstrap founders and we learned to listen to our instincts and mercilessly focus on features that will win our first customers.

We immediately signed one of the largest personal finance apps to use our multi-tenant decision engine. This was a publicly traded company that demanded a lot from Sam and we ended up with a multi-year licensing agreement of our decisioning technology.

Shortly after we signed our first embedded financing client with a sharp focus on legal fee financing. The idea was to embed our platform within each law office and get their staff to offer credit to their clients to finance legal proceedings such as adoptions and divorces.

One of the earlier clients is also a CUSO, Credit Union Service Organization. These were all acronyms that we weren’t used to but will serve us well later in the future. We doubled up on our efforts with these early clients to strengthen our point of sale financing or embedded financing offers which is core to what we’ve set out to do.

Techstars & Plug N Play

Sam and I are both bootstrap founders and we never raised money beyond friends and family. We are both roll up our sleeves type of entrepreneurs and we haven’t got a clue as to what venture capital is all about or any institutional money that could help us grow.

While we were building the foundation of our startup, Techstars came knocking. I know of Techstars because I worked at a place called Realty Mogul a while back and they were a Techstars company. Some of the things I’ve experienced while working at Realty Mogul were clever and cute. I thought maybe one of these days I will have a startup of my own worthy of these fancy start up accelerators.

Sam and I sat on a few of these Techstars interviews and we didn’t think much of it. We had revenue, clients, profitable and a hefty goal to accomplish. Fast forward a few weeks, we got accepted into Fall 2024 Techstars Cohort and at the same time, we got accepted int Plug N Play’s Fall 2024 cohort.

Sam and I had a come to Jesus moment and started contemplating our startup in a whole new light. “Maybe we have something here…”, and maybe we can use some help to grow this company into something bigger than what we’ve imagined. Boy, are we going to be in for a wild ride.

New York City

Sam and I showed up in the city with our suitcases and officially joined the Techstars New York City Fall 2024 cohort with 11 other companies. Although some of the exercises we did was kinda silly, it created a new space for Sam and I to learn from others and learn from each other.

We had our first lunch and dinner together as co-founders. Can you imagine that we were so wrapped up in what we were building, we never really sat down and talked about our lives, our hopes and dreams. Looking back at Sept to Nov 2024, it was magical times and a time where we bounded.

The mentoring sessions and the “VC” sessions were powerful moments where I learned how to pitch, how to talk to VCs and how to deal with the reality of raising money, putting together a data room and potentially dealing with a board.

We have to thank all of the staff members at Techstars for making introductions, individual coaching sessions and constant feedback on how we are going about our business. We also learned a ton from our cohort peers, we still talk to all of them whenever we can.

Traction and The Raise

Equipped with all these fancy jargons, reorganizing ourselves into a c-corp and getting introduced to big boy legal counsels gave us the confidence to start looking at outside investors, like real institutional investors that can help us grow and give us the guidance that can’t be found elsewhere.

I probably talked to over 300 early stage investors during that 60 day period and we will close our seed round at the end of 2024. Sometimes, it still feels surreal that we pull it off but we are very grateful that we did.

Our first believer was Cohen Circle, Katelyn Johnson and Nate Pontician worked on our deal and after a few rounds of discussion they became our lead investor. Other investors we thought were solid leads like (I won't mention their name) but they dropped out at the last minute after we turned down a few other interesting parties. I frantically called some of them back and asked for more introductions from staffers at Techstars.

We finally rounded out our seed round with AlleyCorp (Luc Ryan) and Great North Ventures (Rob Weber). Both of these teams are outstanding people that we couldn’t be more proud to be part of. Techstars, Plug N Play as well as our friend Interlock Capital that put Sam and I together also invested. We completed our $3.2M seed round in Nov 2024 during some of the darkest times of fund raising.

Growth and Team Formation

We finished Techstars and Plug N Play with our final pitches in New York City as well as Palo Alto. We came home with our seed round investment and hired a superb team. From Chakresh to Kay, from Sarthak to Bob, we were fortunate to have all of them join our team at the right time and at the right place.

Towards the end of 2024, our platform processed over 10 million credit applications and we were thrilled to see the platform we’ve spent so much time building working in the wild and producing results for our clients.

Year 1 - Embedded Finance Focus

We finished our first year in business back in March 2025. By then, we have onboarded two dozen clients and hired additional engineering staff to continue to refine our platform. Our VP of Product, Kay and Chakresh spent a lot of time working with clients and internal resources to completely revamp the look and feel of our platform.

From the UI to workflow, we’ve transformed our platform with the latest design and design concepts to make it easier and faster to launch new products and new verticals. Even though embedded finance is a giant market, we needed to focus.

By year 1, we’ve learned so much from how lenders and banks behave with respect to their retail partners online or offline. Our team has built up a compendium of experience dealing with credit risk, identity verification and payments.

Because Sam and I architected our system to have multiple layers of control from day 1, stores, affiliates or any type of tenant can be controlled on our platform which makes embedded financing down to the product or store level an easy implementation. There are no other platforms out there that allow banks, lenders or retailers to control pricing, underwriting down to the store level. We can.

By Mid August of 2025, we’ve grown to about 30 staff members and the industry is taking notice of LendAPI. We were getting a lot of eyeballs from incumbent players, competitors and partners. Our LendAPI FinTech Marketplace has garnered more than 100 members and 40+ of them have had integrations with us.

In August 2025, we joined the American FinTech Council. This is a group of fintech, lenders and banks banded together to work on the cutting edge of our industry, product and regulatory front. AFC is put together by our friend Phil Goldfeder, former Cross River Bank executive and well respected and well liked in the industry. Phil and I went way back at the beginning of the FinTech revolution and it was our distinct pleasure to have joined AFC.

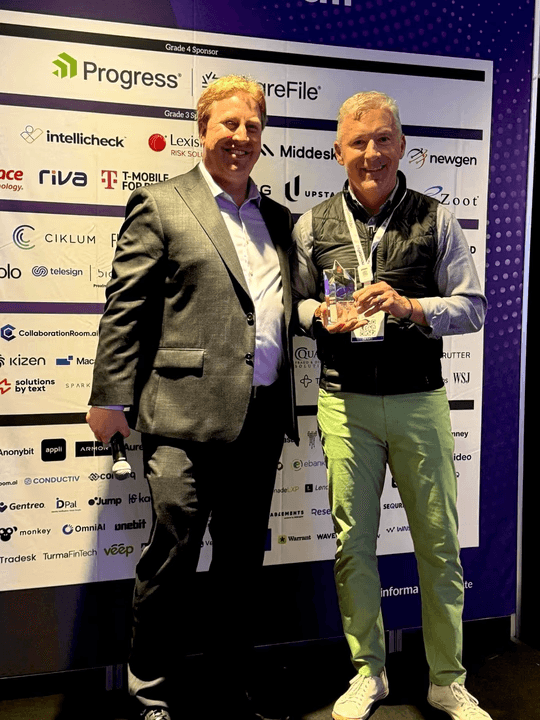

Finovate Fall 2025 - New York City - “Best of Show” Award

In September 2025, we got an invitation by one of the biggest fintech shows in the world Finovate to pitch at their New York City conference as one of the fintech startups.

As the public facing part of the company, we booked our flight, dust off our presentation and headed to New York City. By then, we got a long time member of our industry Eric King to come and join us as our Chief of Staff and he went with me to NYC to exhibit our platform. We were joined by our Advisor Kim Gerhardt at the show as well.

The day of the pitch was nerve wrecking, I think LendAPI was the third one to go to get on stage. I had a total of 8 minutes to impress the audience. This pitch is unique in the sense that they didn’t allow for any presentations and it was a live demo.

I suppose that played into our favor and the live demo is all I did day in and day out to potential clients. I created an entire mortgage application in front of a live audience in a few minutes. Got a few laughs and applause breaks and it was all done before my allotted time was up.

Our booth was crowded with well wishers. Eric and I felt like a million bucks manning our booth. The next day I had to get back to the office either pitch at another event or was traveling to see another client.

While I was having dinner with a client, I got a text message from Eric and Kim and I was told that we had won the “Best in Show” award at Finovate. I was really happy, this was not one of those pay to play awards. This award was hard fought, this award was won because of the countless hours of coding and working through with our clients, nights and weekends. This one was special.

Eric proudly brought home the trophy and the hardware in our office served as a reminder that we have so much more left to do. We reminded ourselves that our vision statement is to launch any embedded finance product instantly.

50 Million Applications and Counting

That October, we surpassed 50 million transactions. These transactions aren’t a simple payment signal or a KYC (Know Your Customer) check, these are full blown credit applications that are heavy and computationally demanding.

Our platform handled it well and without a hitch, ever. I constantly remind myself how great of an engineer Sam is, we couldn’t have asked for a better chief technology office. He fulfilled that role at LendAPI better than anyone that I could’ve imagined.

100 Million Applications and Counting

In January 2026, a month ago, we reached the 100 million credit application milestone. Sometimes when we look back on these statistics, we are amazed at how far we’ve come and how quickly we got there. Barely 12 months ago, we completed our 10 millionth application. A ten fold increase in a year. We are blessed.

Curql Fund Accelerator - Spring 2026

Last month, we were informed that we were invited to join Curql Fund Accelerator Cohort 4. Rowan from Gener8tor called me on a Saturday and asked if we would like to join. It was one of the happiest days of my life.

Mind you that I have applied since the beginning of the Curql Fund Accelerator and I suppose we weren’t ready until Cohort 4. Well, I kind of complained to Michael Perrin, partner at Next Level Venture (which is the venture arm of Curql Fund) a little but he encouraged me to keep on applying and I am glad I did.

Curql Accelerator is the only credit union focused accelerator that takes teams like ours and visits 3 different credit unions around the country to learn and observe the “movement”. Our first visit is to Suncoast Credit Union in Tampa, Florida. In fact I am writing this “2nd Year Anniversary" piece on LendAPI on a Delta flight headed to Tampa with Sam.

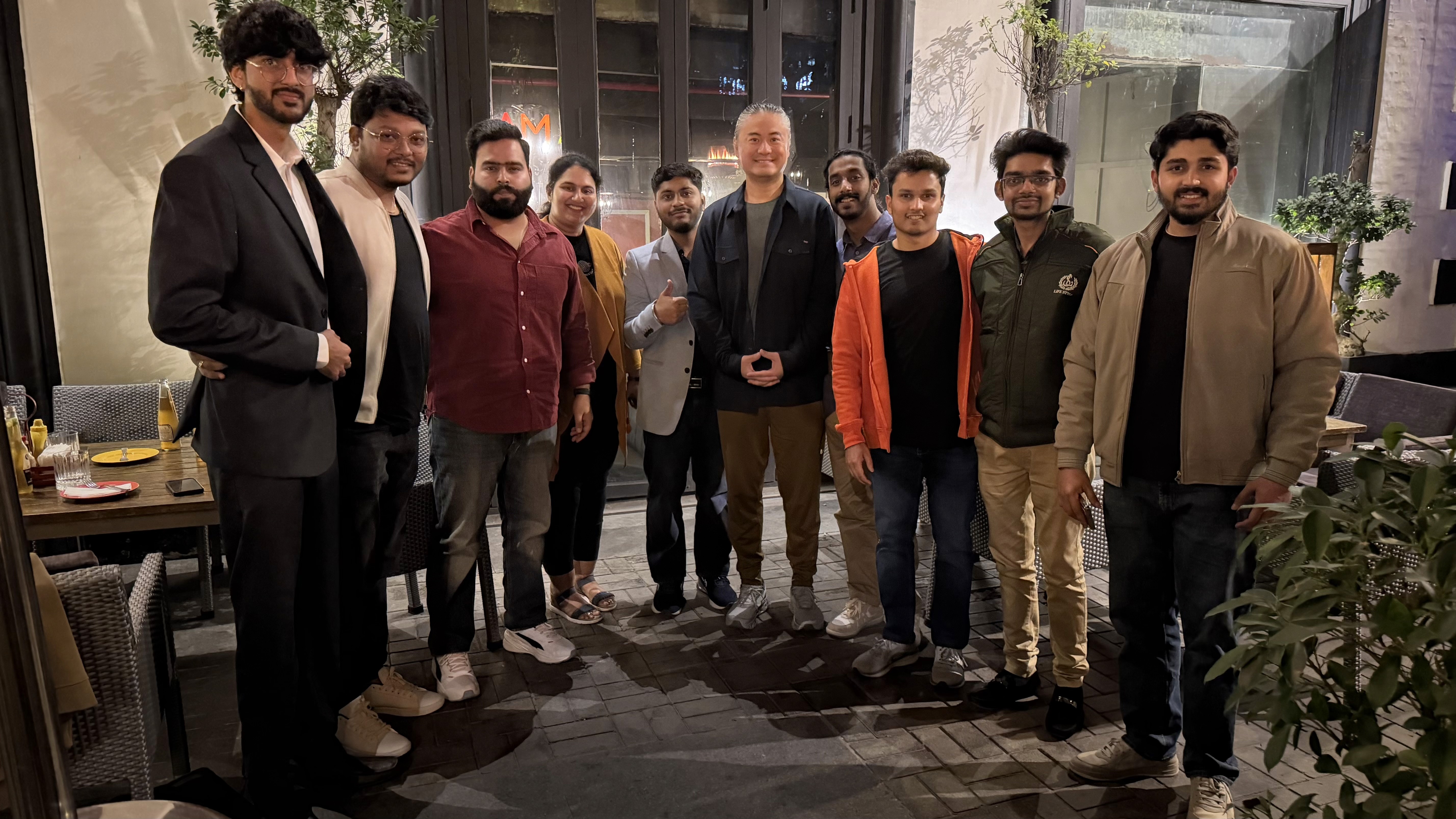

Team India

At the heels of finishing our second year, I had the pleasure to meet our team members in New Delhi, India.

Our team there is one of the most energetic and dedicated members of our big family. We couldn’t have done it without them. They are there, thick and thin and kept on coming up with new features and new performance enhancements to our platform.

Each one of them are shareholders of our firm and I am glad that I had the opportunity to talk to all of them over a family styled dinner. Next time, I will bring Sam with me and see the team. They really wanted to see Sam more than me, anyway, lol.

2nd Year Anniversary

In two weeks and on March 1st 2026, we will complete our 2nd year in business and heading into year 3.

I told my staff that year 3 is going to be our year to scale. We hired one of the best Head of GTM (Go To Market) executives that hasn’t been announced and we can’t wait to put together one of the best sales teams known to fintech.

Our platform is ready, we’ve now financed over $1M worth of consumer products with large retailers such as Sunglasses Hut in 70 store locations, the future is unlimited here at LendAPI.

I want to thank Kay, Chakresh, Bob, AJ, Ricky, Cesar, Andy, Joy, Eric, Sam and all of the front line teammates that work day and night with our clients to build this new embedded future.

Year 1 was about building the engine. Year 2 was about proving it could handle the heat of 100 million applications. Year 3? Year 3 is about putting that engine into every 'vehicle' on the road."

Timothy Li, CEO & Co-Founder, LendAPI